September 2024's Top Growth Picks With High Insider Ownership

Reviewed by Simply Wall St

As global markets show signs of recovery, with U.S. stocks rebounding and growth stocks outperforming value shares, the focus on companies with strong insider ownership becomes increasingly relevant. High insider ownership often signals confidence in a company's future prospects, making these firms particularly attractive during periods of market optimism and economic adjustments.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharma Mar, S.A. is a biopharmaceutical company focused on the research, development, production, and commercialization of bio-active principles for oncology across various regions including Europe and the United States, with a market cap of €833.45 million.

Operations: The company generates €194.09 million in revenue from its oncology segment.

Insider Ownership: 11.9%

Pharma Mar, S.A. presents a mixed picture for growth investors with high insider ownership. Despite a highly volatile share price over the past three months, the company is expected to see revenue growth of 18.2% per year, outpacing the Spanish market's 4.8%. Earnings are forecast to grow at 55.24% annually, and it is projected to become profitable within three years with a high return on equity (34.4%). However, recent earnings show a decline in net income from €6.44 million to €3.54 million year-over-year despite stable revenue (€80.84 million).

- Delve into the full analysis future growth report here for a deeper understanding of Pharma Mar.

- Upon reviewing our latest valuation report, Pharma Mar's share price might be too pessimistic.

APT Medical (SHSE:688617)

Simply Wall St Growth Rating: ★★★★★★

Overview: APT Medical Inc. engages in the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China with a market cap of CN¥32.61 billion.

Operations: APT Medical's revenue from medical products is CN¥1.86 billion.

Insider Ownership: 31.6%

APT Medical Inc. showcases strong growth potential with high insider ownership. Recent earnings for the first half of 2024 revealed significant improvements, with net income rising to CNY 342.56 million from CNY 257.4 million year-over-year and revenue increasing to CNY 1 billion from CNY 787.99 million. The company’s earnings are forecast to grow at an impressive rate of 28.18% per year, surpassing the Chinese market average, while maintaining a high return on equity of 28.3%.

- Unlock comprehensive insights into our analysis of APT Medical stock in this growth report.

- Upon reviewing our latest valuation report, APT Medical's share price might be too optimistic.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★☆☆

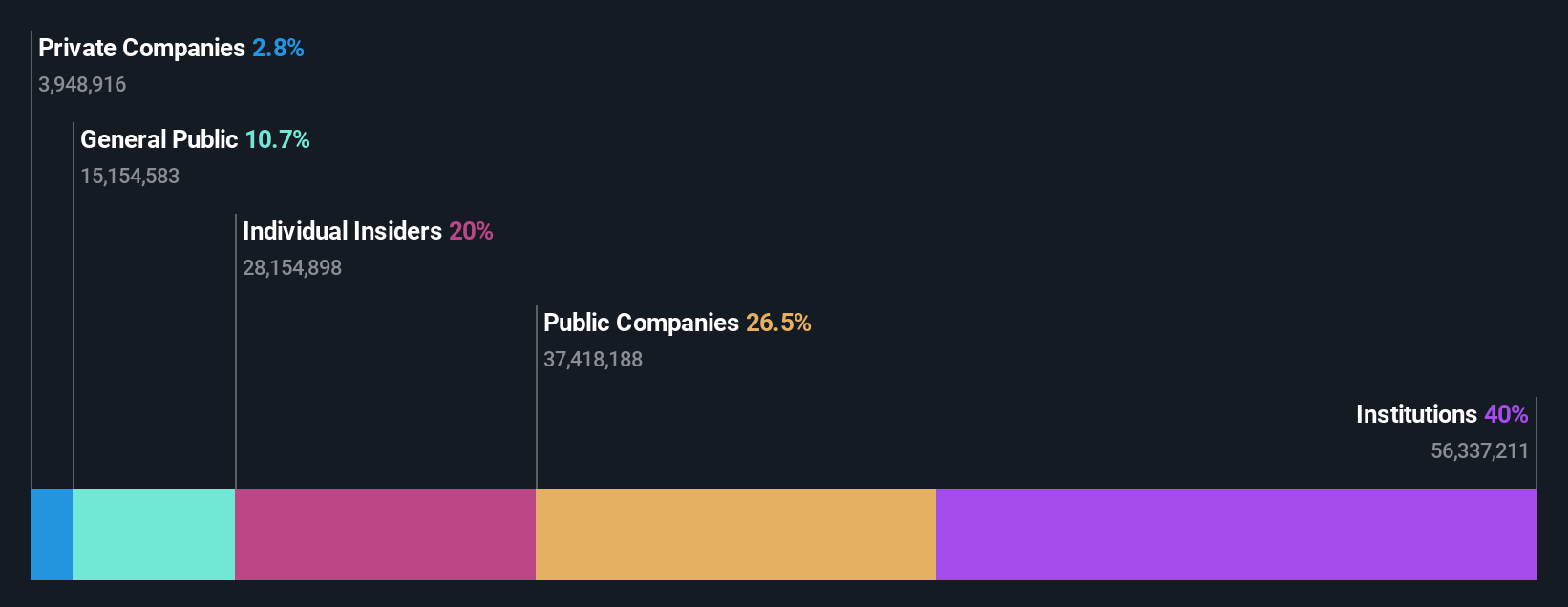

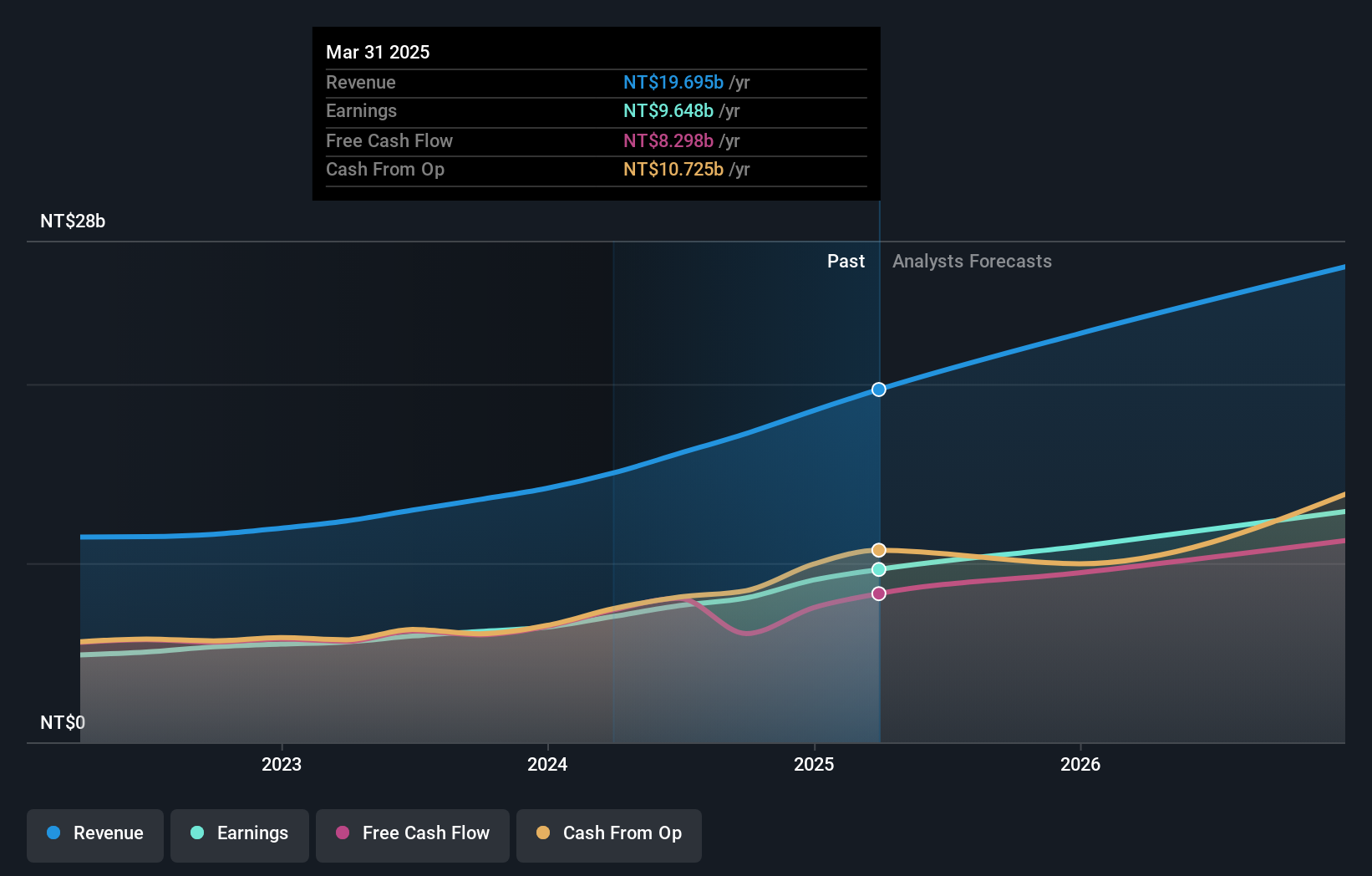

Overview: International Games System Co., Ltd. is engaged in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$231.64 billion.

Operations: The company's revenue is primarily derived from its Online Games Division, generating NT$8.99 billion, and its Business Game Division, contributing NT$7.13 billion.

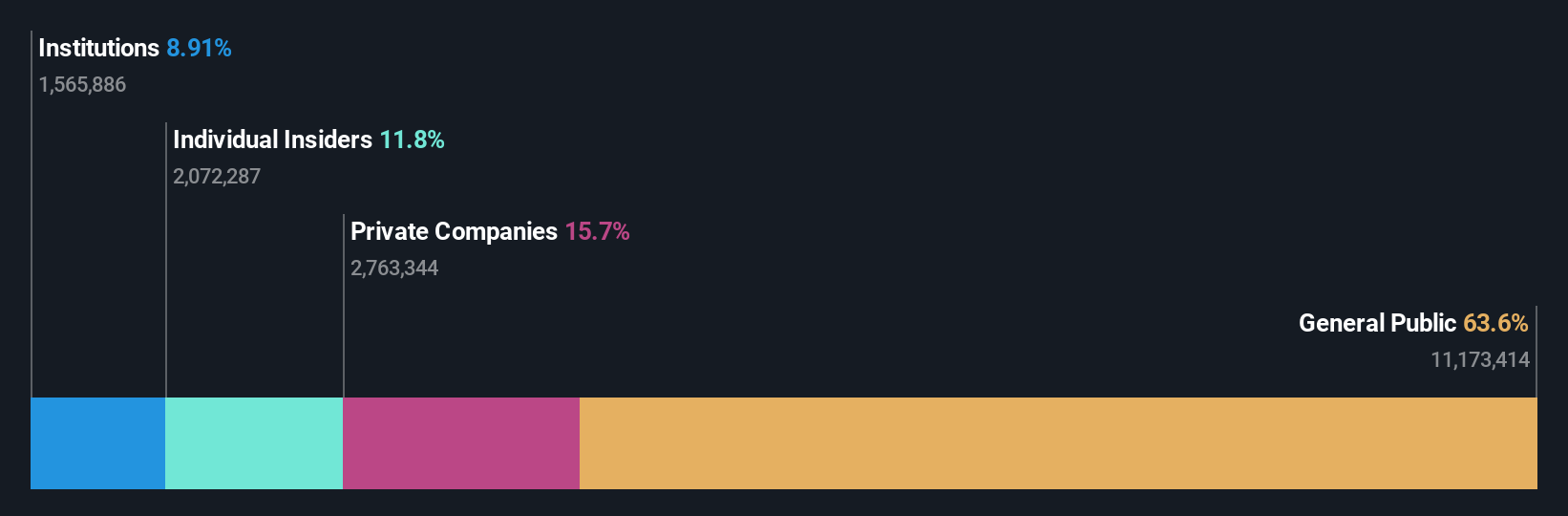

Insider Ownership: 12.5%

International Games System Ltd. demonstrates growth potential with high insider ownership. Earnings for the first half of 2024 showed substantial increases, with net income rising to NT$4.31 billion from NT$3.11 billion year-over-year and revenue increasing to NT$8.75 billion from NT$6.8 billion. The company's earnings are forecast to grow at 19.35% annually, outpacing the Taiwan market average, despite recent share price volatility and stable dividend payments at 2.13%.

- Take a closer look at International Games SystemLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that International Games SystemLtd is trading beyond its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 1519 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PHM

Pharma Mar

A biopharmaceutical company, engages in the research, development, production, and commercialization of bio-active principles for the use in oncology in Spain, Italy, Germany, Ireland, France, rest of the European Union, the United States, and internationally.

Exceptional growth potential with adequate balance sheet.