- Taiwan

- /

- Semiconductors

- /

- TPEX:3374

Does Xintec's (GTSM:3374) CEO Salary Compare Well With The Performance Of The Company?

This article will reflect on the compensation paid to Chia Hsiang Chen who has served as CEO of Xintec Inc. (GTSM:3374) since 2017. This analysis will also assess whether Xintec pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Xintec

Comparing Xintec Inc.'s CEO Compensation With the industry

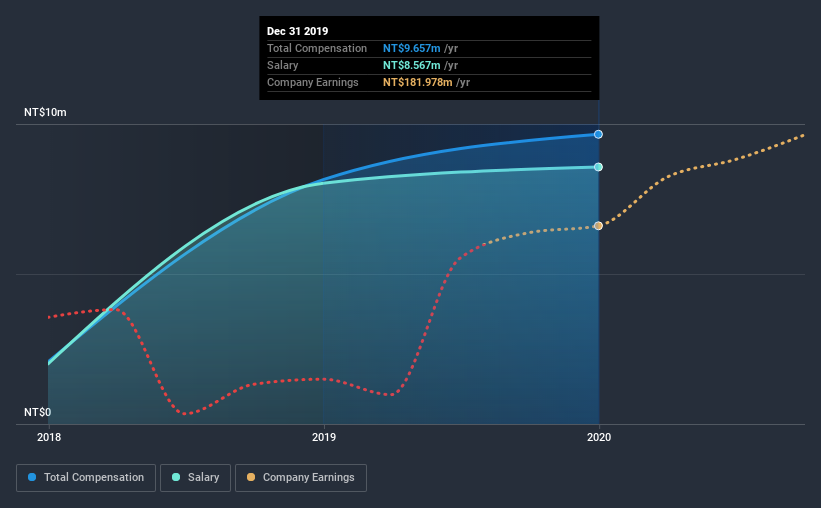

At the time of writing, our data shows that Xintec Inc. has a market capitalization of NT$48b, and reported total annual CEO compensation of NT$9.7m for the year to December 2019. We note that's an increase of 19% above last year. In particular, the salary of NT$8.57m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from NT$29b to NT$91b, the reported median CEO total compensation was NT$12m. This suggests that Xintec remunerates its CEO largely in line with the industry average.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | NT$8.6m | NT$8.0m | 89% |

| Other | NT$1.1m | NT$120k | 11% |

| Total Compensation | NT$9.7m | NT$8.1m | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. Xintec is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Xintec Inc.'s Growth Numbers

Xintec Inc. has seen its earnings per share (EPS) increase by 90% a year over the past three years. In the last year, its revenue is up 34%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Xintec Inc. Been A Good Investment?

Boasting a total shareholder return of 90% over three years, Xintec Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As previously discussed, Chia Hsiang is compensated close to the median for companies of its size, and which belong to the same industry. The company is growing EPS and total shareholder returns have been pleasing. So one could argue that CEO compensation is quite modest, if you consider company performance! Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Xintec that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Xintec, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:3374

Xintec

Operates as a wafer level chip scale packaging company in Asia, the United States, and Europe.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.