PharmaEssentia Corporation's (TWSE:6446) 37% Price Boost Is Out Of Tune With Revenues

PharmaEssentia Corporation (TWSE:6446) shares have continued their recent momentum with a 37% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 71%.

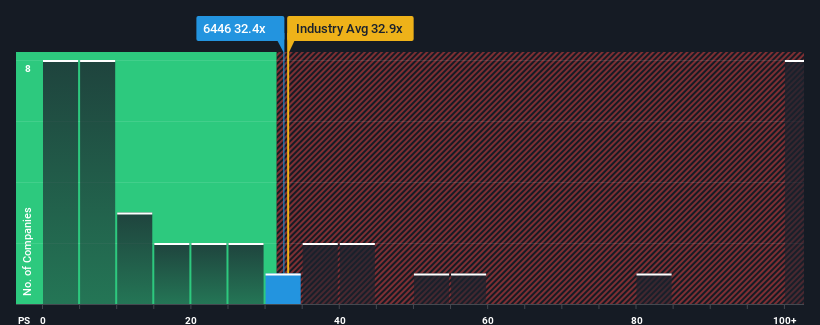

Although its price has surged higher, it's still not a stretch to say that PharmaEssentia's price-to-sales (or "P/S") ratio of 32.4x right now seems quite "middle-of-the-road" compared to the Biotechs industry in Taiwan, where the median P/S ratio is around 32.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for PharmaEssentia

What Does PharmaEssentia's Recent Performance Look Like?

PharmaEssentia could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PharmaEssentia will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For PharmaEssentia?

In order to justify its P/S ratio, PharmaEssentia would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 67% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 63% during the coming year according to the four analysts following the company. With the industry predicted to deliver 139% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that PharmaEssentia's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On PharmaEssentia's P/S

PharmaEssentia appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that PharmaEssentia's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with PharmaEssentia (including 1 which can't be ignored).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.