- Taiwan

- /

- Metals and Mining

- /

- TWSE:2069

Yuen Chang Stainless Steel Co., Ltd.'s (TWSE:2069) Subdued P/S Might Signal An Opportunity

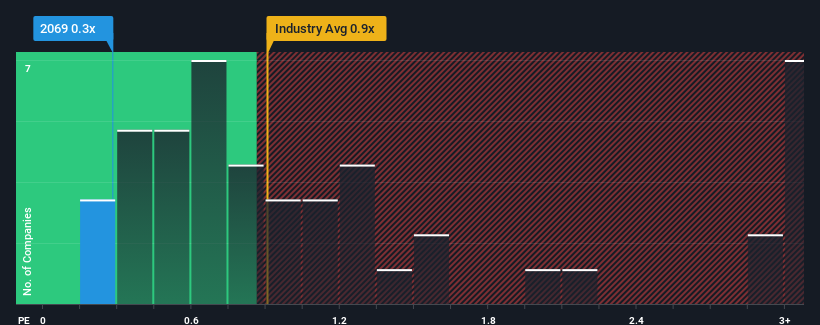

When close to half the companies operating in the Metals and Mining industry in Taiwan have price-to-sales ratios (or "P/S") above 0.9x, you may consider Yuen Chang Stainless Steel Co., Ltd. (TWSE:2069) as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Yuen Chang Stainless Steel

What Does Yuen Chang Stainless Steel's P/S Mean For Shareholders?

For instance, Yuen Chang Stainless Steel's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Yuen Chang Stainless Steel will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Yuen Chang Stainless Steel will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Yuen Chang Stainless Steel would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.3%. Regardless, revenue has managed to lift by a handy 9.9% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 2.7% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Yuen Chang Stainless Steel's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Yuen Chang Stainless Steel revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

There are also other vital risk factors to consider and we've discovered 5 warning signs for Yuen Chang Stainless Steel (2 make us uncomfortable!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Yuen Chang Stainless Steel, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2069

Yuen Chang Stainless Steel

Engages in the processing, manufacturing, and selling of stainless steel products in Taiwan and internationally.

Slight with mediocre balance sheet.