- Japan

- /

- Professional Services

- /

- TSE:9233

Rami Levi Chain Stores Hashikma Marketing 2006 And 2 Other Prominent Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, characterized by rate cuts from the ECB and SNB and anticipated moves from the Federal Reserve, investors are keenly observing shifts in major indices. While technology stocks like those in the Nasdaq Composite have shown resilience, broader market sentiments reflect caution amid inflationary pressures and labor market softening. In such an environment, dividend stocks can offer a measure of stability through regular income streams, making them attractive to investors seeking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1849 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

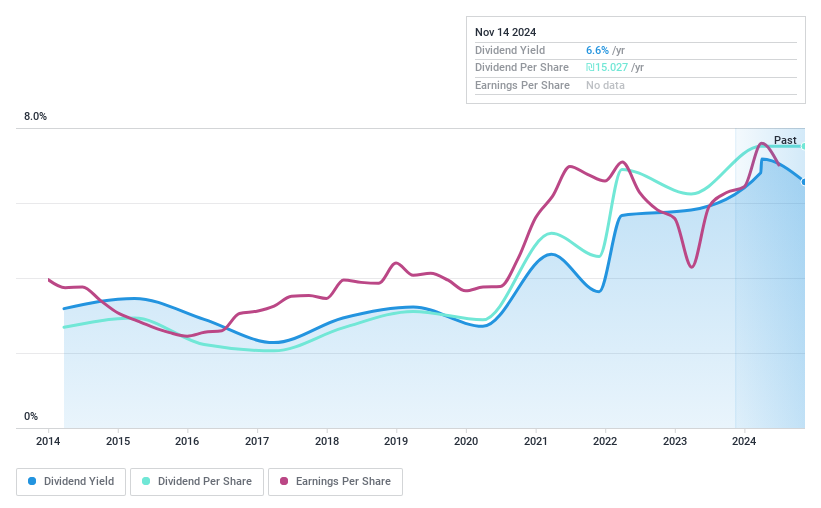

Rami Levi Chain Stores Hashikma Marketing 2006 (TASE:RMLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd operates a chain of discount retail stores in Israel and has a market cap of ₪3.39 billion.

Operations: Rami Levi Chain Stores Hashikma Marketing 2006 Ltd generates revenue primarily from its retail chains, amounting to ₪6.40 billion.

Dividend Yield: 6.1%

Rami Levi Chain Stores Hashikma Marketing 2006 offers a dividend yield of 6.09%, placing it in the top 25% of Israeli dividend payers, but its dividends have been volatile over the past decade. Despite earnings growth and a reasonable cash payout ratio of 45.1%, the high payout ratio of 163.2% indicates dividends are not well covered by earnings, raising sustainability concerns. Recent financials show improved net income and sales, yet dividend reliability remains an issue for investors seeking stable returns.

- Navigate through the intricacies of Rami Levi Chain Stores Hashikma Marketing 2006 with our comprehensive dividend report here.

- The analysis detailed in our Rami Levi Chain Stores Hashikma Marketing 2006 valuation report hints at an deflated share price compared to its estimated value.

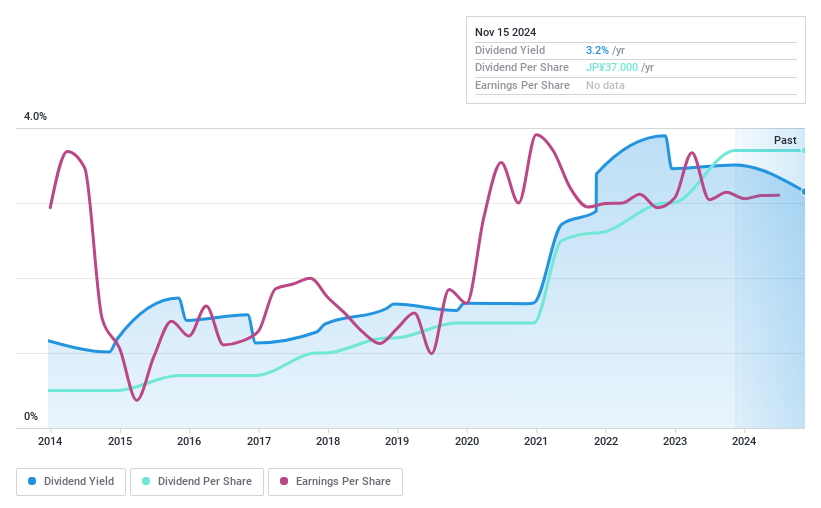

Asia Air Survey (TSE:9233)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Air Survey Co., Ltd. offers aerial surveying services and products both in Japan and internationally, with a market cap of ¥19.96 billion.

Operations: Asia Air Survey Co., Ltd. generates revenue through its aerial surveying services and products provided domestically and internationally.

Dividend Yield: 3.4%

Asia Air Survey has maintained stable and growing dividends over the past decade, although its current yield of 3.37% is below Japan's top 25% dividend payers. Despite a low payout ratio of 30.7%, indicating dividends are covered by earnings, the lack of free cash flows raises sustainability concerns. The company's price-to-earnings ratio of 10.5x suggests good value compared to the broader market, yet investors should note that dividends are not supported by cash flows or earnings alone.

- Click to explore a detailed breakdown of our findings in Asia Air Survey's dividend report.

- Our expertly prepared valuation report Asia Air Survey implies its share price may be too high.

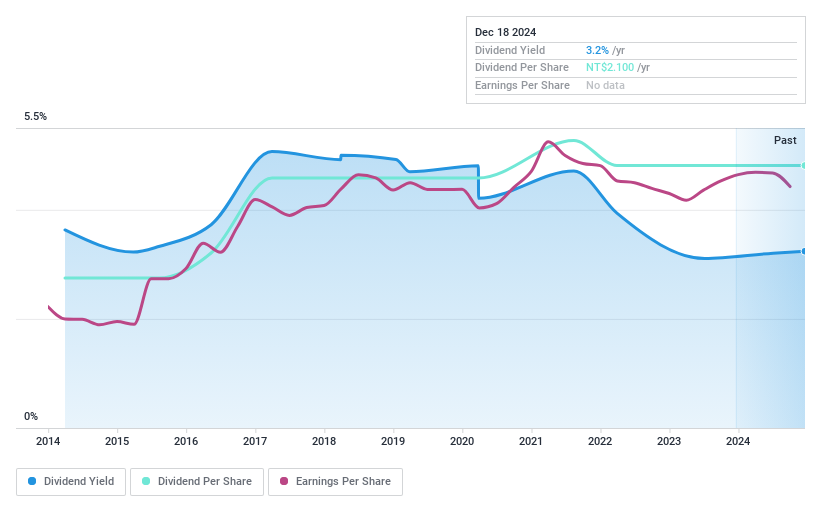

National Petroleum (TWSE:9937)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Petroleum Co., Ltd. operates gas stations in Taiwan and has a market cap of NT$19.99 billion.

Operations: National Petroleum Co., Ltd.'s revenue is primarily derived from the sales of oil products, amounting to NT$24.28 billion.

Dividend Yield: 3.2%

National Petroleum has consistently provided reliable and stable dividends over the past decade, with a current yield of 3.25%, which is below Taiwan's top 25% dividend payers. The company's dividends are covered by both earnings and cash flows, with payout ratios of 87% and 82.8%, respectively. Recent earnings showed a slight decline in net income for Q3 2024 at TWD 192.37 million, indicating potential pressure on future dividend sustainability despite historical reliability.

- Click here to discover the nuances of National Petroleum with our detailed analytical dividend report.

- The analysis detailed in our National Petroleum valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1846 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9233

Asia Air Survey

Provides aerial surveying services and products in Japan and internationally.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives