- South Korea

- /

- Luxury

- /

- KOSE:A105630

3 Reliable Dividend Stocks Offering Up To 4.5% Yield

Reviewed by Simply Wall St

As global markets show signs of resilience with U.S. indexes approaching record highs and positive sentiment driven by strong labor market reports, investors are increasingly looking for stable income sources amid geopolitical uncertainties and economic fluctuations. In this context, dividend stocks can offer a reliable income stream, making them an attractive choice for those seeking steady returns in a dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.59% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

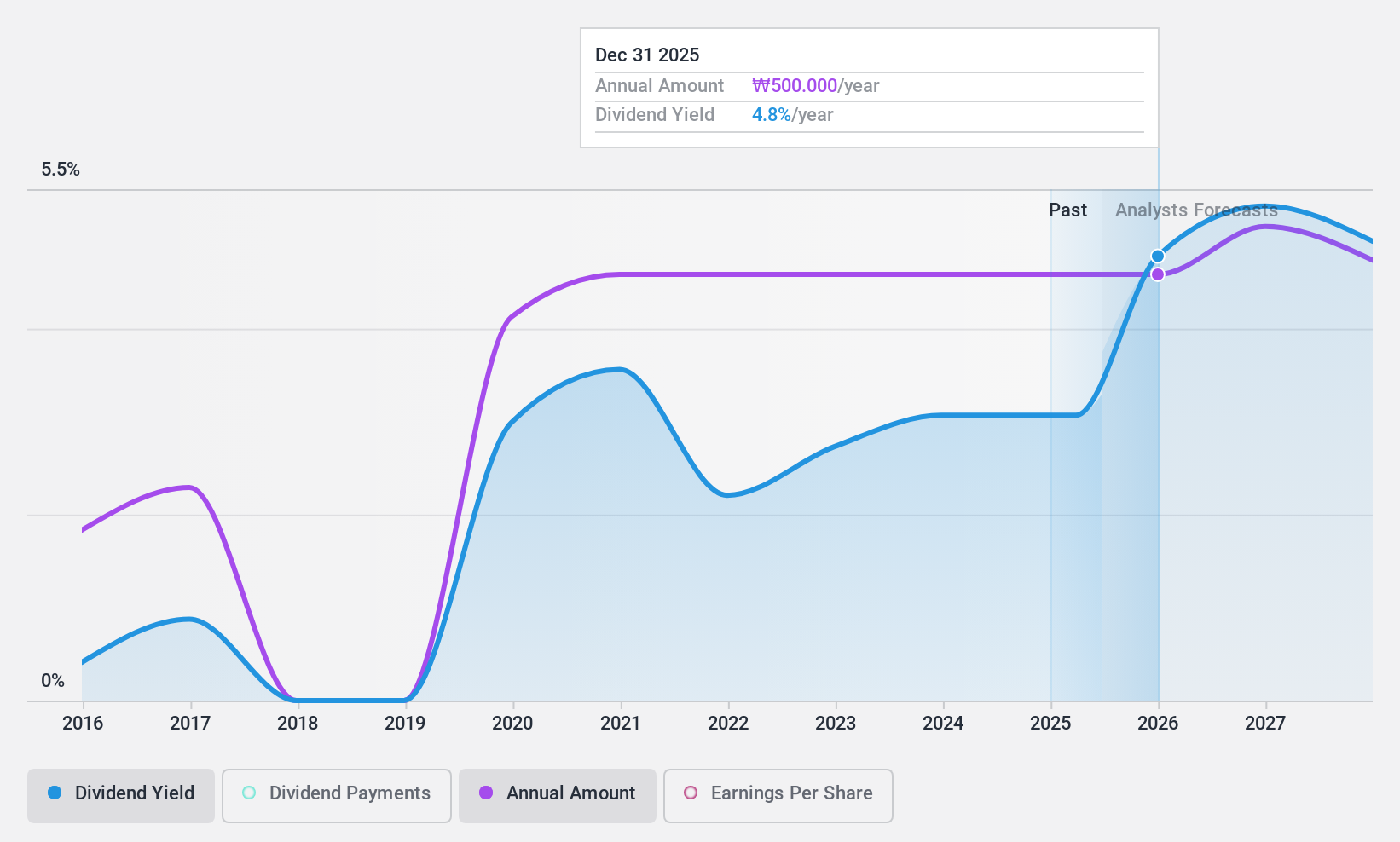

Hansae (KOSE:A105630)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hansae Co., Ltd. manufactures and sells finished clothing products across Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti with a market cap of approximately ₩554.12 billion.

Operations: Hansae Co., Ltd. generates its revenue from the manufacturing and sale of finished clothing products in several countries, including Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti.

Dividend Yield: 3.6%

Hansae's recent earnings report shows a slight decline in net income, impacting dividend sustainability. Despite trading below estimated fair value and maintaining stable dividends over the past decade, the company's high cash payout ratio indicates dividends are not well covered by free cash flow. While earnings grew modestly by 1.3% last year, debt coverage remains weak. The dividend yield of 3.55% is lower than top-tier KR market payers and may not be sustainable long-term without improved cash flow coverage.

- Get an in-depth perspective on Hansae's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Hansae's share price might be too pessimistic.

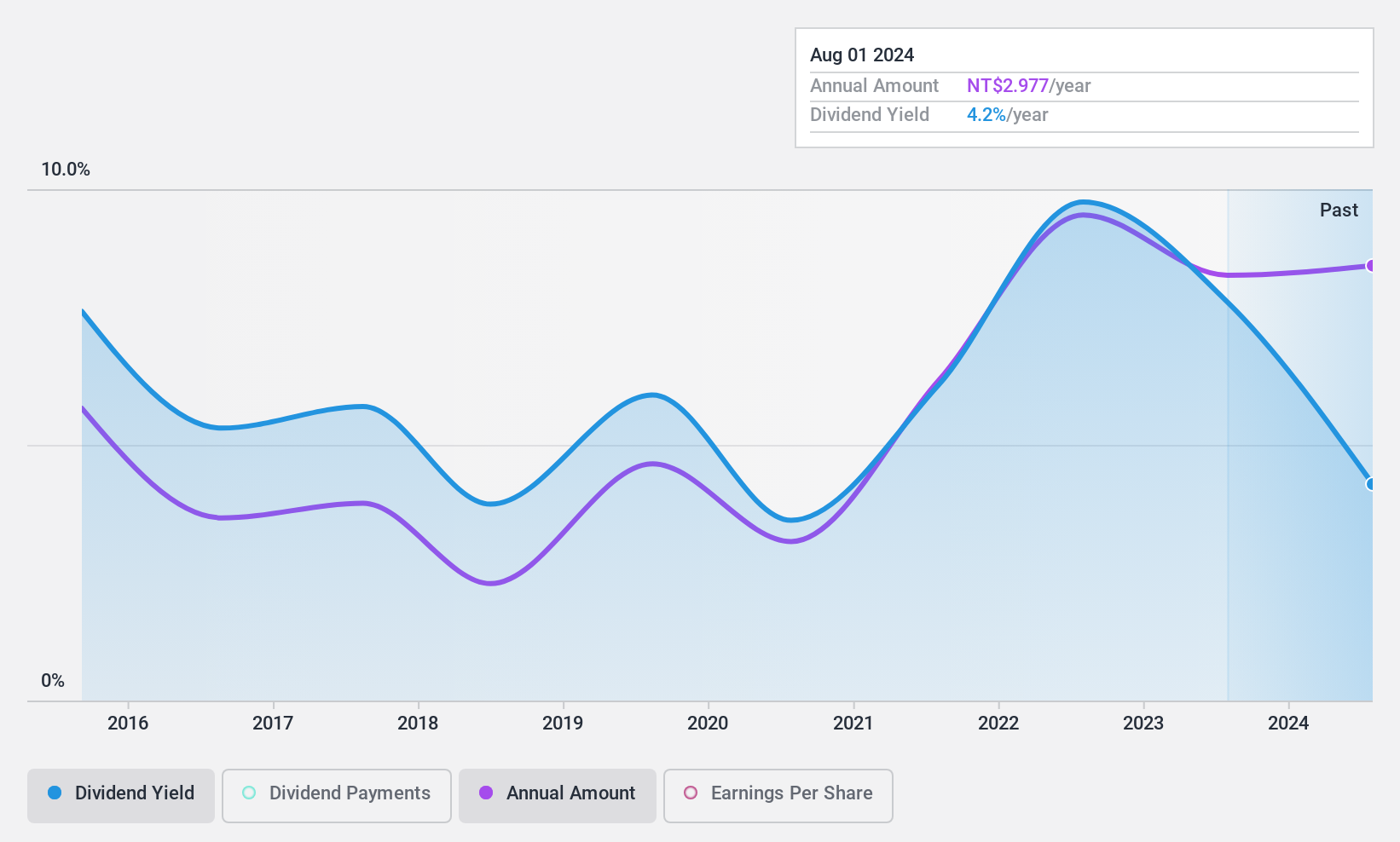

Ubright Optronics (TPEX:4933)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ubright Optronics Corporation manufactures and sells optical films in Taiwan, with a market cap of NT$5.34 billion.

Operations: Ubright Optronics Corporation generates its revenue from the production and distribution of optical films in Taiwan.

Dividend Yield: 4.5%

Ubright Optronics' dividends are covered by earnings and cash flows, with payout ratios of 50.7% and 58.7%, respectively, indicating sustainability despite past volatility. The dividend yield of 4.55% ranks in the top 25% in Taiwan, though historical instability raises concerns about reliability. Recent earnings growth—70.5% over the past year—suggests potential for continued dividend payments, despite a drop in quarterly net income from TWD 145.81 million to TWD 101.89 million year-over-year.

- Navigate through the intricacies of Ubright Optronics with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Ubright Optronics is trading behind its estimated value.

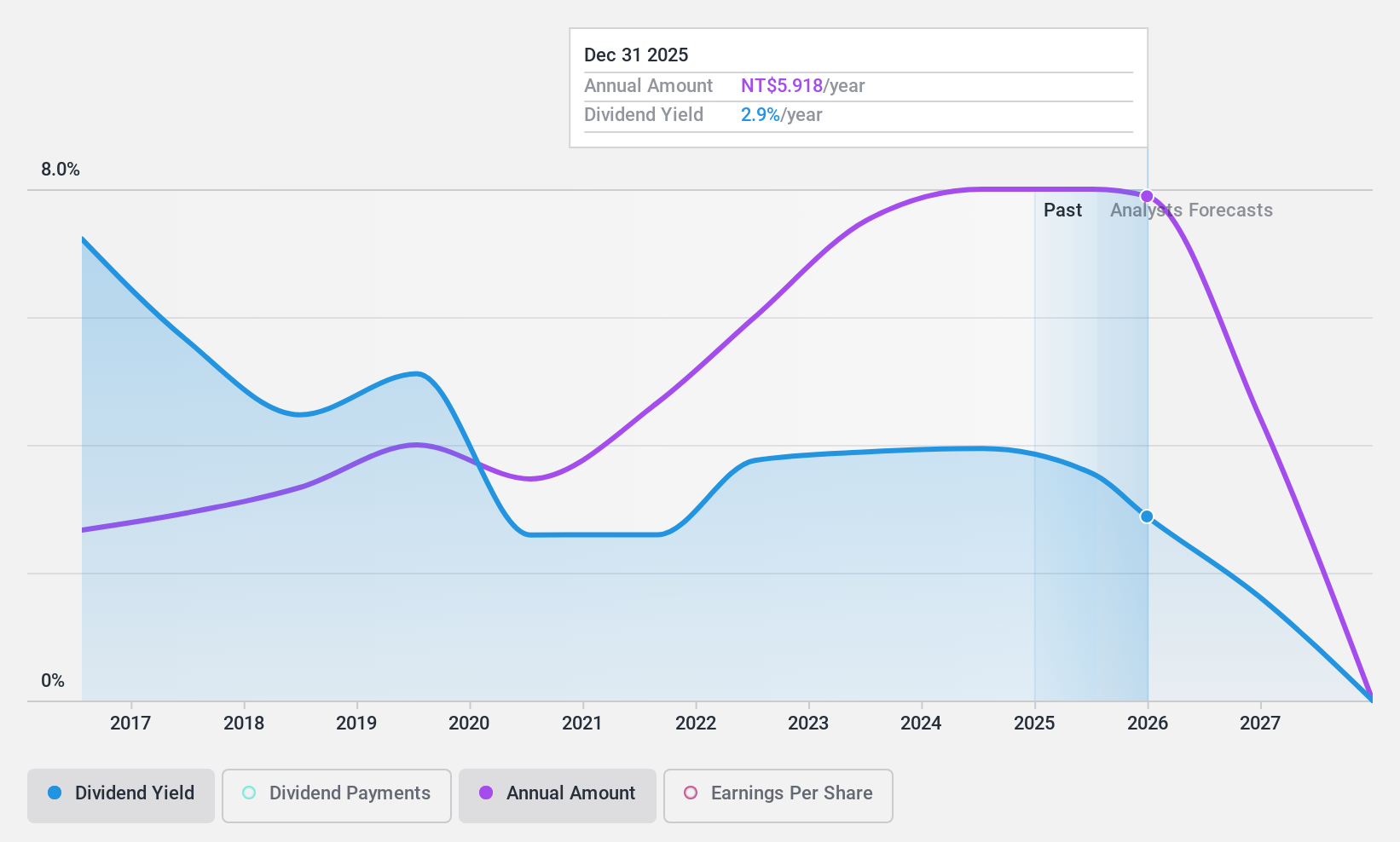

Marketech International (TWSE:6196)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marketech International Corp. operates in the manufacturing, sales, importation, and trading of integrated circuits, semiconductors, electrical and computer equipment and materials, chemicals, gas, and components across Taiwan, China, the United States, and internationally with a market cap of NT$30.80 billion.

Operations: Marketech International Corp.'s revenue segments encompass the production and distribution of integrated circuits, semiconductors, electrical and computer equipment and materials, chemicals, gas, and components across multiple regions including Taiwan, China, the United States, and other international markets.

Dividend Yield: 3.9%

Marketech International offers a stable dividend, supported by a payout ratio of 70.6% and a cash payout ratio of 26.5%, ensuring sustainability. The dividend yield of 3.92% is reliable but below the top tier in Taiwan's market. Despite recent declines in net income, with third-quarter earnings dropping to TWD 538.7 million from TWD 576.72 million year-over-year, the company maintains good value with a price-to-earnings ratio below the market average.

- Click to explore a detailed breakdown of our findings in Marketech International's dividend report.

- According our valuation report, there's an indication that Marketech International's share price might be on the cheaper side.

Seize The Opportunity

- Click through to start exploring the rest of the 1945 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hansae might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A105630

Hansae

Manufactures and sells finished clothing products in Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti.

Undervalued established dividend payer.

Market Insights

Community Narratives