Exploring Three High Growth Tech Stocks For Future Potential

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape marked by declining consumer confidence and fluctuating indices, technology stocks continue to capture attention with their potential for high growth. In this environment, identifying promising tech stocks involves assessing factors such as innovation, market demand, and the ability to adapt to changing economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and internationally, and has a market cap of approximately €5.68 billion.

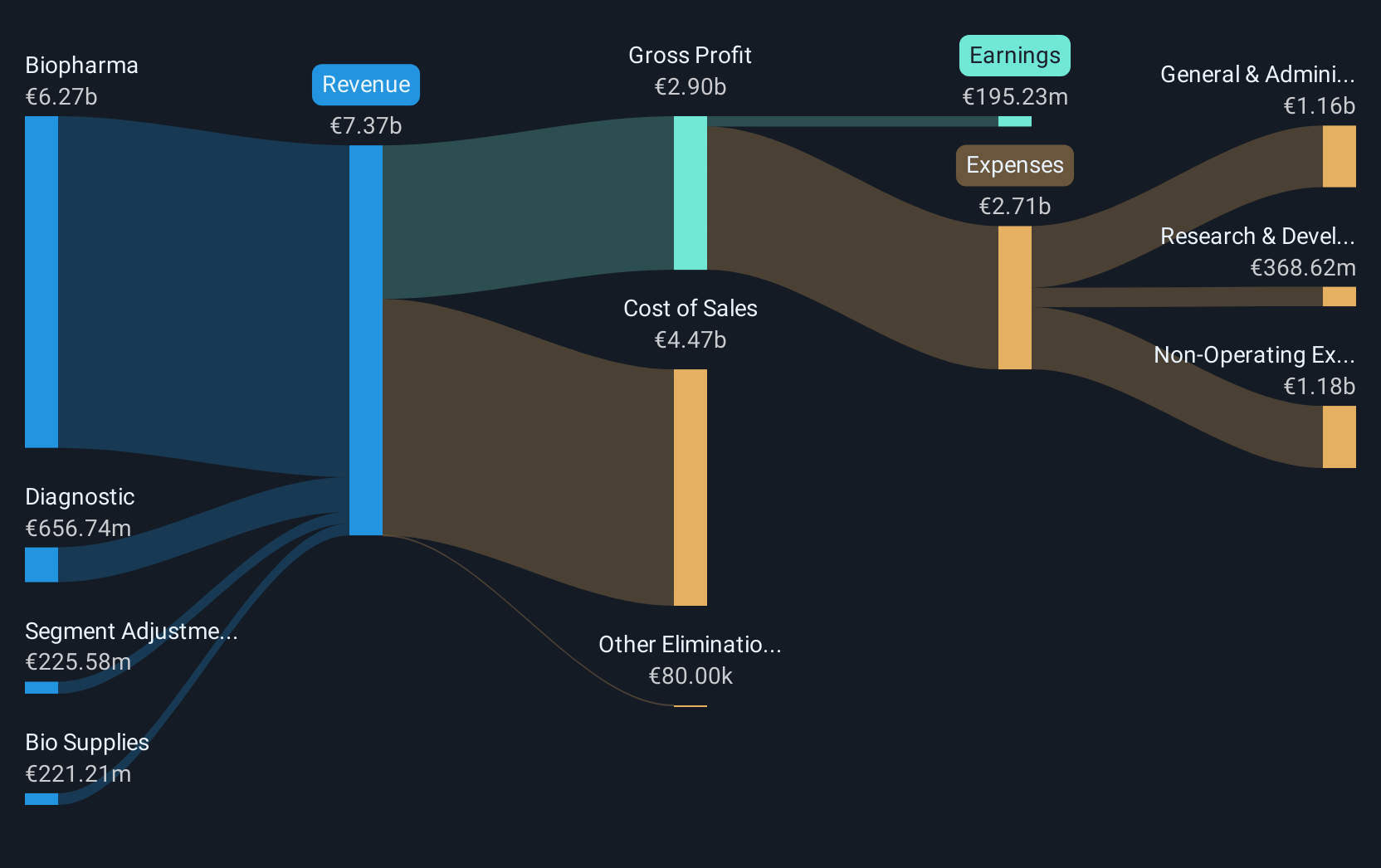

Operations: Grifols generates revenue primarily from its Biopharma segment, contributing €5.95 billion, followed by the Diagnostic and Bio Supplies segments with €651.33 million and €204.55 million respectively.

Amidst recent turbulence, Grifols has demonstrated resilience with a notable 590.4% surge in earnings over the past year, significantly outpacing the biotech industry's -18.2% downturn. Despite challenges, including activist pressures for governance reforms and a failed transaction that could have undervalued the company, Grifols continues to innovate. The firm recently secured EUR 1.3 billion through debt financing to streamline its capital structure and invest in core operations, underscoring its strategic focus on long-term growth amidst governance calls for greater transparency and independent oversight.

- Unlock comprehensive insights into our analysis of Grifols stock in this health report.

Assess Grifols' past performance with our detailed historical performance reports.

DongHua Testing Technology (SZSE:300354)

Simply Wall St Growth Rating: ★★★★★★

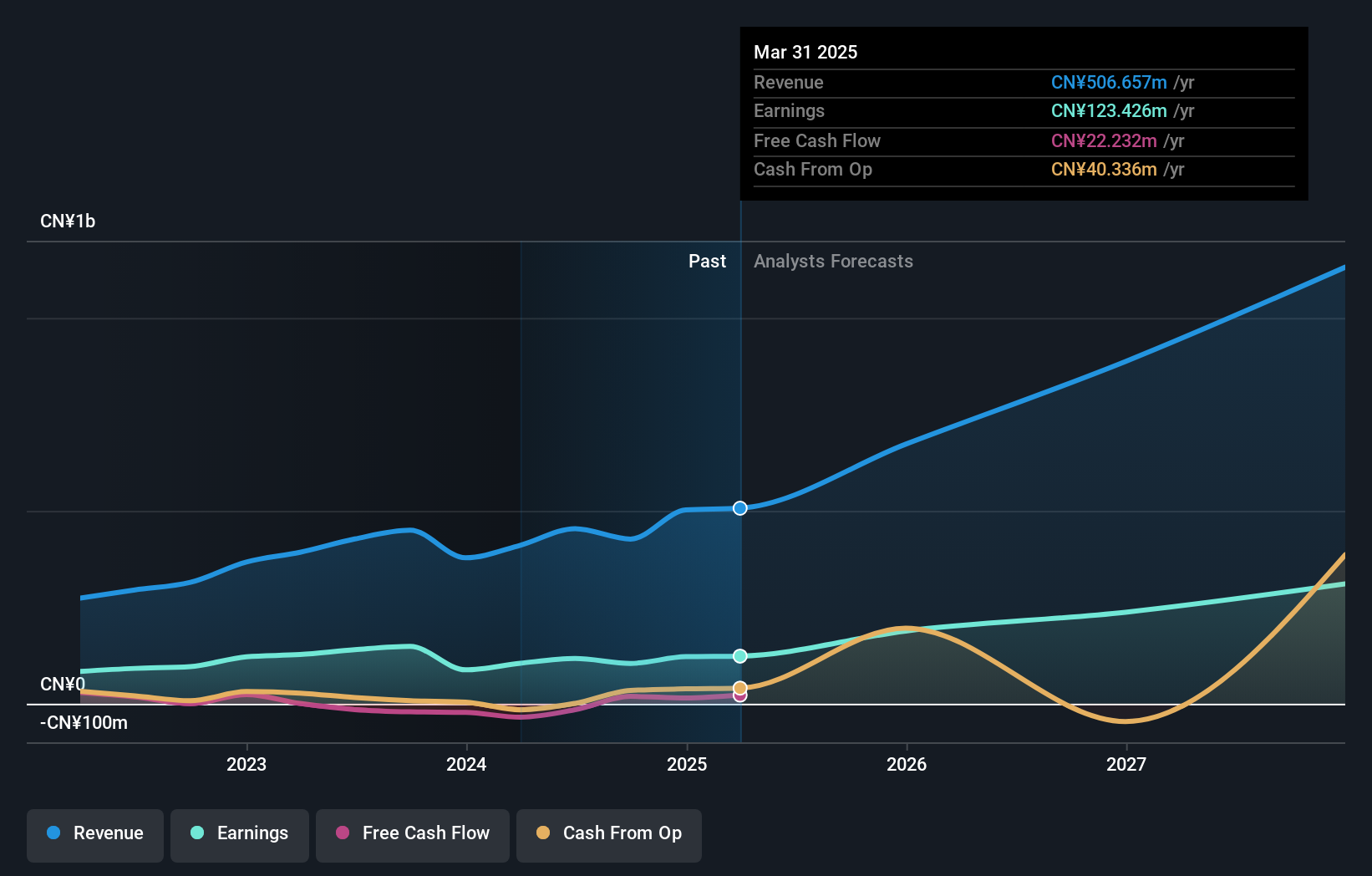

Overview: DongHua Testing Technology Co., Ltd. specializes in providing structural mechanical property testing services in China and has a market capitalization of CN¥4.80 billion.

Operations: The company generates revenue primarily through its instrumentation testing segment, which accounts for CN¥426.74 million.

DongHua Testing Technology has shown a robust performance in the recent earnings announcement, with sales and net income rising to CNY 354.18 million and CNY 99.04 million respectively, marking significant year-over-year increases of 15.9% and 20.3%. This growth is underpinned by an impressive forecast of annual revenue and earnings growth at rates of 35.6% and 41%, respectively, substantially outstripping the broader Chinese market's averages. The company's commitment to R&D is evident as it continues to innovate within the tech testing sector, positioning itself well for sustained future growth amidst a competitive landscape.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★★☆

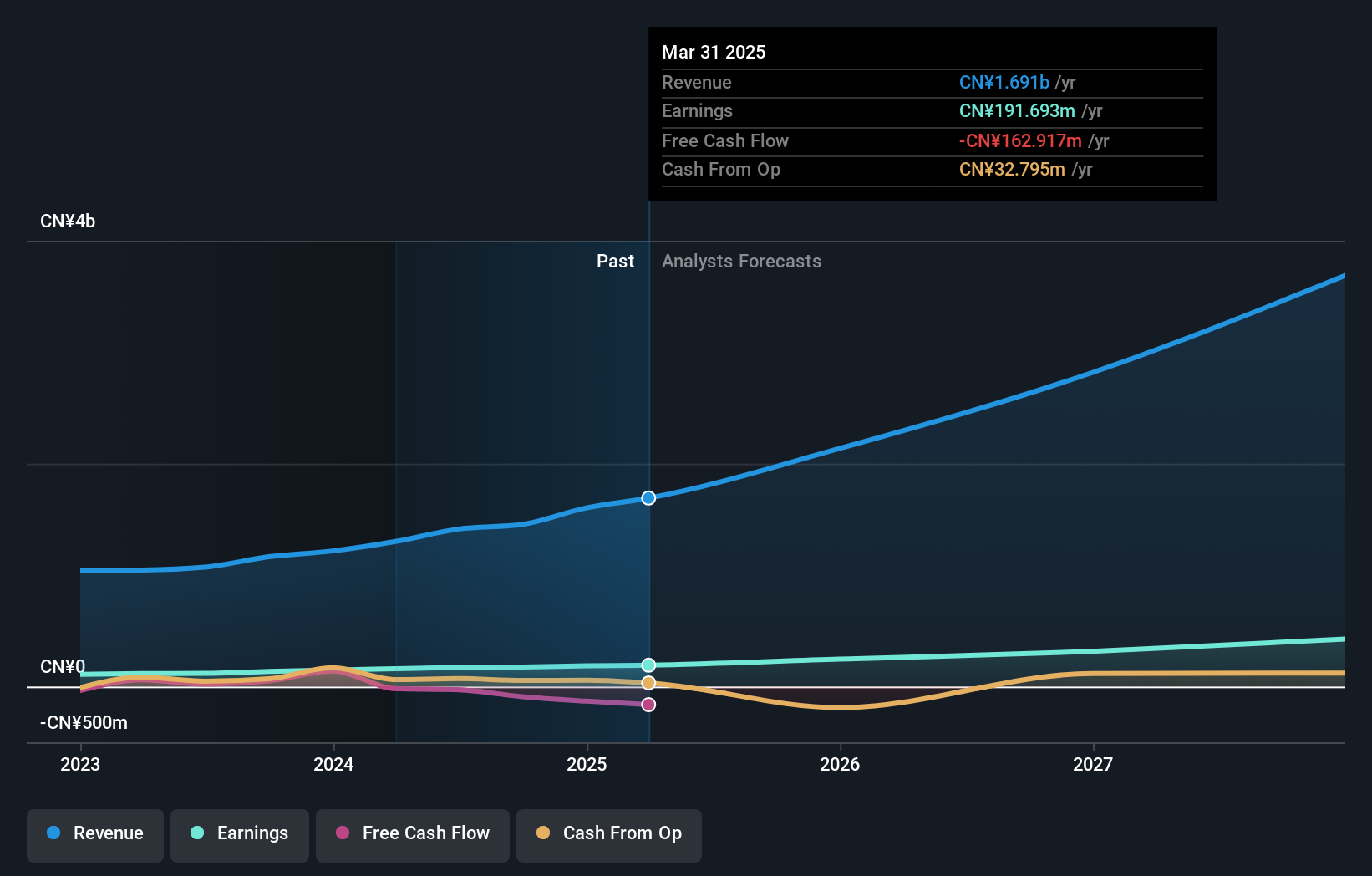

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market cap of CN¥4.02 billion.

Operations: ZUCH Technology focuses on producing electric connectors, with its primary revenue derived from the Chinese market. The company's operations are centered around manufacturing and selling these components, contributing significantly to its financial performance.

Zhejiang ZUCH Technology has demonstrated robust growth, with a 26.6% increase in sales to CNY 1.14 billion and a 25.7% rise in net income to CNY 135.09 million for the nine months ending September 2024. This performance is bolstered by an impressive annual revenue growth forecast of 28.4%, surpassing the Chinese market average of 13.6%. The company's commitment to innovation is reflected in its R&D strategy, which has supported earnings growth exceeding the electronics industry average by over twenty-six percentage points last year, positioning ZUCH well for sustained advancement in a competitive sector.

Where To Now?

- Click through to start exploring the rest of the 1263 High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives