High Growth Tech Stocks And 2 Other Promising Picks With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, the technology-heavy Nasdaq Composite has shown resilience, leading gains in a holiday-shortened week despite some mid-week setbacks. In this environment, identifying promising high-growth tech stocks requires careful consideration of their ability to adapt to shifting economic conditions and leverage innovation for sustained growth.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Xiamen Jihong Technology (SZSE:002803)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in China and has a market capitalization of CN¥5.08 billion.

Operations: The company focuses on cross-border social e-commerce in China, leveraging digital platforms to facilitate international trade and consumer engagement. It generates revenue primarily through its online marketplace activities, which connect buyers and sellers across different regions.

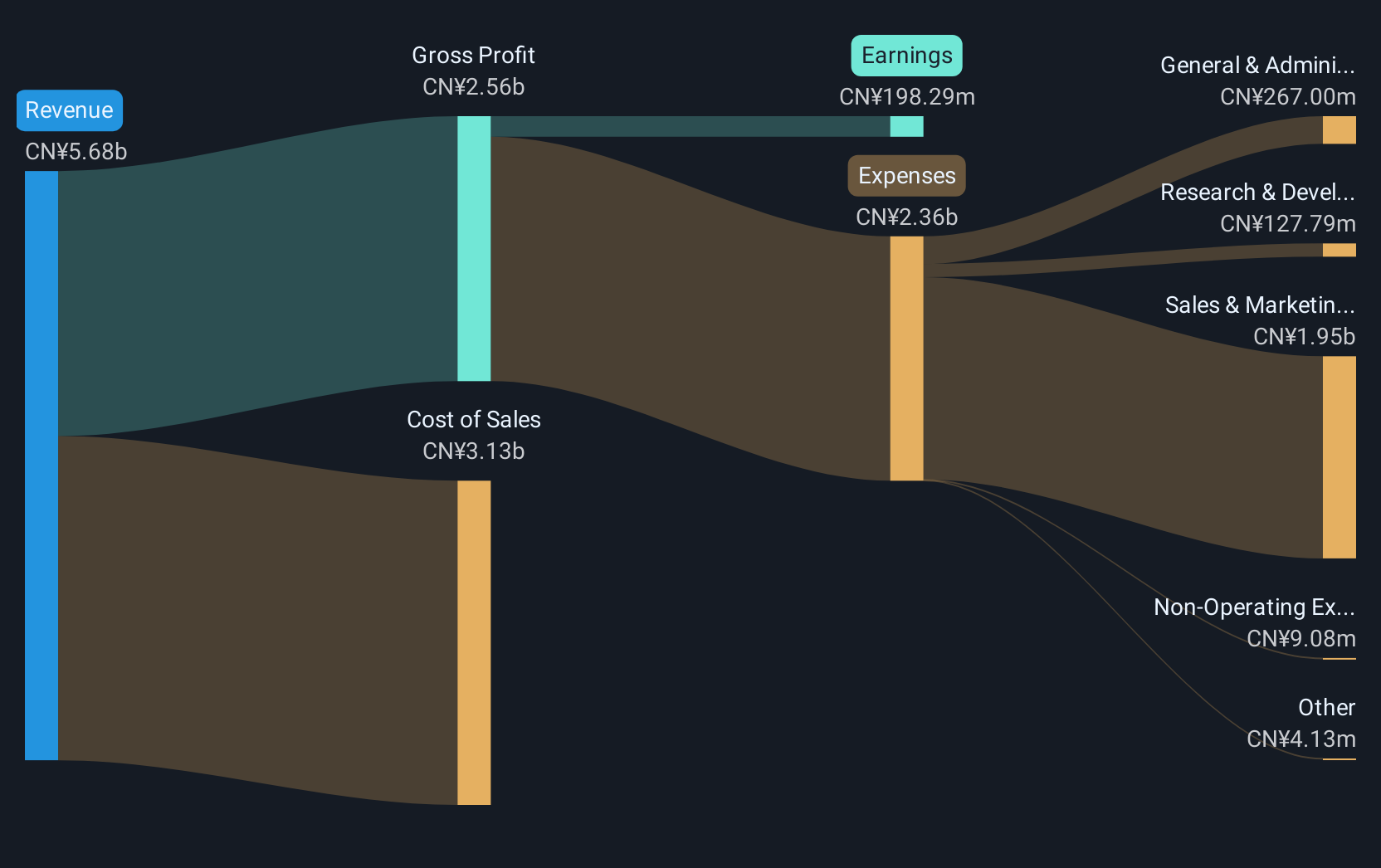

Xiamen Jihong Technology has demonstrated robust financial dynamics, with a forecasted annual revenue growth of 22.2% and earnings growth of 38.1%. Despite recent challenges, including a significant one-off gain of CN¥41.3M affecting its earnings, the company's strategic initiatives such as share repurchases up to CNY 100 million and consistent dividend payments highlight its commitment to shareholder value and employee incentives. These efforts underscore Xiamen Jihong's adaptability in navigating market fluctuations while fostering long-term growth within the tech sector, particularly as it continues to innovate and expand its market presence despite a competitive landscape marked by rapid technological advancements.

Winning Health Technology Group (SZSE:300253)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Winning Health Technology Group Co., Ltd. is a company focused on healthcare information technology solutions, with a market cap of approximately CN¥16.18 billion.

Operations: The company specializes in healthcare information technology solutions.

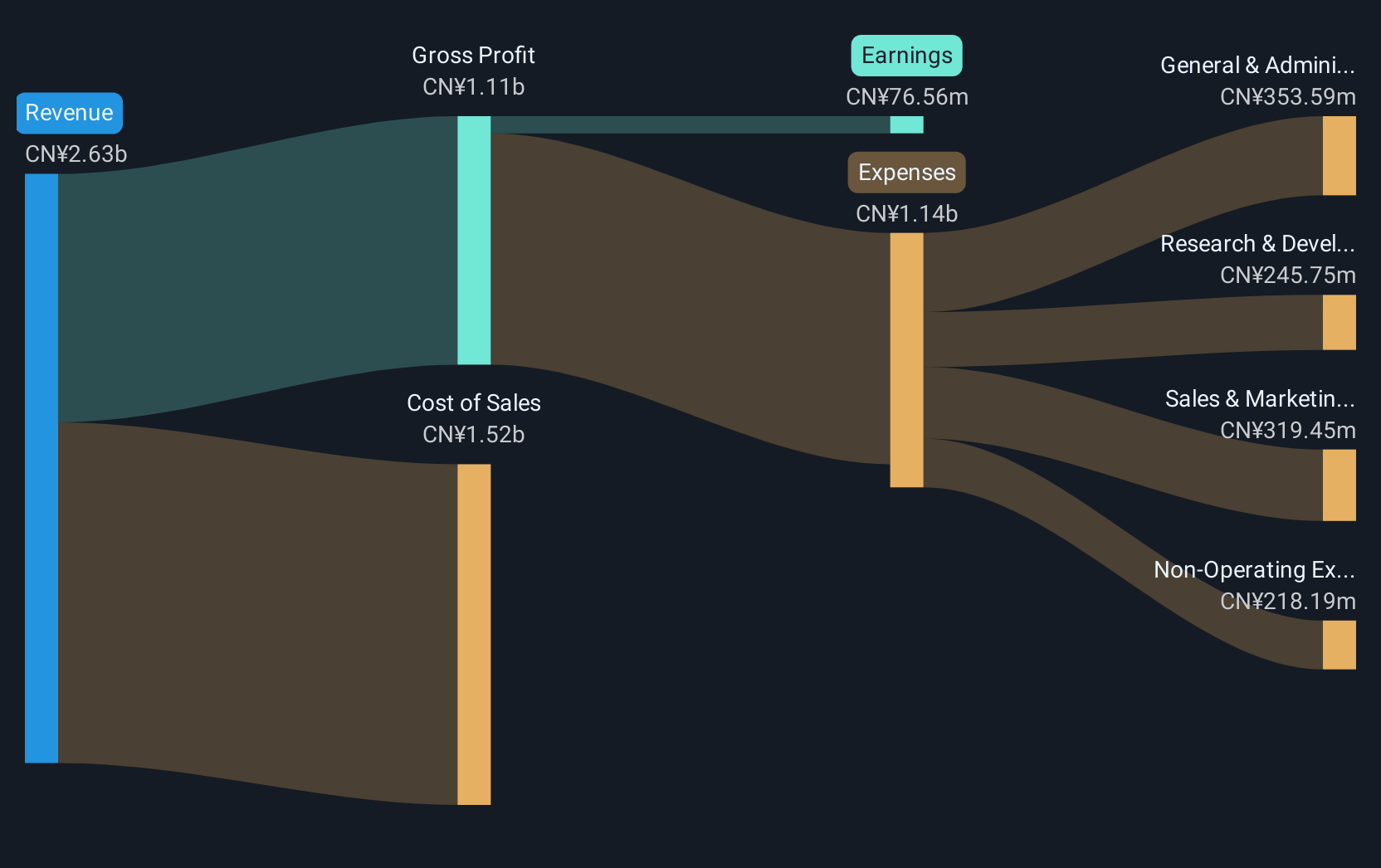

Winning Health Technology Group has showcased a robust trajectory in its financial performance, with revenue and net income seeing slight increases to CNY 1.91 billion and CNY 154.63 million respectively, over the last nine months. This growth is underscored by a significant annual earnings growth rate of 34.9%, outpacing the broader Chinese market's average. The firm's commitment to innovation is evident from its R&D investments, aligning with industry trends towards enhanced healthcare services through technology. Moreover, recent share repurchases totaling CNY 79.99 million reflect confidence in ongoing growth and shareholder value enhancement, despite global economic pressures influencing tech valuations broadly.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: International Games System Co., Ltd. engages in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market capitalization of NT$269.68 billion.

Operations: The company generates revenue primarily through its Online Games Division, contributing NT$10.11 billion, and its Business Game Division, which adds NT$7.13 billion.

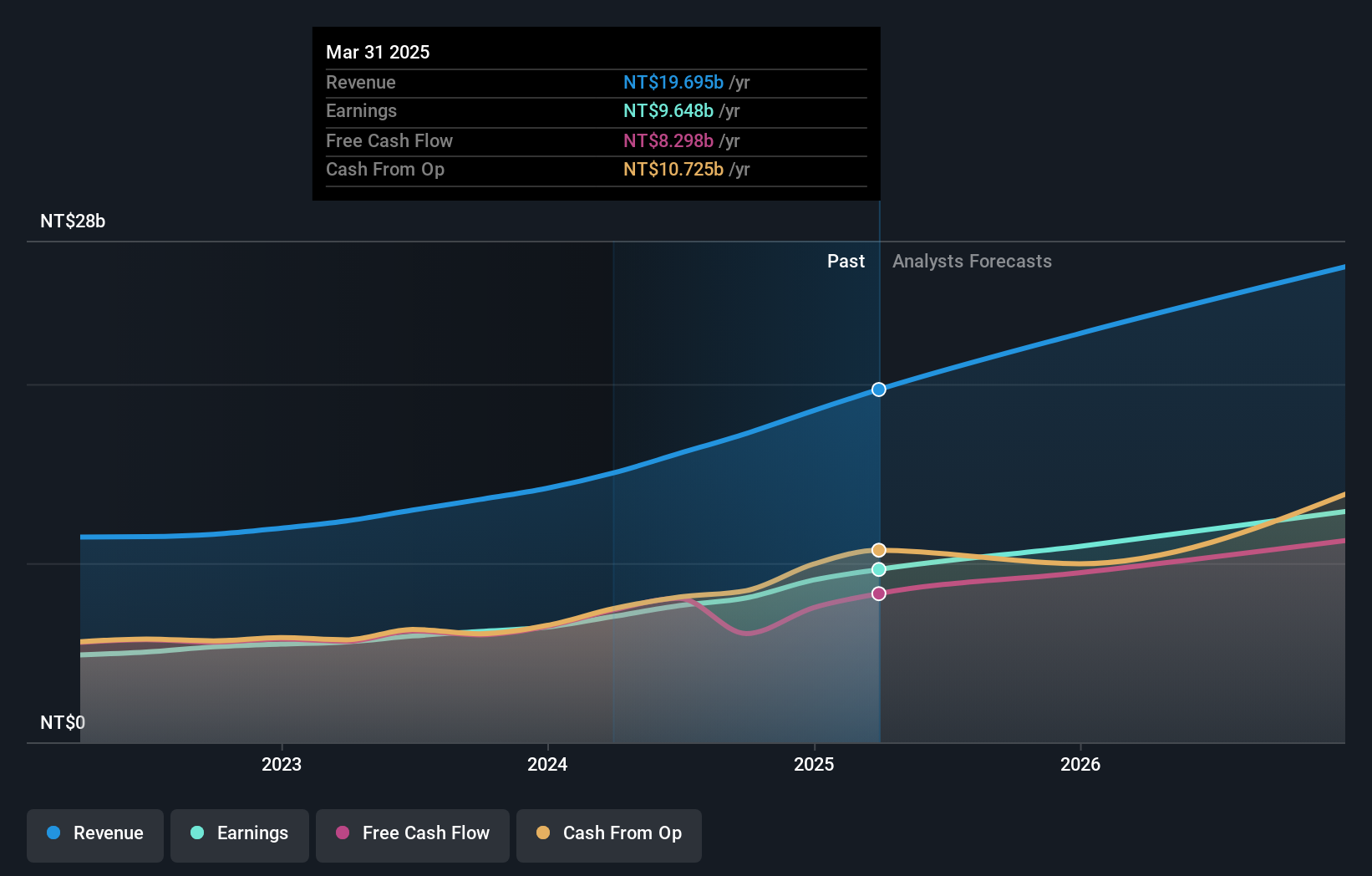

International Games SystemLtd. has demonstrated significant financial growth, with a 30.3% increase in earnings over the past year, outstripping the Entertainment industry's average of 23.8%. This performance is supported by an aggressive R&D investment strategy, which not only fuels innovation but also aligns with broader industry trends towards more immersive and technologically advanced gaming experiences. The company's recent earnings report highlighted a robust increase in sales to TWD 13.45 billion and net income to TWD 6.49 billion for the nine months ended September 2024, reflecting both market expansion and operational efficiency improvements. These figures underscore a promising trajectory, with revenue and earnings forecasted to grow annually at 20.9% and 21.2%, respectively, suggesting sustained upward momentum in its financial health amidst competitive market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of International Games SystemLtd.

Understand International Games SystemLtd's track record by examining our Past report.

Key Takeaways

- Navigate through the entire inventory of 1267 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002803

Xiamen Jihong

Engages in the cross-border social e-commerce and paper packaging solutions business.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives