We Think Handa Pharmaceuticals (GTSM:6620) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Handa Pharmaceuticals (GTSM:6620) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Handa Pharmaceuticals

When Might Handa Pharmaceuticals Run Out Of Money?

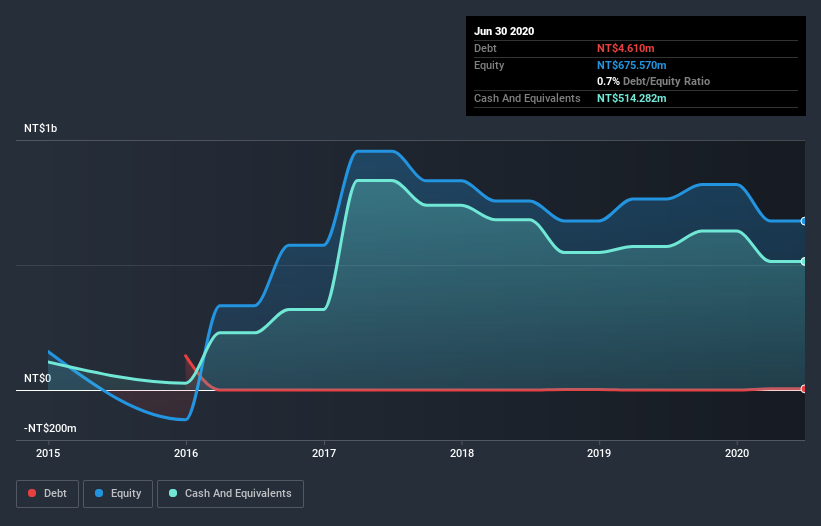

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2020, Handa Pharmaceuticals had cash of NT$514m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was NT$237m over the trailing twelve months. Therefore, from June 2020 it had 2.2 years of cash runway. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

How Well Is Handa Pharmaceuticals Growing?

Handa Pharmaceuticals reduced its cash burn by 5.1% during the last year, which points to some degree of discipline. In contrast, however, operating revenue tanked 63% during the period. Considering both these metrics, we're a little concerned about how the company is developing. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Handa Pharmaceuticals is building its business over time.

How Easily Can Handa Pharmaceuticals Raise Cash?

Even though it seems like Handa Pharmaceuticals is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Handa Pharmaceuticals has a market capitalisation of NT$2.9b and burnt through NT$237m last year, which is 8.0% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Handa Pharmaceuticals' Cash Burn A Worry?

On this analysis of Handa Pharmaceuticals' cash burn, we think its cash burn relative to its market cap was reassuring, while its falling revenue has us a bit worried. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Separately, we looked at different risks affecting the company and spotted 2 warning signs for Handa Pharmaceuticals (of which 1 can't be ignored!) you should know about.

Of course Handa Pharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Handa Pharmaceuticals or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Handa Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6620

Handa Pharmaceuticals

A specialty pharmaceutical company, focuses on the development of drugs for various diseases in the United States and China.

Flawless balance sheet and fair value.