- Taiwan

- /

- Real Estate

- /

- TWSE:6177

Best Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainty, investors are keenly observing the implications of recent rate cuts and economic data. With U.S. stocks experiencing volatility amidst these developments, dividend stocks can offer a degree of stability and income potential for those seeking resilience in their portfolios during uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1950 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

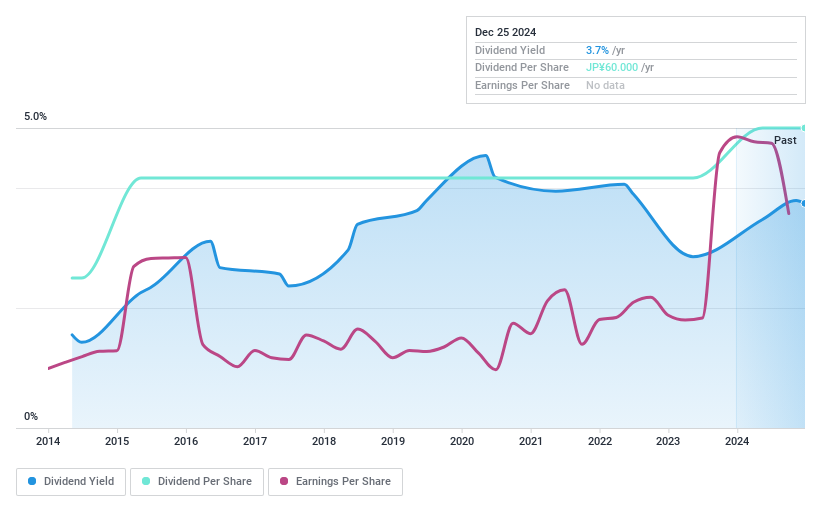

FurukawaLtd (TSE:5715)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Furukawa Co., Ltd., along with its subsidiaries, operates globally in the manufacturing and sale of machinery, metals, electronics, and chemical products, with a market cap of ¥56.63 billion.

Operations: Furukawa Co., Ltd. generates revenue through its global operations in manufacturing and selling machinery, metals, electronics, and chemical products.

Dividend Yield: 3.8%

Furukawa Ltd. recently declared a JPY 30 per share dividend for Q2, with payments starting December 9, 2024. Despite a low payout ratio of 17.1%, indicating dividends are covered by earnings, the company's dividends are not supported by free cash flow and have large one-off items affecting results. However, its price-to-earnings ratio of 4.8x is attractive compared to the JP market average of 13.5x, offering potential value for investors seeking yield stability amidst growth challenges.

- Dive into the specifics of FurukawaLtd here with our thorough dividend report.

- Our expertly prepared valuation report FurukawaLtd implies its share price may be too high.

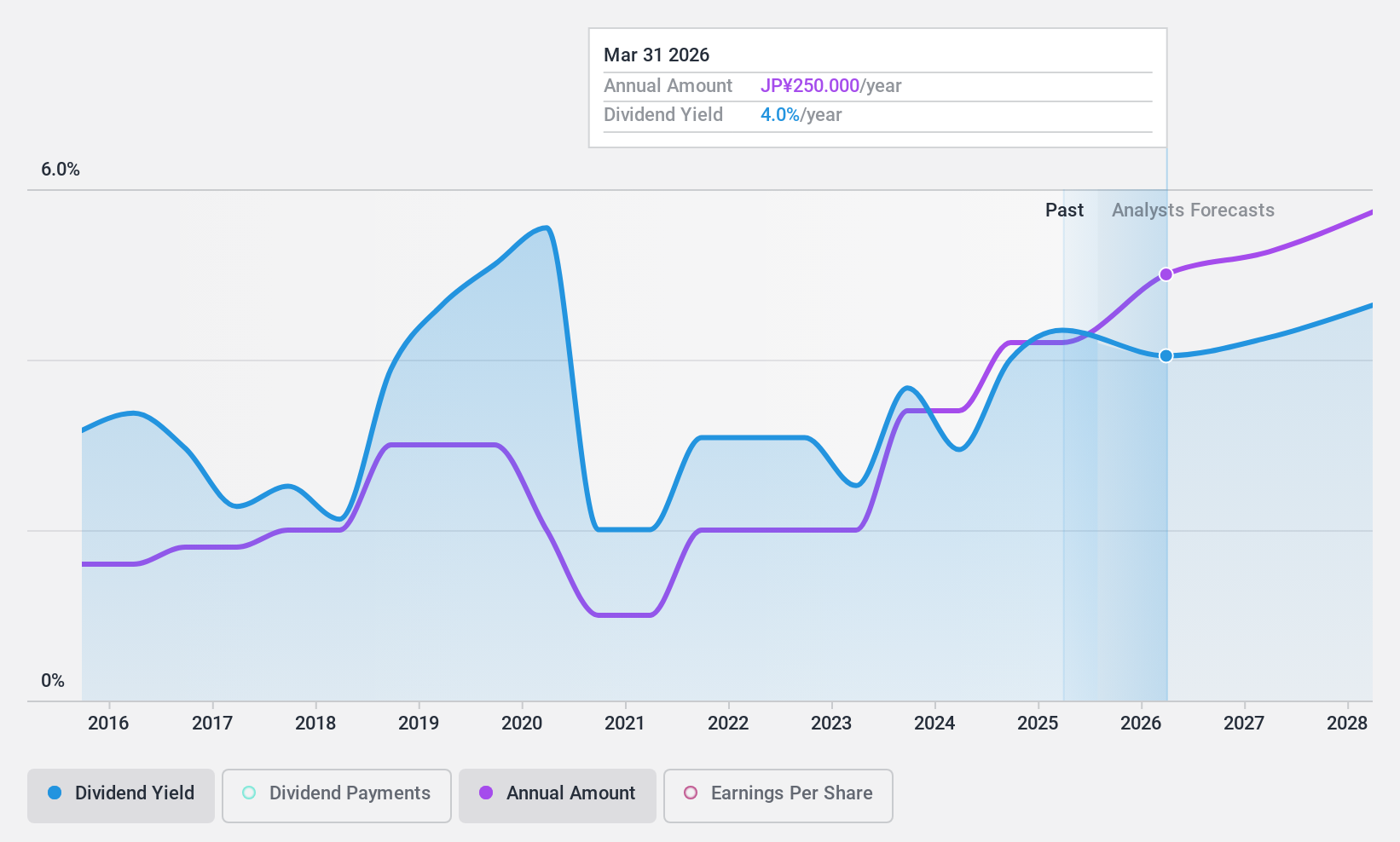

Hanwa (TSE:8078)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanwa Co., Ltd. is a diversified trading company engaged in the trade of steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products both in Japan and internationally with a market cap of ¥196.29 billion.

Operations: Hanwa Co., Ltd.'s revenue is primarily derived from its Steel Business at ¥1.20 billion, followed by Energy and Household Materials at ¥380.72 million, Overseas Sales Subsidiary at ¥374.52 million, Primary Metal at ¥212.01 million, Metal Recycling at ¥167.68 million, and Foods segment at ¥127.50 million.

Dividend Yield: 4.3%

Hanwa's dividend yield of 4.32% is among the top 25% in Japan, supported by a low payout ratio of 21%, ensuring coverage by earnings and cash flows. Despite historical volatility, recent increases to JPY 105 per share indicate growth potential. Trading at 32.5% below estimated fair value suggests good relative value compared to peers. However, debt coverage remains a concern with operating cash flow limitations, requiring careful consideration for sustained dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Hanwa.

- Our valuation report here indicates Hanwa may be undervalued.

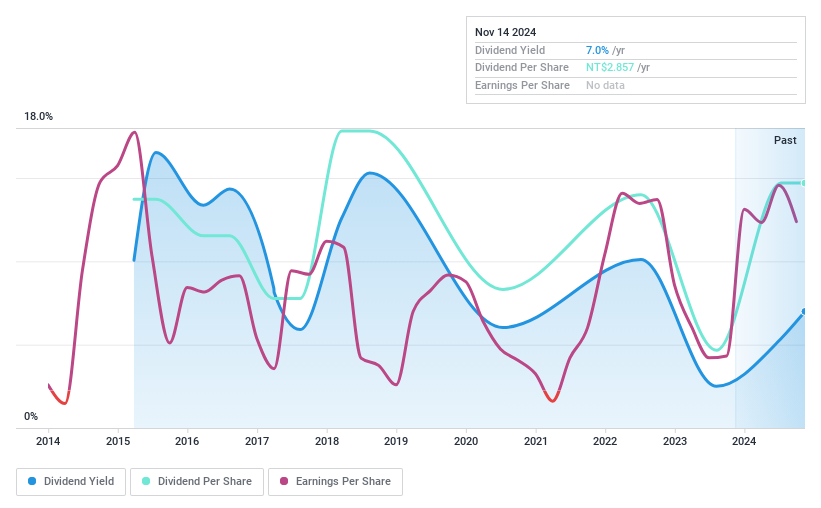

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, engages in the construction business in Taiwan and the United States, with a market capitalization of NT$18.68 billion.

Operations: Da-Li Development Co., Ltd. generates revenue from its Construction Segment and Construction Department, amounting to NT$4.36 billion and NT$14.61 billion respectively.

Dividend Yield: 6.6%

Da-Li Development Ltd.'s dividend yield of 6.56% ranks in the top 25% of Taiwan's market, with a payout ratio of 63.5% and cash payout ratio of 21.8%, indicating coverage by earnings and cash flows despite an unstable track record over the past decade. Recent earnings declines raise concerns, yet trading at 76.7% below estimated fair value suggests potential undervaluation. High debt levels and recent land acquisitions could impact future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Da-Li DevelopmentLtd.

- The valuation report we've compiled suggests that Da-Li DevelopmentLtd's current price could be quite moderate.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1947 more companies for you to explore.Click here to unveil our expertly curated list of 1950 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6177

Da-Li DevelopmentLtd

Together its subsidiaries, operates construction business in Taiwan and the United States.

Solid track record with excellent balance sheet and pays a dividend.