- Taiwan

- /

- Semiconductors

- /

- TWSE:2369

Lingsen Precision Industries, Ltd. (TWSE:2369) Looks Inexpensive After Falling 28% But Perhaps Not Attractive Enough

Lingsen Precision Industries, Ltd. (TWSE:2369) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 5.4% over that longer period.

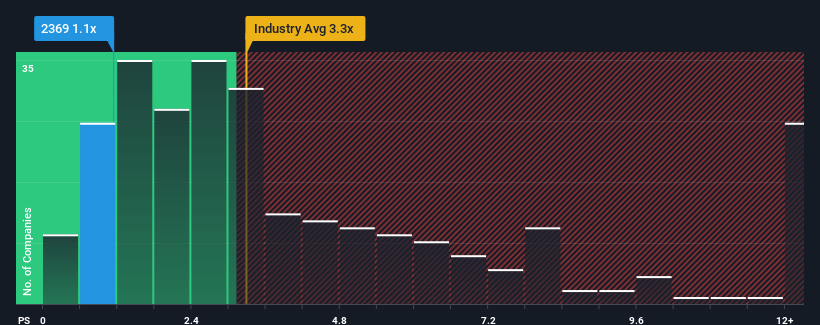

After such a large drop in price, Lingsen Precision Industries' price-to-sales (or "P/S") ratio of 1.1x might make it look like a strong buy right now compared to the wider Semiconductor industry in Taiwan, where around half of the companies have P/S ratios above 3.3x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Lingsen Precision Industries

What Does Lingsen Precision Industries' Recent Performance Look Like?

The recent revenue growth at Lingsen Precision Industries would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on Lingsen Precision Industries will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Lingsen Precision Industries will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Lingsen Precision Industries would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.3%. However, this wasn't enough as the latest three year period has seen an unpleasant 1.9% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 26% shows it's an unpleasant look.

With this information, we are not surprised that Lingsen Precision Industries is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Lingsen Precision Industries' P/S Mean For Investors?

Lingsen Precision Industries' P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Lingsen Precision Industries revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Lingsen Precision Industries with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2369

Lingsen Precision Industries

Engages in the semiconductor business in Taiwan, rest of Asia, Europe, the Americas, and Africa.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives