- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6278

Results: Taiwan Surface Mounting Technology Corp. Beat Earnings Expectations And Analysts Now Have New Forecasts

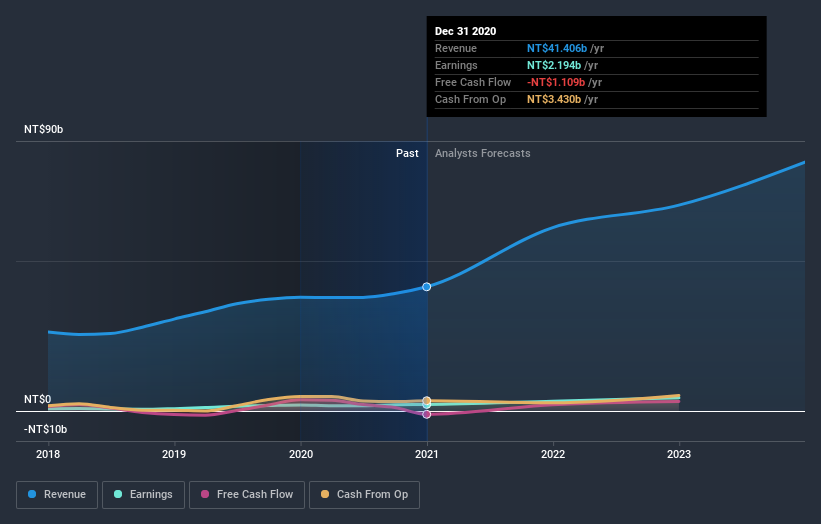

Investors in Taiwan Surface Mounting Technology Corp. (TPE:6278) had a good week, as its shares rose 9.5% to close at NT$121 following the release of its annual results. The result was positive overall - although revenues of NT$41b were in line with what the analysts predicted, Taiwan Surface Mounting Technology surprised by delivering a statutory profit of NT$7.50 per share, modestly greater than expected. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Taiwan Surface Mounting Technology

After the latest results, the four analysts covering Taiwan Surface Mounting Technology are now predicting revenues of NT$61.1b in 2021. If met, this would reflect a sizeable 48% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to jump 41% to NT$10.60. Before this earnings report, the analysts had been forecasting revenues of NT$60.7b and earnings per share (EPS) of NT$10.61 in 2021. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

The consensus price target fell 6.0% to NT$145, suggesting that the analysts might have been a bit enthusiastic in their previous valuation - or they were expecting the company to provide stronger guidance in the annual results. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Taiwan Surface Mounting Technology, with the most bullish analyst valuing it at NT$195 and the most bearish at NT$120 per share. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Taiwan Surface Mounting Technology's past performance and to peers in the same industry. It's clear from the latest estimates that Taiwan Surface Mounting Technology's rate of growth is expected to accelerate meaningfully, with the forecast 48% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 7.4% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 14% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Taiwan Surface Mounting Technology to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Taiwan Surface Mounting Technology's future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Taiwan Surface Mounting Technology. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Taiwan Surface Mounting Technology going out to 2023, and you can see them free on our platform here..

You should always think about risks though. Case in point, we've spotted 3 warning signs for Taiwan Surface Mounting Technology you should be aware of, and 1 of them is a bit unpleasant.

If you decide to trade Taiwan Surface Mounting Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Surface Mounting Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6278

Taiwan Surface Mounting Technology

Engages in the design, processing, manufacturing, and trading of TFT-LCD panels, general electronic information products, and PCB surface mount packaging worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026