- Taiwan

- /

- Specialty Stores

- /

- TWSE:2911

More Unpleasant Surprises Could Be In Store For Les Enphants Co., Ltd.'s (TWSE:2911) Shares After Tumbling 29%

Les Enphants Co., Ltd. (TWSE:2911) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

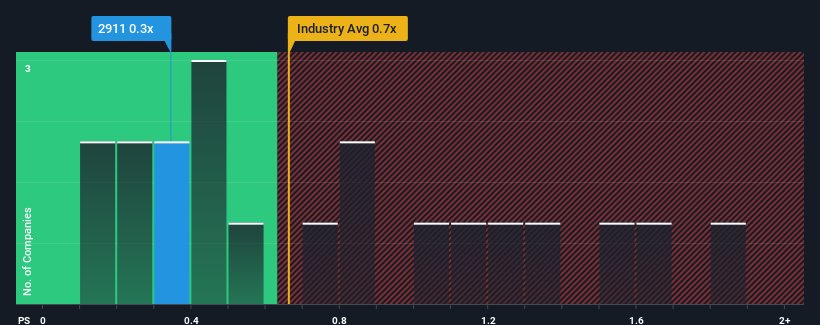

In spite of the heavy fall in price, there still wouldn't be many who think Les Enphants' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Taiwan's Specialty Retail industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Les Enphants

What Does Les Enphants' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Les Enphants over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Les Enphants' earnings, revenue and cash flow.How Is Les Enphants' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Les Enphants' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. As a result, revenue from three years ago have also fallen 25% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 13% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Les Enphants is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Les Enphants' P/S?

With its share price dropping off a cliff, the P/S for Les Enphants looks to be in line with the rest of the Specialty Retail industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Les Enphants revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Les Enphants (1 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2911

Les Enphants

Manufactures and sells clothes, toys, and supplies for children and infants.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives