If You Had Bought OBI Pharma's (GTSM:4174) Shares Five Years Ago You Would Be Down 82%

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding OBI Pharma, Inc. (GTSM:4174) during the five years that saw its share price drop a whopping 82%. It's up 2.2% in the last seven days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for OBI Pharma

OBI Pharma recorded just NT$61,325,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. It seems likely some shareholders believe that OBI Pharma has the funding to invent a new product before too long.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. OBI Pharma has already given some investors a taste of the bitter losses that high risk investing can cause.

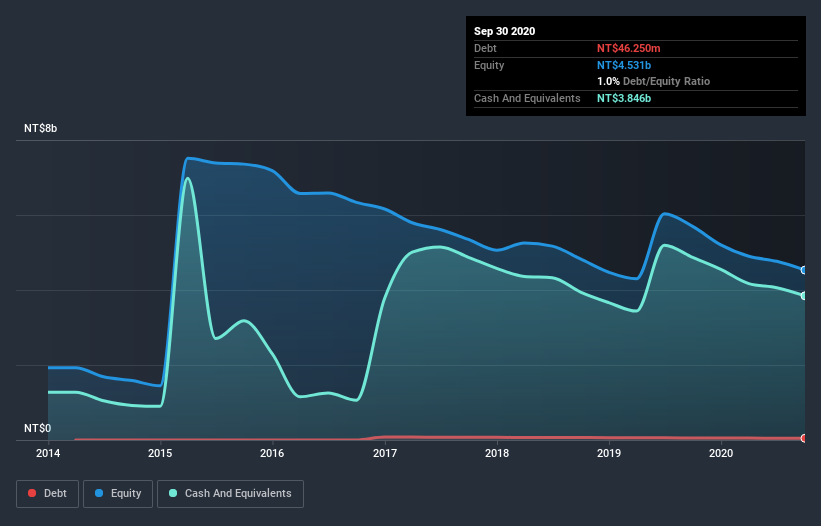

OBI Pharma had cash in excess of all liabilities of NT$3.5b when it last reported (September 2020). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 13% per year, over 5 years , it seems likely that the need for cash is weighing on investors' minds. You can click on the image below to see (in greater detail) how OBI Pharma's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. You can click here to see if there are insiders selling.

A Different Perspective

While the broader market gained around 22% in the last year, OBI Pharma shareholders lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 13% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for OBI Pharma (1 shouldn't be ignored) that you should be aware of.

We will like OBI Pharma better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade OBI Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:4174

OBI Pharma

A clinical stage oncology company, research and develops novel therapeutic agents for unmet medical needs against cancer in Taiwan and internationally.

Mediocre balance sheet low.

Market Insights

Community Narratives