- Taiwan

- /

- Semiconductors

- /

- TWSE:3189

Kinsus Interconnect Technology Corp.'s (TPE:3189) Has Been On A Rise But Financial Prospects Look Weak: Is The Stock Overpriced?

Kinsus Interconnect Technology (TPE:3189) has had a great run on the share market with its stock up by a significant 22% over the last three months. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. In this article, we decided to focus on Kinsus Interconnect Technology's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Kinsus Interconnect Technology

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kinsus Interconnect Technology is:

2.4% = NT$681m ÷ NT$29b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.02 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

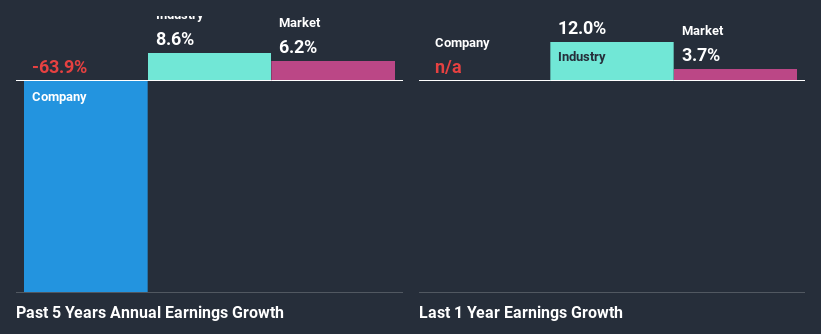

A Side By Side comparison of Kinsus Interconnect Technology's Earnings Growth And 2.4% ROE

As you can see, Kinsus Interconnect Technology's ROE looks pretty weak. Even compared to the average industry ROE of 11%, the company's ROE is quite dismal. Therefore, it might not be wrong to say that the five year net income decline of 64% seen by Kinsus Interconnect Technology was possibly a result of it having a lower ROE. We reckon that there could also be other factors at play here. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

However, when we compared Kinsus Interconnect Technology's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 8.6% in the same period. This is quite worrisome.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Kinsus Interconnect Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Kinsus Interconnect Technology Using Its Retained Earnings Effectively?

Kinsus Interconnect Technology's high three-year median payout ratio of 136% suggests that the company is depleting its resources to keep up its dividend payments, and this shows in its shrinking earnings. Paying a dividend beyond their means is usually not viable over the long term.

Additionally, Kinsus Interconnect Technology has paid dividends over a period of eight years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 41% over the next three years. As a result, the expected drop in Kinsus Interconnect Technology's payout ratio explains the anticipated rise in the company's future ROE to 7.8%, over the same period.

Conclusion

On the whole, Kinsus Interconnect Technology's performance is quite a big let-down. Specifically, it has shown quite an unsatisfactory performance as far as earnings growth is concerned, and a poor ROE and an equally poor rate of reinvestment seem to be the reason behind this inadequate performance. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade Kinsus Interconnect Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kinsus Interconnect Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3189

Kinsus Interconnect Technology

Engages in the manufacture and sale of electronic products in Taiwan and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives