- Taiwan

- /

- Semiconductors

- /

- TPEX:3131

Insider-Owned Growth Companies To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of accelerating inflation and near-record highs in U.S. stock indexes, growth stocks have been outpacing their value counterparts, capturing investor attention. In this environment, companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business, making them worth watching for potential long-term growth opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 118.4% |

Here we highlight a subset of our preferred stocks from the screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd specializes in telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market cap of ₩1.36 trillion.

Operations: The company's revenue segments include the EMS Sector with ₩1.79 billion and the Semiconductor Sector with ₩187.83 million.

Insider Ownership: 32.1%

Revenue Growth Forecast: 35.4% p.a.

Seojin System Ltd. exhibits strong growth potential with forecasted earnings and revenue growth rates significantly outpacing the KR market, at 39.9% and 35.4% per year respectively. Despite recent shareholder dilution, the stock trades at a good value compared to peers, with analysts expecting a substantial price increase of 60.5%. However, its debt is not well covered by operating cash flow, which could be a concern for financial stability.

- Take a closer look at Seojin SystemLtd's potential here in our earnings growth report.

- Our expertly prepared valuation report Seojin SystemLtd implies its share price may be lower than expected.

Canmax Technologies (SZSE:300390)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canmax Technologies Co., Ltd. specializes in the production of new energy lithium battery materials and has a market capitalization of CN¥18.97 billion.

Operations: The company generates its revenue primarily from the sale of new energy lithium battery materials.

Insider Ownership: 33.7%

Revenue Growth Forecast: 42.2% p.a.

Canmax Technologies shows promising growth potential, with earnings expected to grow 35.9% annually, outpacing the CN market's average. Revenue is also set to rise significantly at 42.2% per year. Despite a low forecasted return on equity of 12.8%, its price-to-earnings ratio of 25x suggests good value compared to the broader market. Recent reaffirmation of their commitment to a key project highlights strategic alignment and operational focus, though profit margins have decreased from last year’s levels.

- Delve into the full analysis future growth report here for a deeper understanding of Canmax Technologies.

- According our valuation report, there's an indication that Canmax Technologies' share price might be on the expensive side.

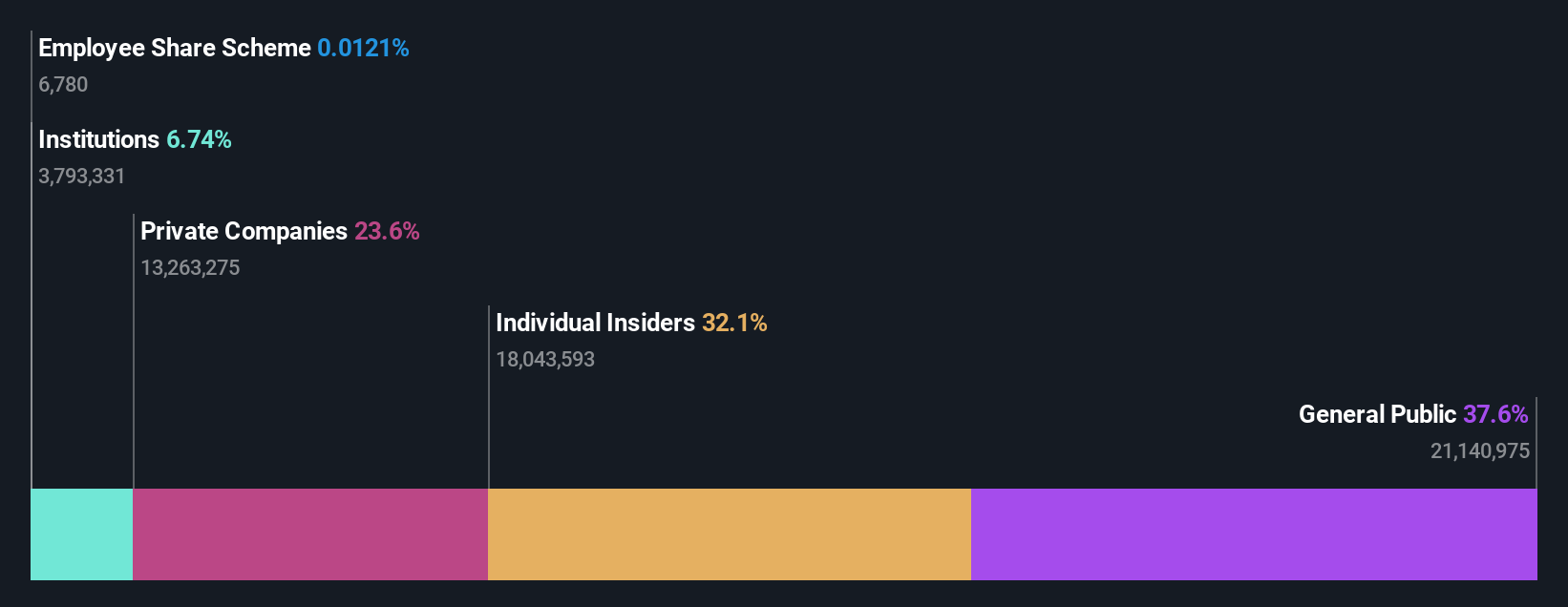

Grand Process Technology (TPEX:3131)

Simply Wall St Growth Rating: ★★★★★★

Overview: Grand Process Technology Corporation is a Taiwan-based company specializing in the manufacturing and sale of semiconductor equipment, with a market cap of NT$37.25 billion.

Operations: The company's revenue is primarily derived from its Equipment Manufacturing Segment at NT$1.79 billion, followed by the Chemical Materials Manufacturing Department at NT$1.12 billion, Equipment Sales Agent Department at NT$912.46 million, and Software Sales Department at NT$62.60 million.

Insider Ownership: 12.5%

Revenue Growth Forecast: 35.6% p.a.

Grand Process Technology is poised for strong growth, with earnings projected to increase by 39.3% annually, surpassing the TW market's average. Revenue growth is also robust at 35.6% per year, significantly outpacing the market rate. The company's return on equity is forecasted to reach a high of 31.7% in three years, indicating efficient management and potential profitability. However, its share price has been highly volatile recently, which may concern some investors seeking stability.

- Get an in-depth perspective on Grand Process Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Grand Process Technology valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Explore the 1460 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3131

Grand Process Technology

Engages in manufacturing and sale of semiconductor equipment in Taiwan.

Exceptional growth potential with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives