- Taiwan

- /

- Semiconductors

- /

- TPEX:3265

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by U.S. tariff uncertainties and mixed economic signals, investors are increasingly turning to dividend stocks for stability and potential income. With manufacturing activity showing signs of recovery despite labor market cooling, selecting dividend stocks with strong fundamentals can be a prudent strategy in these uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1962 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

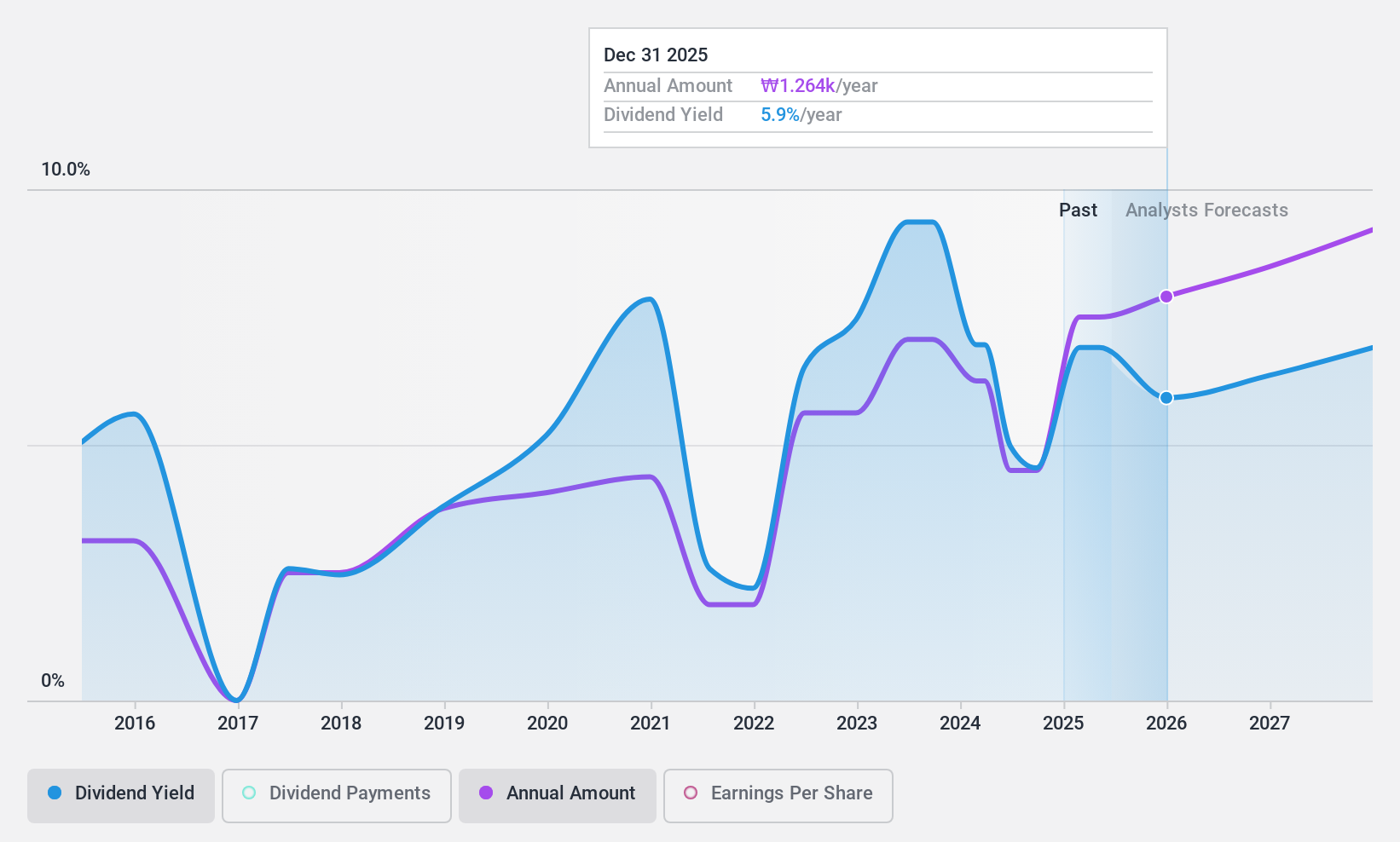

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., along with its subsidiaries, functions as a commercial bank offering diverse financial services to individual, business, and institutional clients in Korea, with a market cap of approximately ₩11.43 billion.

Operations: Woori Financial Group Inc.'s revenue segments include Banking at ₩7.45 billion, Capital at ₩282.19 million, Credit Cards at ₩468.39 million, and Investment Banking at -₩26.20 million.

Dividend Yield: 4.4%

Woori Financial Group has announced a share buyback program worth KRW 150 billion to stabilize its stock price. The board also recommended a year-end dividend of KRW 660 per share. Although the dividend yield is competitive within the Korean market, Woori's dividend history shows volatility and unreliability over the past decade. However, with a low payout ratio of 34.1%, dividends are well covered by earnings, suggesting sustainability despite past inconsistencies.

- Delve into the full analysis dividend report here for a deeper understanding of Woori Financial Group.

- Our comprehensive valuation report raises the possibility that Woori Financial Group is priced lower than what may be justified by its financials.

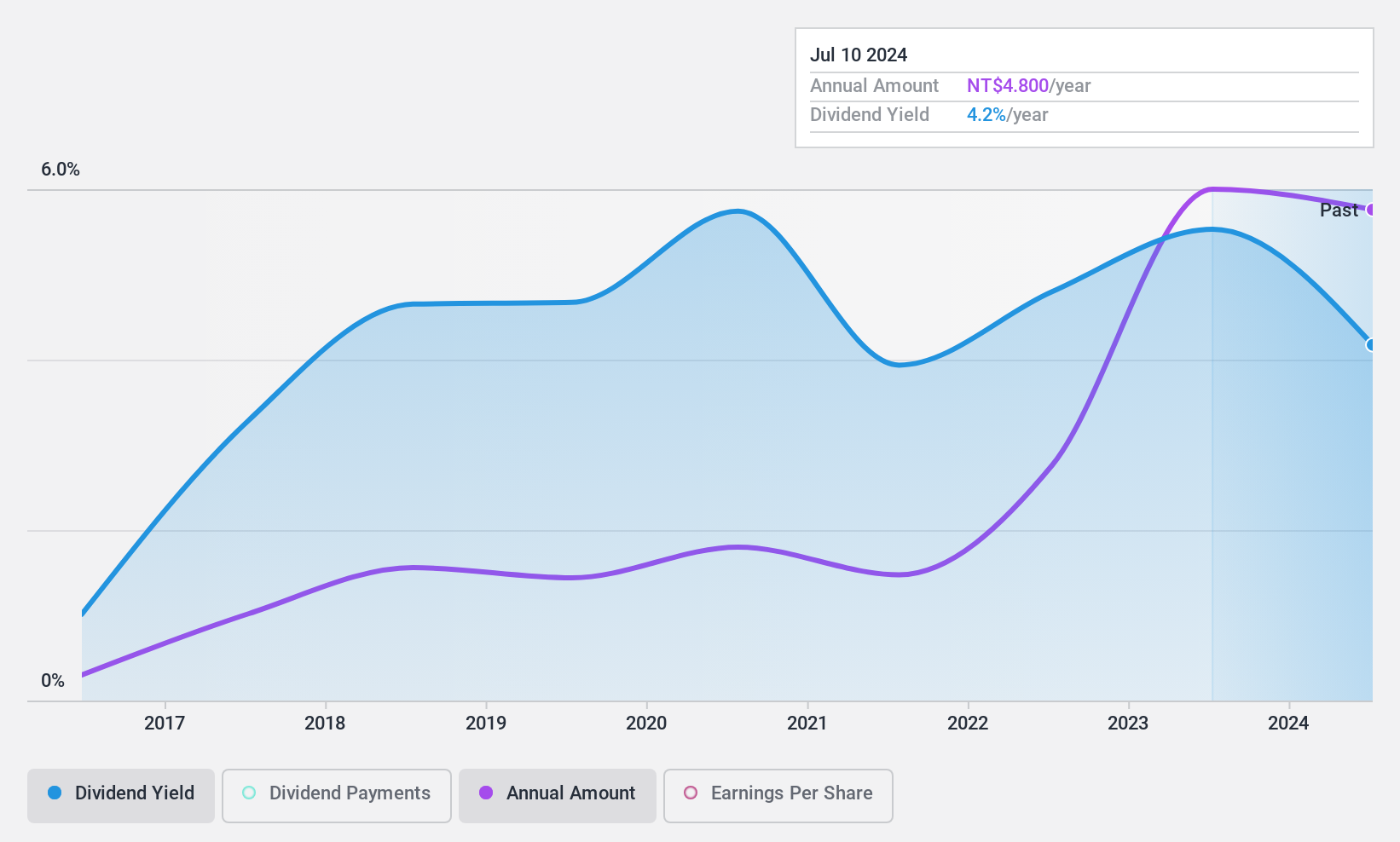

Winstek Semiconductor (TPEX:3265)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Winstek Semiconductor Co., Ltd. and its subsidiaries offer integrated circuits testing and wafer bumping and packing services in Taiwan, with a market cap of NT$15.06 billion.

Operations: Winstek Semiconductor Co., Ltd. generates revenue from its Packaging segment, which accounts for NT$2.96 billion, and its Testing Business segment, contributing NT$1.39 billion.

Dividend Yield: 4.3%

Winstek Semiconductor's recent earnings report shows increased sales but decreased net income, impacting its dividend reliability. Despite a volatile dividend history with drops over 20%, the current payout ratio of 83.4% suggests dividends are covered by earnings and cash flows, though at a high rate. The dividend yield is slightly below the top tier in Taiwan, and while the price-to-earnings ratio is favorable, sustainability concerns remain due to past volatility.

- Get an in-depth perspective on Winstek Semiconductor's performance by reading our dividend report here.

- The analysis detailed in our Winstek Semiconductor valuation report hints at an inflated share price compared to its estimated value.

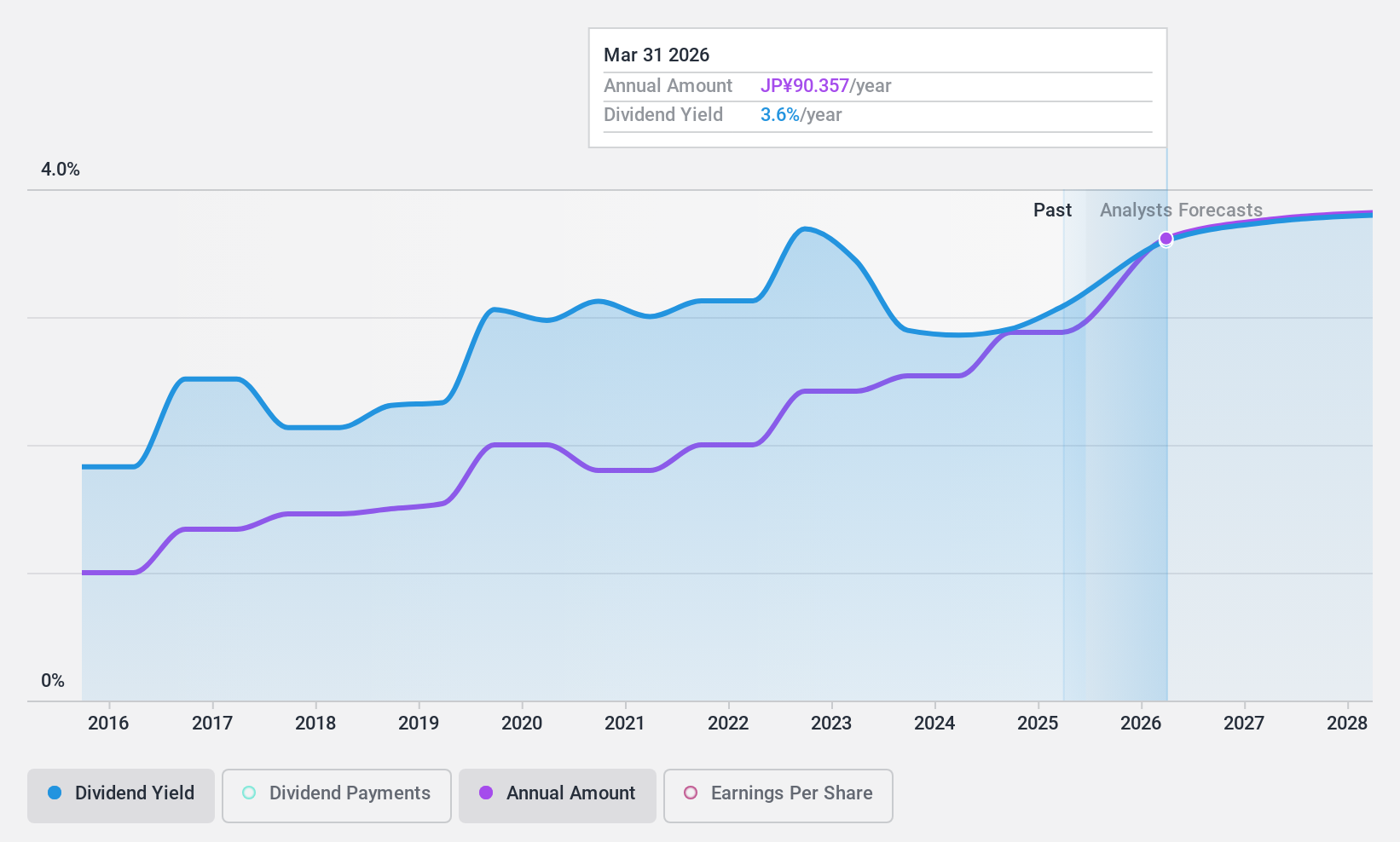

Taikisha (TSE:1979)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taikisha Ltd. designs, manages, and constructs HVAC systems and automobile paint plants while selling related equipment both in Japan and internationally, with a market cap of ¥148.84 billion.

Operations: Taikisha Ltd. generates revenue from its Environmental Systems Business, which accounts for ¥182.32 billion, and its Paint Finishing System Division, contributing ¥95.47 billion.

Dividend Yield: 3%

Taikisha's dividend yield of 3% is below the top tier in Japan, and while dividends have been stable and growing over the past decade, they are not well covered by free cash flows. The payout ratio of 31.5% indicates coverage by earnings but raises sustainability concerns without adequate cash flow support. Recent guidance revisions show increased sales and profit forecasts for fiscal year ending March 2025, potentially supporting future dividend stability amidst a share split to enhance liquidity.

- Take a closer look at Taikisha's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Taikisha shares in the market.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1962 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Winstek Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3265

Winstek Semiconductor

Engages in the testing of integrated circuits and chip bumping and wafer packaging services in Taiwan.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion