- China

- /

- Electrical

- /

- SZSE:000541

Three Undiscovered Gems in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience fluctuations, with key indices like the S&P 500 and Nasdaq Composite reaching record highs amid easing geopolitical tensions and new trade agreements, attention turns to Asia where economic resilience and strategic policy adjustments present intriguing opportunities. In this dynamic environment, identifying stocks with strong fundamentals, innovative potential, and adaptability to evolving market conditions is crucial for uncovering promising investment prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kyoritsu Electric | 6.30% | 4.83% | 15.38% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | 0.01% | 22.78% | 17.11% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 4.06% | 9.83% | ★★★★★★ |

| Dura Tek | 4.98% | 42.18% | 94.37% | ★★★★★☆ |

| Uniplus Electronics | 32.17% | 46.30% | 75.33% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 43.28% | 3.45% | -5.24% | ★★★★★☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 88.11% | 9.84% | 42.67% | ★★★★☆☆ |

| Guangdong Tloong Technology GroupLtd | 39.59% | -7.11% | -21.90% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

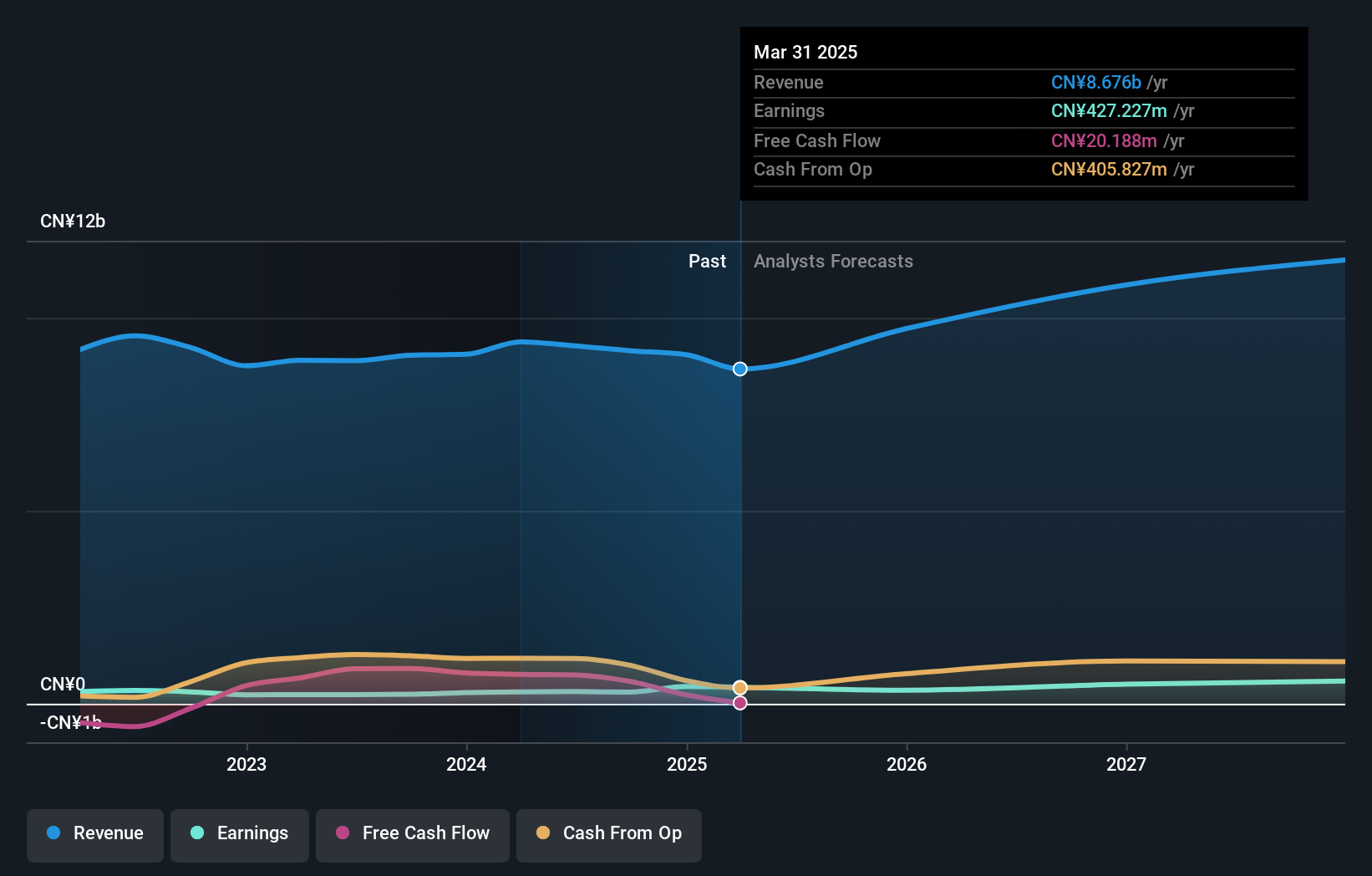

Foshan Electrical and LightingLtd (SZSE:000541)

Simply Wall St Value Rating: ★★★★★☆

Overview: Foshan Electrical and Lighting Co., Ltd is involved in the research, development, production, and sales of general lighting and electrical products, automotive lighting, and LED packaging products both domestically in China and internationally, with a market cap of CN¥9.15 billion.

Operations: The company's revenue streams primarily include general lighting and electrical products, automotive lighting, and LED packaging products. It has a market capitalization of CN¥9.15 billion.

Foshan Electrical and Lighting, a smaller player in the industry, has demonstrated notable financial resilience. Despite a slight dip in sales to CN¥2.15 billion for Q1 2025 from CN¥2.52 billion the previous year, net income rose to CN¥446.18 million for 2024 from CN¥290.36 million in 2023, reflecting strong operational efficiency with a net profit margin of approximately 4%. The company's price-to-earnings ratio stands at an attractive 24.6x compared to the broader Chinese market's 39.6x, suggesting potential undervaluation and room for growth as earnings are forecasted to rise by over 13% annually.

- Click to explore a detailed breakdown of our findings in Foshan Electrical and LightingLtd's health report.

Learn about Foshan Electrical and LightingLtd's historical performance.

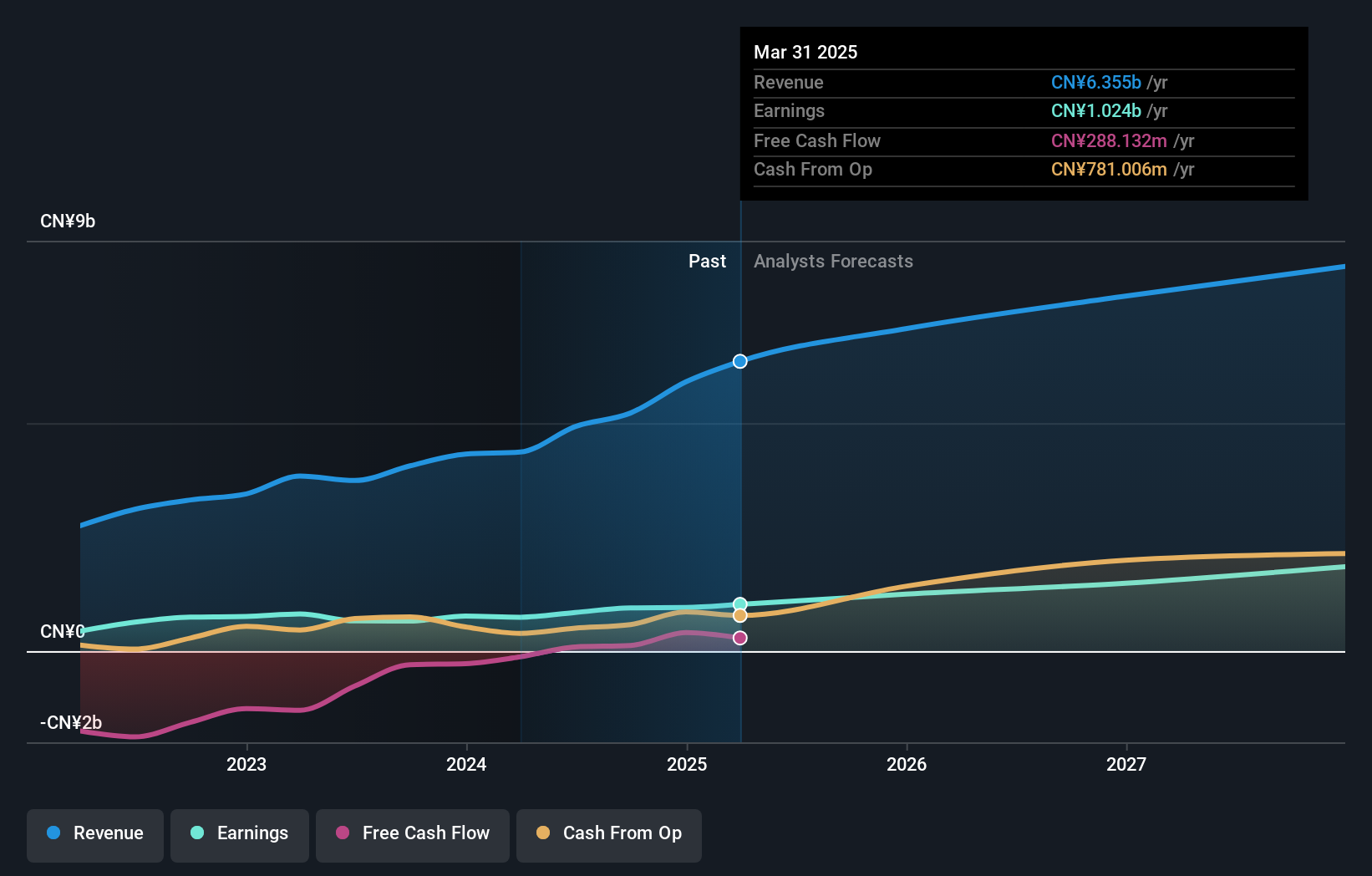

Guizhou Chanhen Chemical (SZSE:002895)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guizhou Chanhen Chemical Corporation is involved in the mining and beneficiation of phosphate and processing of phosphorus in China, with a market cap of CN¥13.79 billion.

Operations: The company generates revenue primarily from the mining and beneficiation of phosphate, as well as processing phosphorus. It has a market cap of CN¥13.79 billion. The financial performance is influenced by its net profit margin, which reflects the efficiency in managing costs relative to its revenues.

Guizhou Chanhen Chemical, a noteworthy player in the chemical sector, reported impressive earnings growth of 37.9% over the past year, significantly outpacing the industry average of 4%. The company seems to be trading at an attractive value, currently priced 18% below its estimated fair value. With a net income of CNY 956.48 million for 2024 and basic earnings per share from continuing operations at CNY 1.76, it demonstrates robust financial health. Furthermore, its debt management appears satisfactory with a net debt to equity ratio of 28.8%, and interest payments are comfortably covered by EBIT at a multiple of 14.3x.

- Take a closer look at Guizhou Chanhen Chemical's potential here in our health report.

Gain insights into Guizhou Chanhen Chemical's past trends and performance with our Past report.

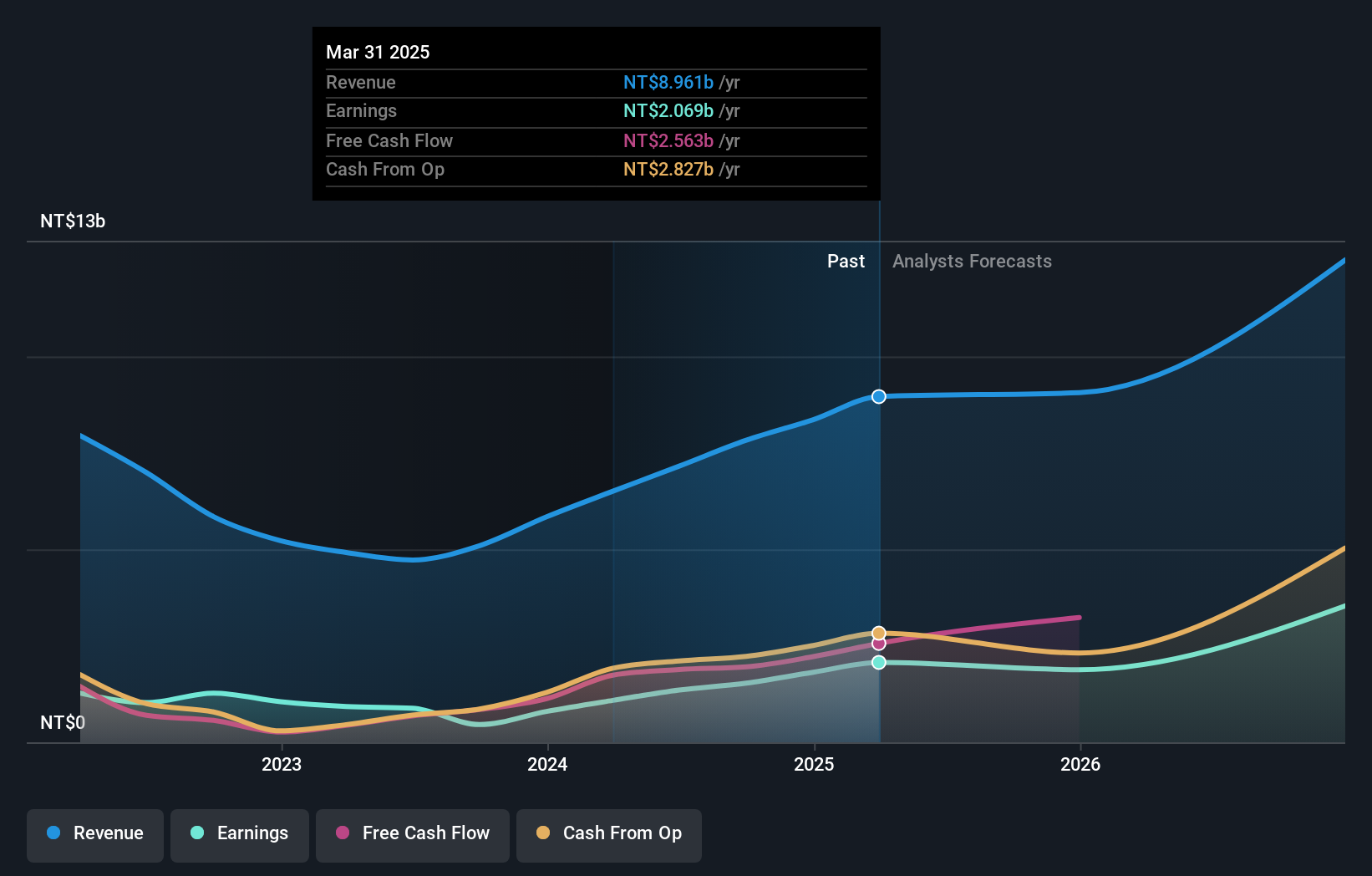

PixArt Imaging (TPEX:3227)

Simply Wall St Value Rating: ★★★★★☆

Overview: PixArt Imaging Inc. is a company that specializes in the research, design, production, and sale of CMOS image sensors and related integrated circuits across Taiwan, Hong Kong, China, Japan, and other international markets with a market capitalization of NT$36.86 billion.

Operations: PixArt Imaging generates revenue primarily from the sale of CMOS image sensors and related integrated circuits. The company has a market capitalization of NT$36.86 billion.

PixArt Imaging, a notable player in the semiconductor sector, reported impressive earnings growth of 90.6% over the past year, outpacing industry growth of 10.8%. The company's recent financials show a net income of TWD 545 million for Q1 2025, up from TWD 291 million the previous year, with basic earnings per share rising to TWD 3.74 from TWD 2.02. Trading at nearly one-third below its estimated fair value and maintaining more cash than total debt suggests solid financial health and potential undervaluation in the market. Recent amendments to its charter indicate proactive governance adjustments aligning with strategic goals.

- Navigate through the intricacies of PixArt Imaging with our comprehensive health report here.

Assess PixArt Imaging's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 2609 Asian Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000541

Foshan Electrical and LightingLtd

Engages in the research and development, production, and sales of general lighting and electrical products, automotive lighting, LED packaging products, and others in the People’s Republic of China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives