- Taiwan

- /

- Semiconductors

- /

- TWSE:2369

Does Lingsen Precision Industries (TPE:2369) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Lingsen Precision Industries, Ltd. (TPE:2369) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Lingsen Precision Industries

How Much Debt Does Lingsen Precision Industries Carry?

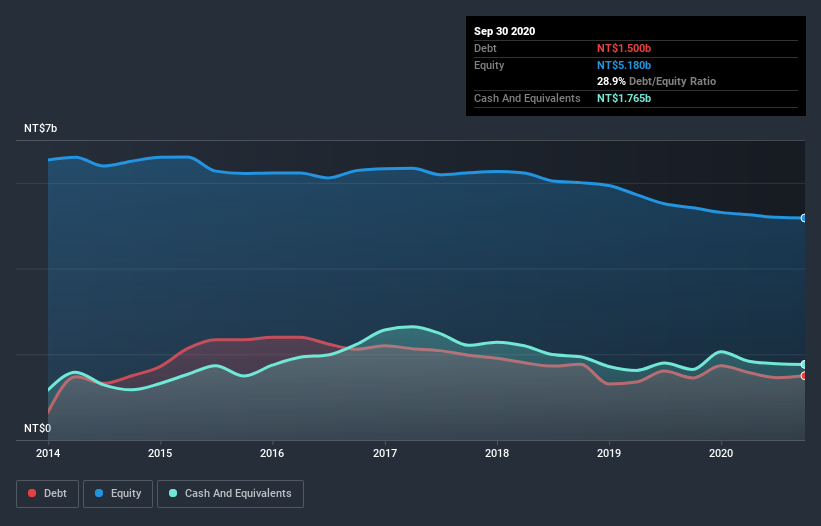

The chart below, which you can click on for greater detail, shows that Lingsen Precision Industries had NT$1.50b in debt in September 2020; about the same as the year before. But it also has NT$1.76b in cash to offset that, meaning it has NT$265.0m net cash.

A Look At Lingsen Precision Industries's Liabilities

The latest balance sheet data shows that Lingsen Precision Industries had liabilities of NT$1.65b due within a year, and liabilities of NT$924.8m falling due after that. Offsetting these obligations, it had cash of NT$1.76b as well as receivables valued at NT$1.36b due within 12 months. So it actually has NT$549.2m more liquid assets than total liabilities.

This surplus suggests that Lingsen Precision Industries has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Lingsen Precision Industries has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Lingsen Precision Industries's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Lingsen Precision Industries wasn't profitable at an EBIT level, but managed to grow its revenue by 11%, to NT$5.2b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Lingsen Precision Industries?

Although Lingsen Precision Industries had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of NT$114m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. With mediocre revenue growth in the last year, we're don't find the investment opportunity particularly compelling. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Lingsen Precision Industries you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Lingsen Precision Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2369

Lingsen Precision Industries

Engages in the semiconductor business in Taiwan, rest of Asia, Europe, the Americas, and Africa.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives