- Taiwan

- /

- Semiconductors

- /

- TPEX:8096

If You Had Bought CoAsia Electronics (GTSM:8096) Stock A Year Ago, You Could Pocket A 33% Gain Today

One way to deal with stock volatility is to ensure you have a properly diverse portfolio. Of course, the aim of the game is to pick stocks that do better than an index fund. One such company is CoAsia Electronics Corp. (GTSM:8096), which saw its share price increase 33% in the last year, slightly above the market return of around 30% (not including dividends). On the other hand, longer term shareholders have had a tougher run, with the stock falling 5.4% in three years.

View our latest analysis for CoAsia Electronics

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

CoAsia Electronics went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We doubt the modest 1.4% dividend yield is doing much to support the share price. However the year on year revenue growth of 11% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

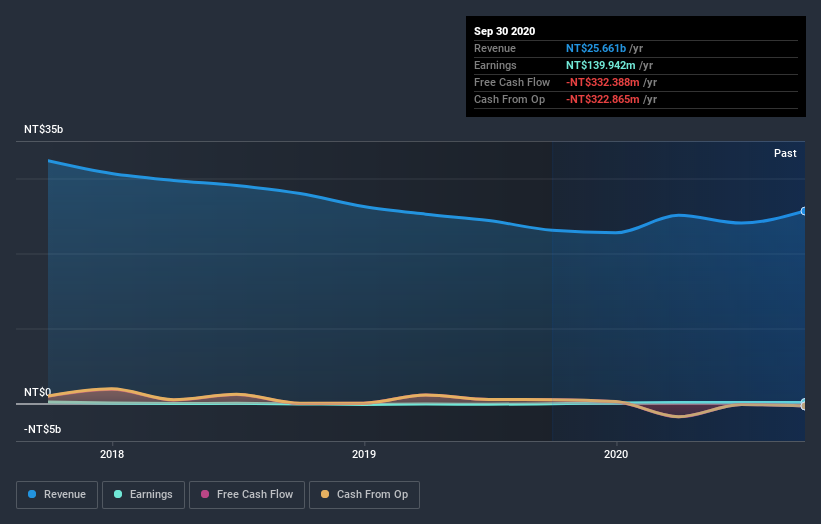

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, CoAsia Electronics' TSR for the last year was 36%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

CoAsia Electronics shareholders have received returns of 36% over twelve months (even including dividends), which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 1.4% over the last five years. While 'turnarounds seldom turn' there are green shoots for CoAsia Electronics. It's always interesting to track share price performance over the longer term. But to understand CoAsia Electronics better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with CoAsia Electronics (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading CoAsia Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8096

CoAsia Electronics

Provides components for mobile multimedia in Taiwan, China, the United States, Southeast Asia, India, and Korea.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.