As global markets navigate a period of uncertainty marked by cautious Federal Reserve commentary and political tensions, U.S. stocks have experienced broad-based declines with smaller-cap indexes being particularly affected. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability to economic shifts, as these qualities can help them withstand market volatility and capitalize on emerging opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.09% | 42.97% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

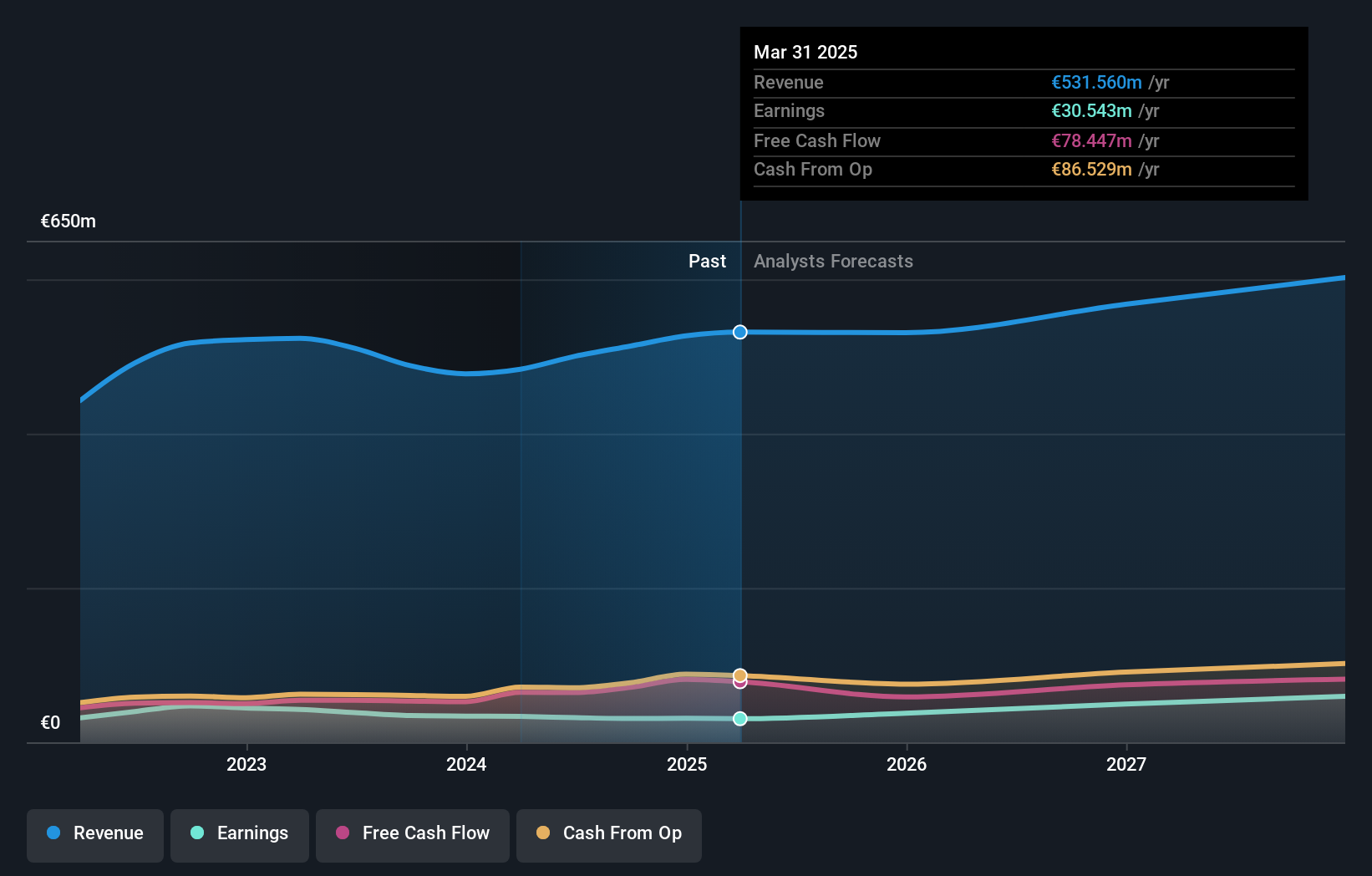

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture industries across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market capitalization of €961.32 million.

Operations: The company generates revenue from its industrial intelligence solutions across the fashion, automotive, and furniture sectors, with significant contributions from the Americas (€172.19 million) and Asia-Pacific (€124.33 million).

Lectra, a company specializing in software solutions for fabric and leather industries, demonstrates robust growth potential amid challenging market conditions. With an annual revenue growth of 5.7%, slightly outpacing the French market's 5.5%, Lectra is making strategic strides. Notably, its R&D commitment is evident with significant investment amounting to EUR 32 million this year alone, underscoring a focus on innovation and technology advancement. Additionally, the firm's earnings are projected to surge by 25.6% annually, reflecting strong operational efficiency and market adaptation strategies. Recent financial results revealed sales reaching EUR 394.22 million over nine months, up from EUR 358.26 million in the previous year, although net income slightly decreased to EUR 22.77 million from EUR 25.87 million due to strategic reinvestments into R&D and global expansion efforts.

- Click here and access our complete health analysis report to understand the dynamics of Lectra.

Examine Lectra's past performance report to understand how it has performed in the past.

Beijing E-Hualu Information Technology (SZSE:300212)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing E-Hualu Information Technology Co., Ltd. operates in the information technology sector and has a market capitalization of CN¥18.71 billion.

Operations: E-Hualu focuses on providing intelligent transportation and public safety solutions, leveraging its expertise in big data and cloud computing. The company generates revenue primarily through software development, system integration, and related services. Over recent periods, the net profit margin has shown notable fluctuations around 10%, reflecting variations in operational efficiency and cost management.

Beijing E-Hualu Information Technology, despite recent financial setbacks with a net loss widening to CNY 612.93 million from CNY 539.54 million year-over-year, is poised for significant recovery. The firm's revenue growth forecast at an impressive 73% annually outstrips the Chinese market average of 13.8%, indicating potential resilience and market capture capabilities. Moreover, projected earnings growth of 176.3% annually underscores an aggressive turnaround strategy, focusing on innovation and market adaptation despite current unprofitability and highly volatile share prices.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases, operating both in Taiwan and internationally, with a market capitalization of NT$188.08 billion.

Operations: The company generates revenue primarily from the research and development of new drugs, amounting to NT$8.32 billion.

PharmaEssentia, amidst a robust year of financial performance and strategic executive appointments, has demonstrated significant growth and innovation. The company reported a doubling of its third-quarter sales to TWD 2.71 billion from TWD 1.31 billion year-over-year, with net income soaring to TWD 719.69 million from TWD 198.52 million in the same period, reflecting an annualized revenue growth of 40.7% and earnings growth of 92%. These figures underscore PharmaEssentia's successful expansion strategies and operational efficiency in the biotech sector. Recent executive team bolstering, including the appointment of Joseph R. Horvat as Global Chief Commercial Officer, aligns with its focus on enhancing global commercial strategies and drug development pipelines, particularly in markets like the USA which are pivotal for future revenue streams.

- Get an in-depth perspective on PharmaEssentia's performance by reading our health report here.

Gain insights into PharmaEssentia's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1279 High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives