OBI Pharma (GTSM:4174) Shareholders Booked A 69% Gain In The Last Year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the OBI Pharma, Inc. (GTSM:4174) share price is 69% higher than it was a year ago, much better than the market return of around 54% (not including dividends) in the same period. So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 17% in three years.

View our latest analysis for OBI Pharma

OBI Pharma recorded just NT$61,325,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that OBI Pharma comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Some OBI Pharma investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

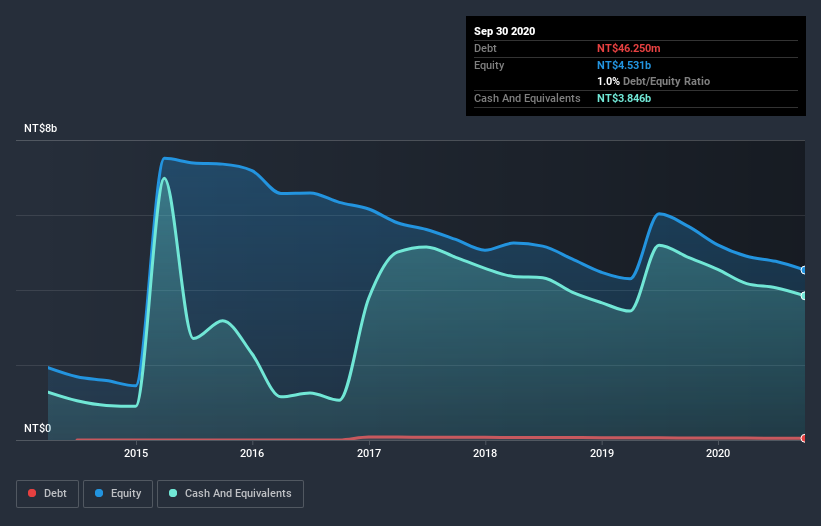

When it last reported its balance sheet in September 2020, OBI Pharma had cash in excess of all liabilities of NT$3.5b. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. With the share price up 114% in the last year , the market is seems hopeful about the potential, despite the cash burn. You can see in the image below, how OBI Pharma's cash levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

It's nice to see that OBI Pharma shareholders have received a total shareholder return of 69% over the last year. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for OBI Pharma (1 can't be ignored!) that you should be aware of before investing here.

Of course OBI Pharma may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade OBI Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4174

OBI Pharma

A clinical stage oncology company, research and develops novel therapeutic agents for unmet medical needs against cancer in Taiwan and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives