- Taiwan

- /

- Semiconductors

- /

- TPEX:3490

Single Well Industrial's (GTSM:3490) Earnings Are Of Questionable Quality

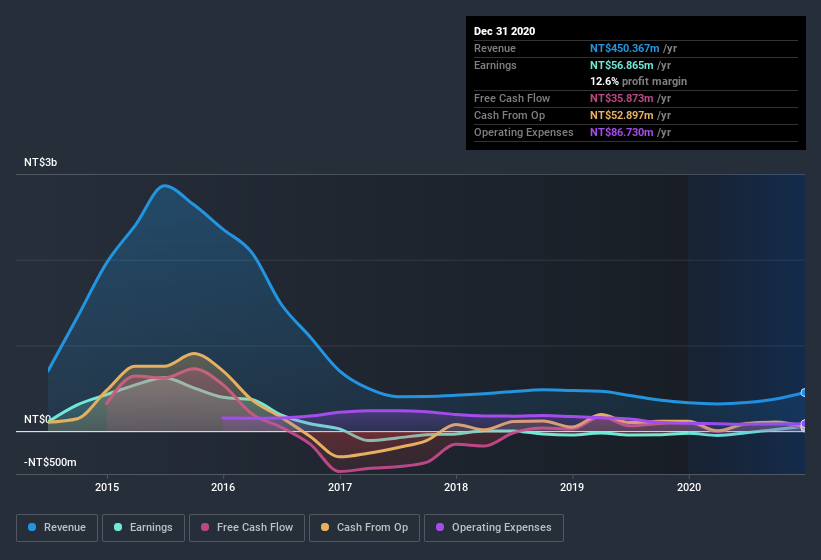

Despite posting some strong earnings, the market for Single Well Industrial Corporation's (GTSM:3490) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

Check out our latest analysis for Single Well Industrial

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Single Well Industrial's profit was reduced by NT$4.6m, due to unusual items, over the last year. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. If Single Well Industrial doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Single Well Industrial.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Single Well Industrial received a tax benefit which contributed NT$11m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Single Well Industrial's Profit Performance

In its last report Single Well Industrial received a tax benefit which might make its profit look better than it really is on a underlying level. Having said that, it also had a unusual item reducing its profit. Having considered these factors, we don't think Single Well Industrial's statutory profits give an overly harsh view of the business. If you'd like to know more about Single Well Industrial as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 2 warning signs for Single Well Industrial (of which 1 doesn't sit too well with us!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Single Well Industrial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3490

Single Well Industrial

Manufactures and sells packaging molds, automation equipment, and solar energy products in Taiwan.

Mediocre balance sheet unattractive dividend payer.

Market Insights

Community Narratives