- Taiwan

- /

- Real Estate

- /

- TWSE:5522

Farglory Land Development (TPE:5522) Has Gifted Shareholders With A Fantastic 104% Total Return On Their Investment

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Farglory Land Development Co., Ltd. (TPE:5522), which is up 59%, over three years, soundly beating the market return of 41% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 38% in the last year , including dividends .

View our latest analysis for Farglory Land Development

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

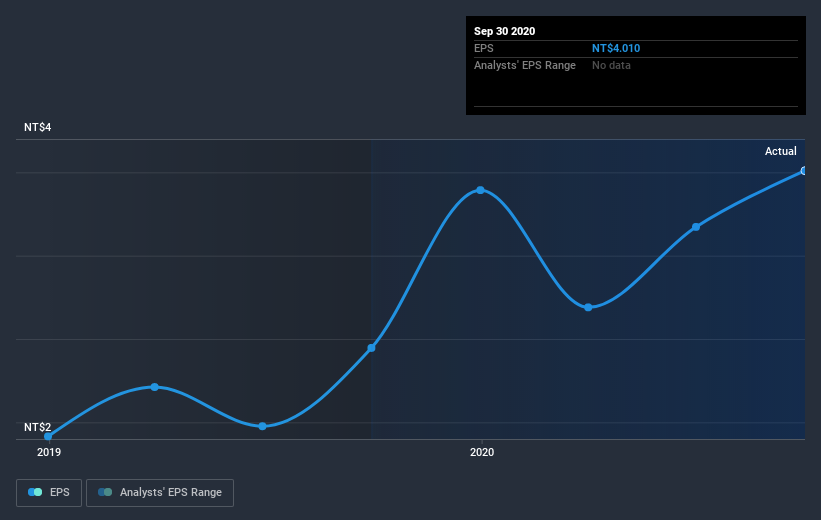

Farglory Land Development was able to grow its EPS at 67% per year over three years, sending the share price higher. The average annual share price increase of 17% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Farglory Land Development has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Farglory Land Development's financial health with this free report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Farglory Land Development's TSR for the last 3 years was 104%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Farglory Land Development shareholders have received returns of 38% over twelve months (even including dividends), which isn't far from the general market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 19% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand Farglory Land Development better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Farglory Land Development (including 2 which are a bit concerning) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Farglory Land Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5522

Farglory Land Development

Together with its subsidiary, Farglory Construction Co., Ltd., develops real estate properties in Taiwan.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives