- Taiwan

- /

- Semiconductors

- /

- TPEX:6826

JoeoneLtd And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets experience shifts, with small-cap stocks notably outperforming their larger counterparts, investors are increasingly turning their attention to the dynamic landscape of Asia's emerging companies. In this climate, uncovering stocks that demonstrate resilience and growth potential amidst economic fluctuations can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lelon Electronics | 16.20% | 4.62% | 7.59% | ★★★★★★ |

| Konishi | 0.13% | 1.57% | 10.10% | ★★★★★★ |

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| 104 | NA | 9.90% | 10.14% | ★★★★★★ |

| Anapass | 8.99% | 20.82% | 58.41% | ★★★★★★ |

| New Asia Construction & Development | 42.25% | 8.68% | 50.79% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| Apacer Technology | 9.82% | 1.89% | 0.97% | ★★★★☆☆ |

| Hospital Corporation of China | 138.30% | 28.23% | 50.13% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

JoeoneLtd (SHSE:601566)

Simply Wall St Value Rating: ★★★★★★

Overview: Joeone Co., Ltd is a company that focuses on producing and selling men's trousers and business casual clothing in China, with a market capitalization of approximately CN¥8.53 billion.

Operations: Joeone Co., Ltd generates its revenue primarily from the clothing industry, reporting CN¥3.04 billion in this segment. The company's financial performance is highlighted by a gross profit margin trend that reflects its operational efficiency within the market.

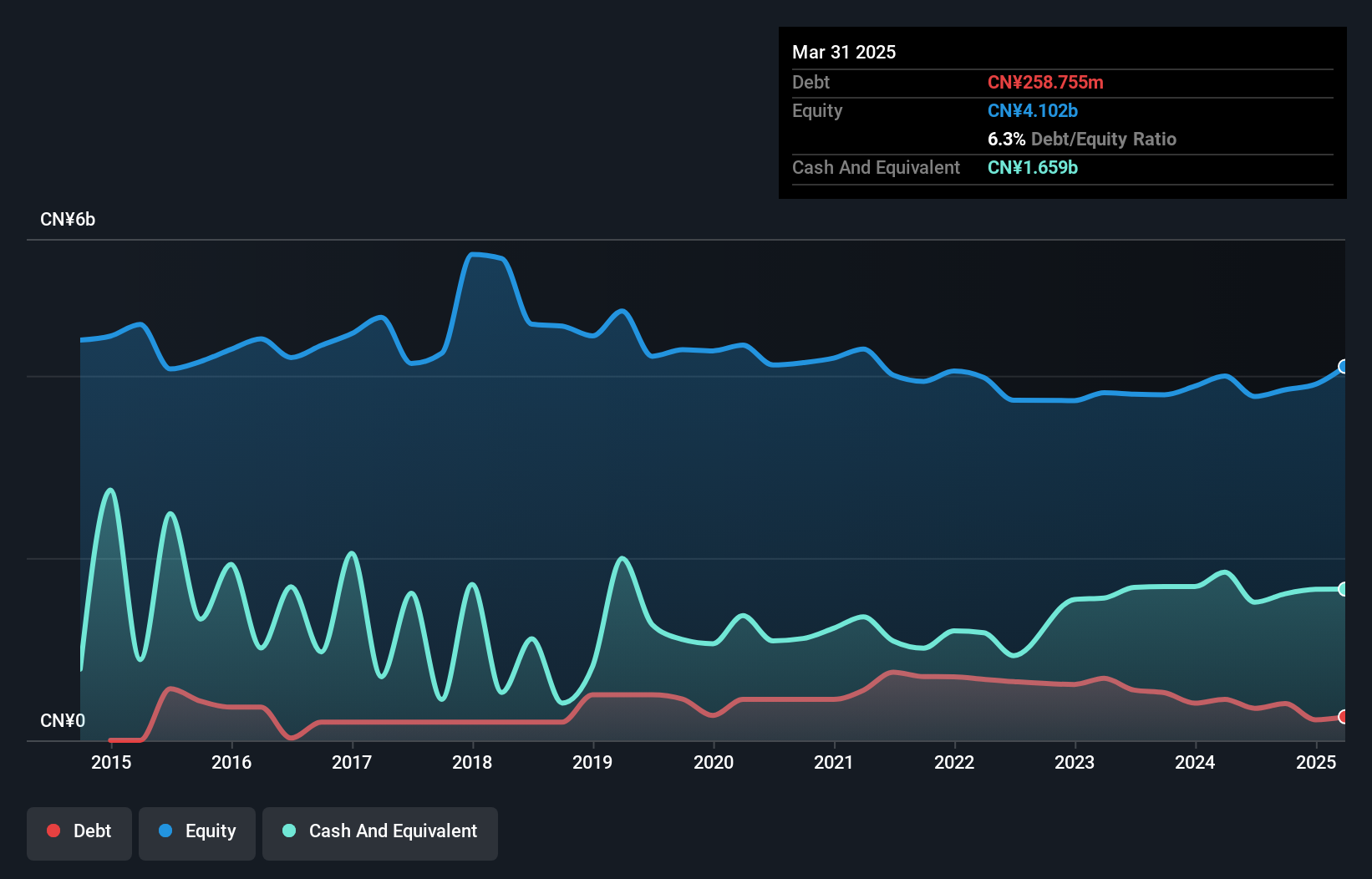

Joeone Ltd, a smaller player in the market, reported a notable net income of CN¥310.18 million for the nine months ending September 2025, up from CN¥135.08 million the previous year. This jump in earnings includes a significant one-off gain of CN¥198.9 million, which likely skews its financial results positively. Despite this, Joeone's price-to-earnings ratio stands at 24.3x, offering better value compared to the broader Chinese market average of 43.7x. The company has also reduced its debt-to-equity ratio from 10.8% to 6.6% over five years and maintains positive free cash flow amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of JoeoneLtd.

Assess JoeoneLtd's past performance with our detailed historical performance reports.

Taiwan Puritic (TPEX:6826)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Puritic Corp. focuses on the sale and maintenance of integrated circuit semiconductors, electronics, and computer equipment products in Taiwan with a market capitalization of NT$38.07 billion.

Operations: The primary revenue stream for Taiwan Puritic is the installation of gas equipment, generating NT$16.44 billion.

Taiwan Puritic, a promising player in the semiconductor industry, has shown impressive earnings growth of 34.5% over the past year, outpacing the industry's 2.4%. The company is trading at a significant discount of 82.7% below its estimated fair value, suggesting potential upside for investors. With a reduced debt to equity ratio from 59.8% to 38.2% over five years and interest payments well covered by EBIT at 128 times coverage, financial stability seems solid. Despite recent share price volatility, its high-quality earnings and positive free cash flow position it as an intriguing investment opportunity in Asia's dynamic tech landscape.

- Navigate through the intricacies of Taiwan Puritic with our comprehensive health report here.

Understand Taiwan Puritic's track record by examining our Past report.

Horng Terng Automation (TPEX:7751)

Simply Wall St Value Rating: ★★★★★★

Overview: Horng Terng Automation Co., Ltd. specializes in the development of LED and solar application equipment and has a market capitalization of NT$16.19 billion.

Operations: Horng Terng Automation generates revenue primarily from its Machinery & Industrial Equipment segment, totaling NT$1.61 billion. The company's financial performance includes a focus on managing costs related to this core business area.

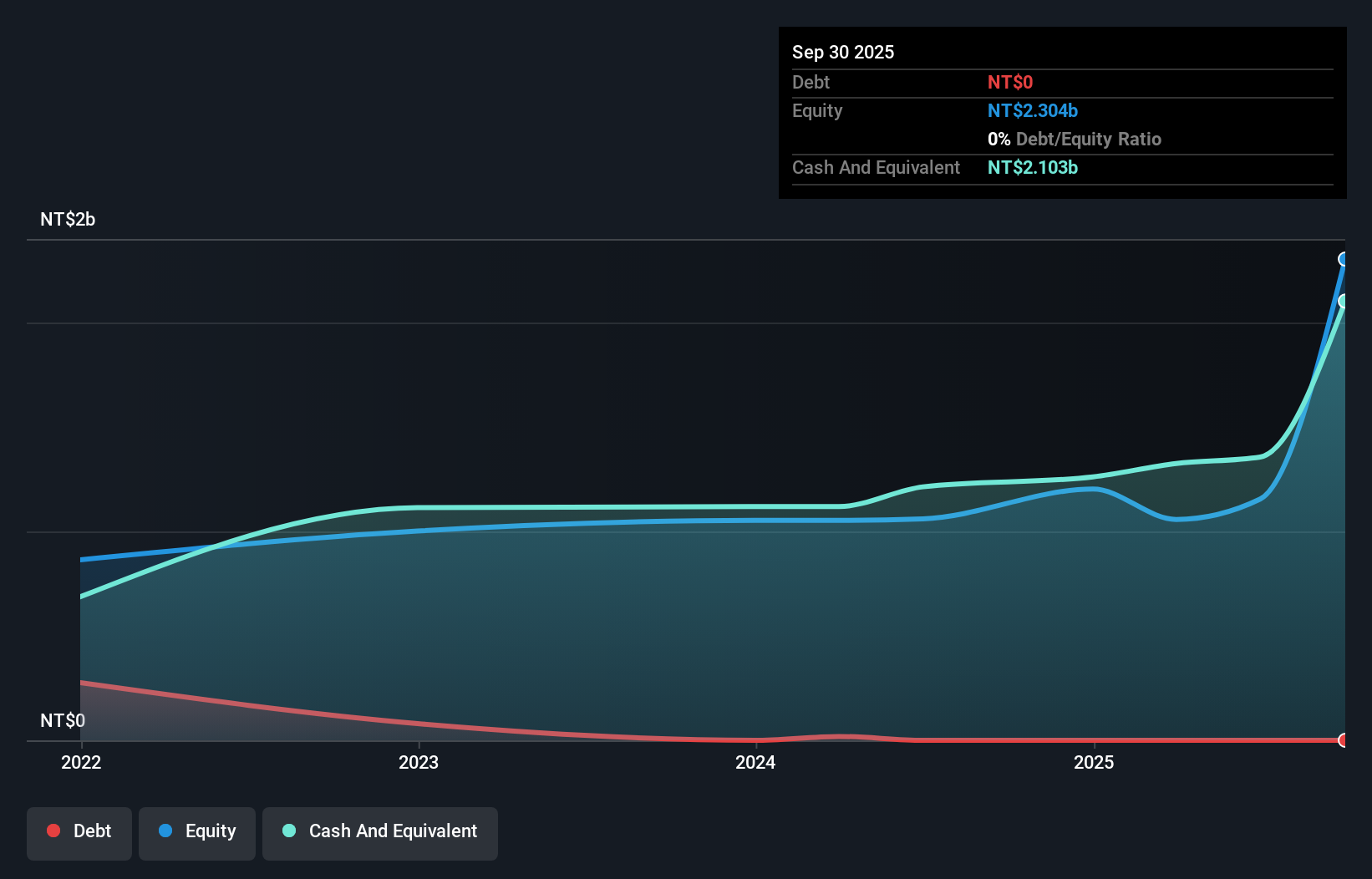

Horng Terng Automation, a nimble player in the automation sector, has shown impressive growth with earnings surging 66.9% over the past year, outpacing the broader semiconductor industry. The company is debt-free and boasts high-quality earnings, providing a solid foundation for future expansion. Recent results highlight robust performance; for Q3 2025, sales reached TWD 507 million from TWD 290 million last year, while net income climbed to TWD 157 million from TWD 69 million. Basic EPS rose to TWD 6.16 compared to TWD 2.81 previously, reflecting strong operational efficiency and potential for continued success in its market niche.

Seize The Opportunity

- Discover the full array of 2506 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Puritic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6826

Taiwan Puritic

Engages in the sale and maintenance of integrated circuit semiconductors, electronics, and computer equipment products in Taiwan.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026