- Taiwan

- /

- Semiconductors

- /

- TWSE:2441

Undiscovered Gems on None for February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising inflation and near-record highs in major U.S. stock indexes, small-cap stocks have lagged behind their larger counterparts, with the Russell 2000 trailing the S&P 500. In this environment, finding undiscovered gems among small-cap stocks requires a keen eye for companies that can thrive despite economic uncertainties and capitalize on unique growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hangzhou Juheshun New MaterialLTD (SHSE:605166)

Simply Wall St Value Rating: ★★★★★☆

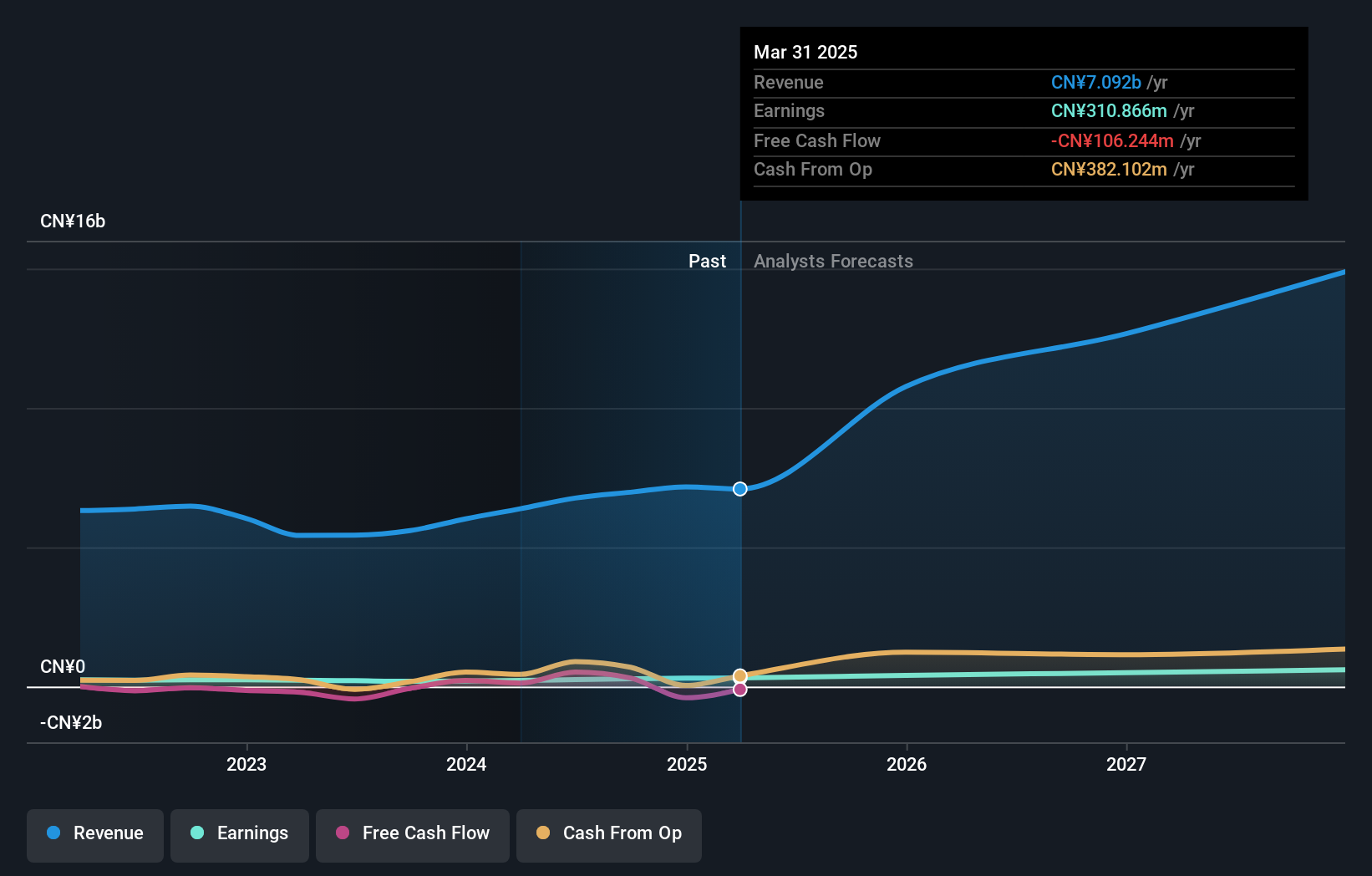

Overview: Hangzhou Juheshun New Material Co., LTD, along with its subsidiaries, focuses on the research, development, manufacture, and sale of polyamide-6 chips across various global markets and has a market cap of approximately CN¥3.89 billion.

Operations: The primary revenue stream for Juheshun comes from the production and sale of nylon chips, generating approximately CN¥6.97 billion. The company's financial performance can be evaluated by examining its gross profit margin, which demonstrates notable fluctuations over recent periods.

Hangzhou Juheshun New Material Co., Ltd. stands out with its solid financial footing, trading at 81% below estimated fair value, suggesting a potential bargain. Over the past year, earnings surged by 48.9%, outpacing the broader Chemicals industry which saw a -5.4% performance. The company's debt-to-equity ratio climbed from 14.5% to 41.9% over five years, yet it holds more cash than total debt, indicating robust financial health. Looking ahead, earnings are forecasted to grow by nearly 22% annually, hinting at promising prospects in its sector despite recent inactivity in share repurchases announced for up to CNY 20 million.

Jiuzhitang (SZSE:000989)

Simply Wall St Value Rating: ★★★★☆☆

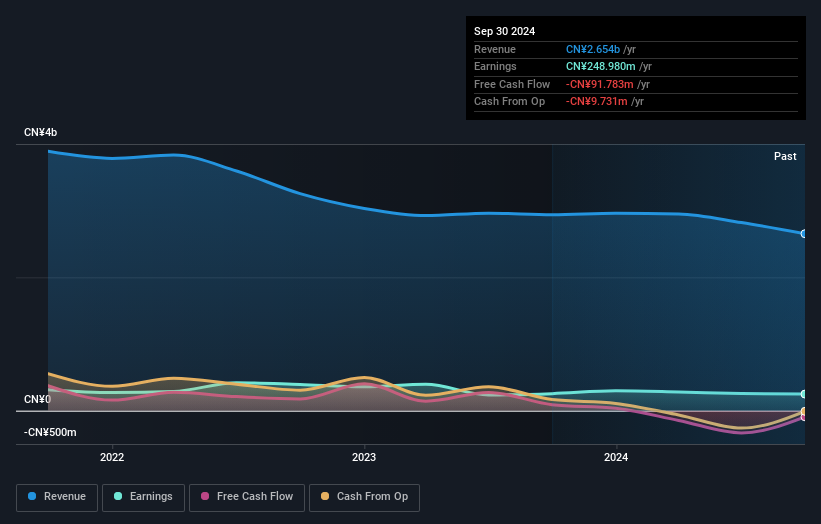

Overview: Jiuzhitang Co., Ltd. is a company that offers traditional Chinese, chemical, biological, and health medicine products in China with a market capitalization of approximately CN¥7.03 billion.

Operations: The company's primary revenue streams are derived from its traditional Chinese, chemical, biological, and health medicine products. It operates with a market capitalization of approximately CN¥7.03 billion.

Jiuzhitang, a player in the pharmaceuticals industry, showcases high-quality earnings with a price-to-earnings ratio of 28.2x, undercutting the CN market's 36.5x. Despite a 3.4% rise in its debt to equity ratio over five years, it remains financially sound with more cash than total debt and no concerns over interest coverage. Recent activities include Heilongjiang Chenneng Gongda Venture Capital acquiring an additional 6.25% stake for CNY 380 million and completing a share buyback of 9.66 million shares worth CNY 76.21 million by December end, reflecting strategic maneuvers to enhance shareholder value amidst negative earnings growth of -2.5%.

- Unlock comprehensive insights into our analysis of Jiuzhitang stock in this health report.

Review our historical performance report to gain insights into Jiuzhitang's's past performance.

Greatek Electronics (TWSE:2441)

Simply Wall St Value Rating: ★★★★★★

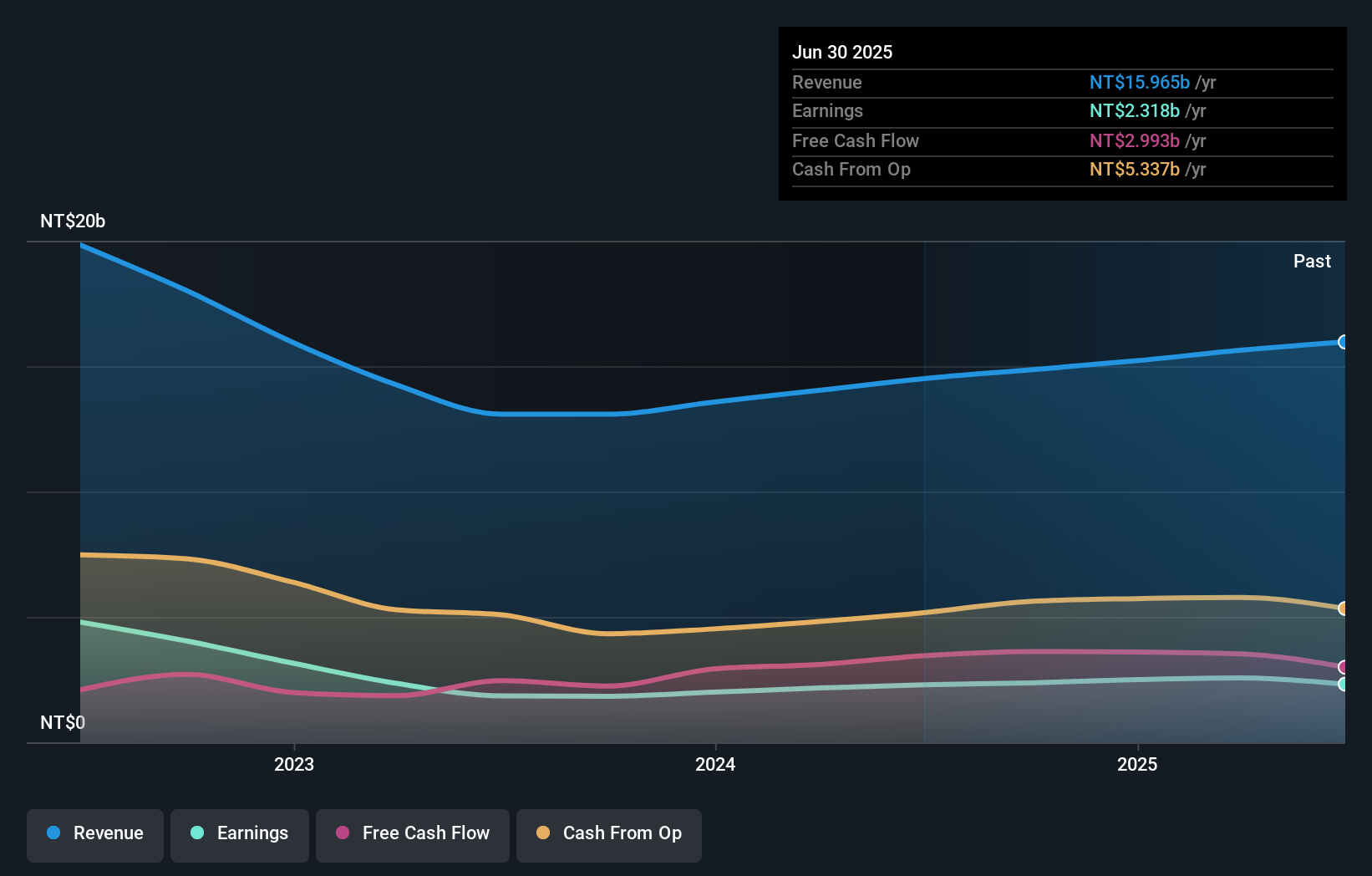

Overview: Greatek Electronics Inc. operates in the packaging and testing of integrated circuits across multiple regions including Taiwan, Asia, America, Europe, and Africa with a market cap of NT$37.49 billion.

Operations: Greatek Electronics generates revenue primarily from its semiconductor segment, amounting to NT$15.21 billion. The company's financial performance is influenced by its operations in packaging and testing integrated circuits across various global regions.

Greatek Electronics, a smaller player in the semiconductor space, has shown impressive growth with earnings rising 25% over the past year, outpacing the industry average of 5.9%. The company reported TWD 15.21 billion in sales for 2024, up from TWD 13.57 billion in the previous year, while net income reached TWD 2.50 billion compared to TWD 1.99 billion previously. With a price-to-earnings ratio of 15x undercutting the TW market's average of 21.6x and no debt on its books for five years, Greatek seems well-positioned financially despite a historical annual earnings dip of about 3.4%.

- Click here to discover the nuances of Greatek Electronics with our detailed analytical health report.

Evaluate Greatek Electronics' historical performance by accessing our past performance report.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4745 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2441

Greatek Electronics

Provides semiconductor assembly and testing services in Taiwan, Asia, America, Europe, and Africa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success