Today we'll take a closer look at Sunfon Construction Co., Ltd. (GTSM:5514) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

Investors might not know much about Sunfon Construction's dividend prospects, even though it has been paying dividends for the last nine years and offers a 2.7% yield. While the yield may not look too great, the relatively long payment history is interesting. Some simple analysis can reduce the risk of holding Sunfon Construction for its dividend, and we'll focus on the most important aspects below.

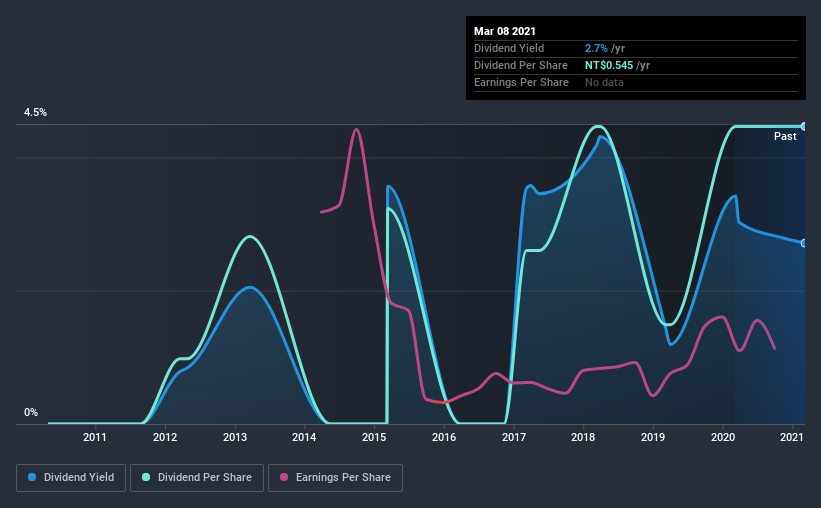

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 48% of Sunfon Construction's profits were paid out as dividends in the last 12 months. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, Sunfon Construction paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

With a strong net cash balance, Sunfon Construction investors may not have much to worry about in the near term from a dividend perspective.

We update our data on Sunfon Construction every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Looking at the last decade of data, we can see that Sunfon Construction paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was NT$0.1 in 2012, compared to NT$0.5 last year. This works out to be a compound annual growth rate (CAGR) of approximately 18% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

Sunfon Construction has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see Sunfon Construction has been growing its earnings per share at 100% a year over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Sunfon Construction has a low payout ratio, which we like, although it paid out virtually all of its generated cash. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. Ultimately, Sunfon Construction comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Sunfon Construction that investors should take into consideration.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Sunfon Construction, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5514

Sunfon Construction

Together with its subsidiary, engages in the development, construction, and sale of public housing and commercial buildings.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026