- Taiwan

- /

- Real Estate

- /

- TWSE:2506

Reflecting on Pacific Construction's (TPE:2506) Share Price Returns Over The Last Five Years

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Pacific Construction Co., Ltd (TPE:2506), since the last five years saw the share price fall 36%.

View our latest analysis for Pacific Construction

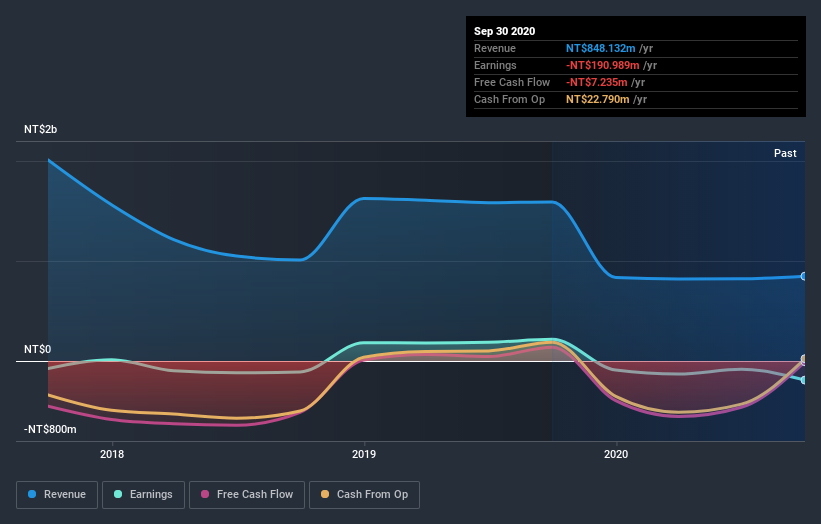

Because Pacific Construction made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Pacific Construction saw its revenue shrink by 19% per year. That puts it in an unattractive cohort, to put it mildly. On the face of it we'd posit the share price fall of 6% compound, over five years is well justified by the fundamental deterioration. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Pacific Construction stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Pacific Construction's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Pacific Construction shareholders, and that cash payout explains why its total shareholder loss of 32%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 34% in the last year, Pacific Construction shareholders lost 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Pacific Construction better, we need to consider many other factors. For example, we've discovered 3 warning signs for Pacific Construction (2 are a bit unpleasant!) that you should be aware of before investing here.

We will like Pacific Construction better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Pacific Construction or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2506

Pacific Construction

Engages in the construction business in Taiwan and Malaysia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives