- Hong Kong

- /

- Medical Equipment

- /

- SEHK:3600

Undiscovered Gems To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical uncertainties, small-cap stocks have been particularly sensitive to these shifts, with indices like the S&P 600 reflecting the volatility. Amidst this backdrop, investors often seek out lesser-known opportunities that may offer potential growth despite broader market challenges. In this context, identifying stocks with strong fundamentals and resilience to economic pressures can be crucial for uncovering hidden gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Modern Dental Group (SEHK:3600)

Simply Wall St Value Rating: ★★★★★★

Overview: Modern Dental Group Limited is an investment holding company involved in the production, distribution, and trading of dental prosthetic devices across Europe, Greater China, North America, Australia, and other international markets with a market capitalization of approximately HK$3.97 billion.

Operations: The company generates revenue primarily from fixed prosthetic devices, contributing HK$2.02 billion, followed by removable prosthetic devices at HK$755.93 million.

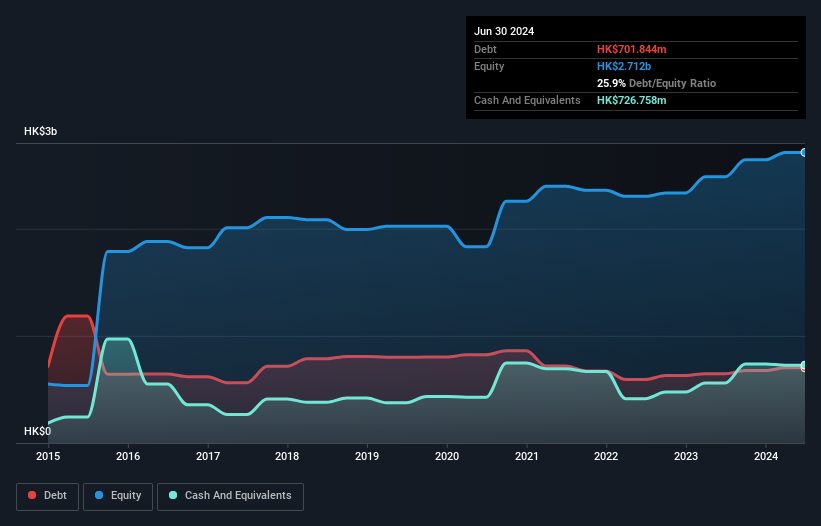

Modern Dental Group, a promising player in the dental industry, has shown impressive performance with its earnings growing by 23% over the past year, outpacing the Medical Equipment industry's -4.3%. The company is trading at 73.9% below its estimated fair value, suggesting potential for investors seeking undervalued opportunities. With a debt-to-equity ratio reduced from 39.6% to 25.9% over five years and interest payments well-covered at 13.6 times EBIT, financial health seems robust. Recent leadership changes aim to drive future growth as Dr. Chan Ronald Yik Long steps in as CEO from January 2025, bringing strategic expertise and innovation focus to the table.

- Click to explore a detailed breakdown of our findings in Modern Dental Group's health report.

Gain insights into Modern Dental Group's past trends and performance with our Past report.

Ashot Ashkelon Industries (TASE:ASHO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ashot Ashkelon Industries Ltd. is a company that manufactures and sells systems and components for aerospace and defense in Israel and internationally, with a market cap of ₪1.30 billion.

Operations: Ashot Ashkelon Industries generates revenue primarily from its military segment, contributing ₪250.03 million, and its aviation and complex assemblies segment, adding ₪100.23 million. The company's subsidiary in the USA accounts for an additional ₪67.39 million in revenue.

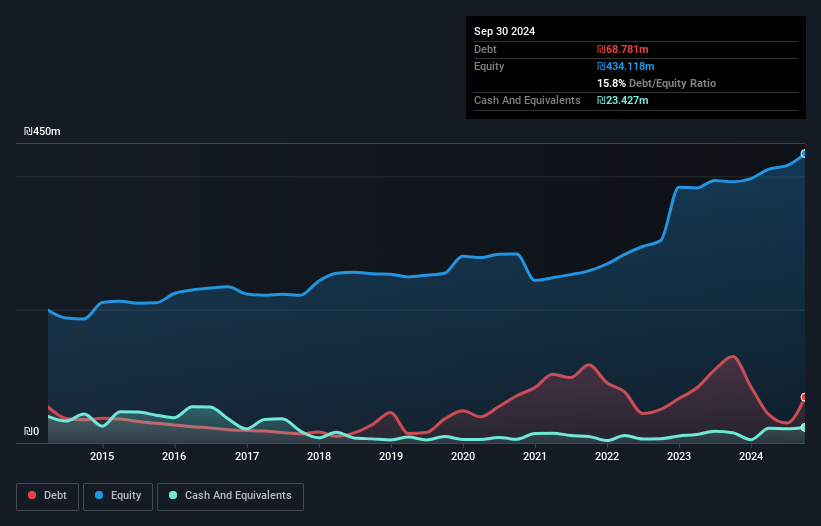

Ashot Ashkelon Industries, a smaller player in the Aerospace & Defense sector, has shown impressive growth with earnings surging 128.6% over the past year, outpacing industry averages. Its debt management appears stable with a net debt to equity ratio at 10.4%, deemed satisfactory. Despite this, the company's debt to equity ratio slightly increased from 14.1% to 15.8% over five years, indicating some leverage adjustments. Recent financials highlight robust performance; third-quarter sales reached ILS 100 million compared to last year's ILS 80 million, and net income improved from ILS 7.85 million to ILS 11.37 million during the same period.

- Click here to discover the nuances of Ashot Ashkelon Industries with our detailed analytical health report.

Learn about Ashot Ashkelon Industries' historical performance.

PharmaEngine (TPEX:4162)

Simply Wall St Value Rating: ★★★★★★

Overview: PharmaEngine, Inc. is a biopharmaceutical company focused on developing cancer treatment drugs in Taiwan, with a market cap of NT$14.37 billion.

Operations: PharmaEngine's revenue is primarily derived from its new medicine development segment, amounting to NT$831.92 million.

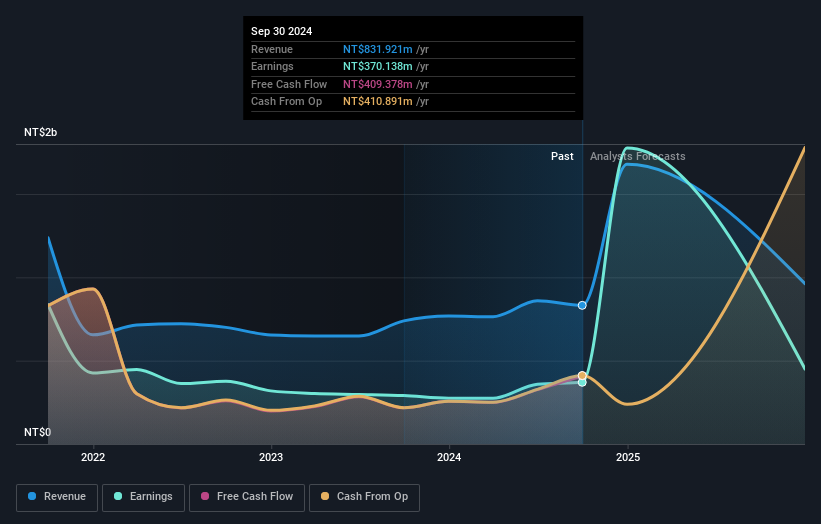

PharmaEngine, a nimble player in the biotech sector, has been making waves with its robust financial health. The company boasts high-quality earnings and has seen a 27% growth in profits over the past year, outpacing the industry average of 9%. Trading at nearly 9% below its fair value estimate, it presents an attractive proposition. Despite no debt on its books for five years, future earnings are expected to dip by an average of 26% annually over three years. Recent partnerships and solid net income gains highlight strategic moves that could bolster its market position.

- Click here and access our complete health analysis report to understand the dynamics of PharmaEngine.

Assess PharmaEngine's past performance with our detailed historical performance reports.

Make It Happen

- Access the full spectrum of 4663 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3600

Modern Dental Group

An investment holding company, engages in production, distribution, and trading of dental prosthetic devices in Europe, Greater China, North America, Australia, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives