High Growth Tech And 2 Other Promising Stocks With Potential To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility as investors react to policy uncertainties surrounding the incoming Trump administration, with significant sectoral shifts seen in financials and energy due to deregulation hopes, while healthcare and EV sectors face pressures from potential regulatory changes. Amidst these fluctuations, identifying stocks with high growth potential can be crucial for enhancing a portfolio; particularly in the tech sector where innovation and adaptability are key drivers of success.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1296 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Beijing E-Hualu Information Technology (SZSE:300212)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing E-Hualu Information Technology Co., Ltd. operates in the technology sector with a focus on information services and solutions, and has a market cap of CN¥19.75 billion.

Operations: E-Hualu generates revenue primarily through its information services and solutions in the technology sector. The company's operations are focused on leveraging technological expertise to deliver tailored solutions, contributing to its market presence and valuation.

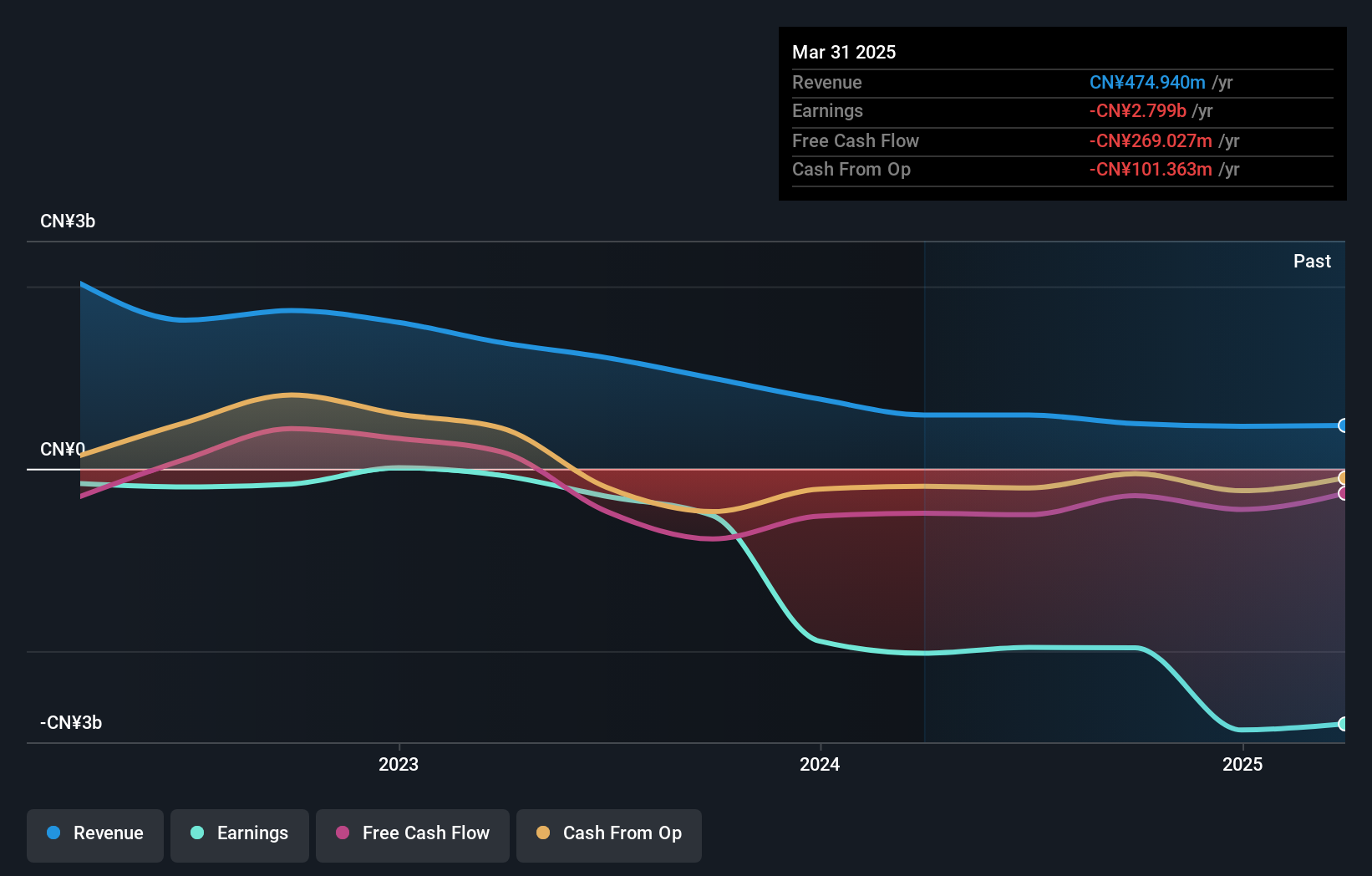

Beijing E-Hualu Information Technology, amid a challenging fiscal year with a net loss widening to CNY 612.93 million from CNY 539.54 million, still projects robust future growth. The company's revenue is expected to surge by an impressive 59.1% annually, outpacing the broader Chinese market's growth rate of 13.9%. Despite current unprofitability, forecasts suggest a significant turnaround with earnings anticipated to grow by 147.96% annually over the next three years. This potential for high revenue and earnings growth highlights Beijing E-Hualu's capacity for recovery and expansion in the tech sector, driven by strategic adjustments and market positioning that could capitalize on emerging technology trends.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China with a market capitalization of CN¥20.49 billion.

Operations: The company focuses on digital publishing within China, leveraging its market presence to generate revenue through various digital content offerings. It operates with a market capitalization of CN¥20.49 billion, indicating its significant position in the industry.

Despite a challenging fiscal year for COL GroupLtd, with revenue dropping from CNY 1.02 billion to CNY 808.05 million and shifting from a net profit to a loss of CNY 188.12 million, the company's aggressive R&D investment strategy underscores its commitment to innovation. In the latest reporting period, R&D expenses surged by 20%, reflecting a strategic pivot towards enhancing product offerings and potentially capturing new market segments. Moreover, COL GroupLtd has actively repurchased shares worth CNY 20.05 million, signaling confidence in its future prospects despite current financial headwinds. This blend of bolstered research efforts and shareholder-focused actions could position the firm favorably as it navigates through tech industry fluctuations and aims for recovery.

- Click here to discover the nuances of COL GroupLtd with our detailed analytical health report.

Review our historical performance report to gain insights into COL GroupLtd's's past performance.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases, operating in Taiwan and internationally, with a market cap of NT$189.74 billion.

Operations: The company's primary revenue stream is derived from its research and development of new drugs, generating NT$8.32 billion.

PharmaEssentia showcases a robust growth trajectory, with its revenue soaring by 40.4% annually, outpacing the broader TW market's expansion of 12.7%. This surge is underpinned by significant R&D investments aimed at pioneering treatments in biotechnology, as evidenced by their latest earnings report where R&D expenses were crucial to supporting ongoing clinical trials and product development. Notably, the company has transitioned from a net loss to a profit this year, with earnings expected to climb by an impressive 92% annually. These financial dynamics are complemented by PharmaEssentia's strategic presentations at multiple global healthcare conferences, signaling their proactive engagement with the broader medical and investment communities to foster growth and innovation in high-stakes markets like oncology and hematology.

- Take a closer look at PharmaEssentia's potential here in our health report.

Gain insights into PharmaEssentia's past trends and performance with our Past report.

Summing It All Up

- Gain an insight into the universe of 1296 High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PharmaEssentia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.