- Taiwan

- /

- Metals and Mining

- /

- TWSE:2029

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. stock indexes nearing record highs and European indices reaching fresh peaks, investors are keenly observing the impact of inflationary pressures and interest rate expectations on their portfolios. In this environment, dividend stocks can offer a compelling option for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.83% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1977 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

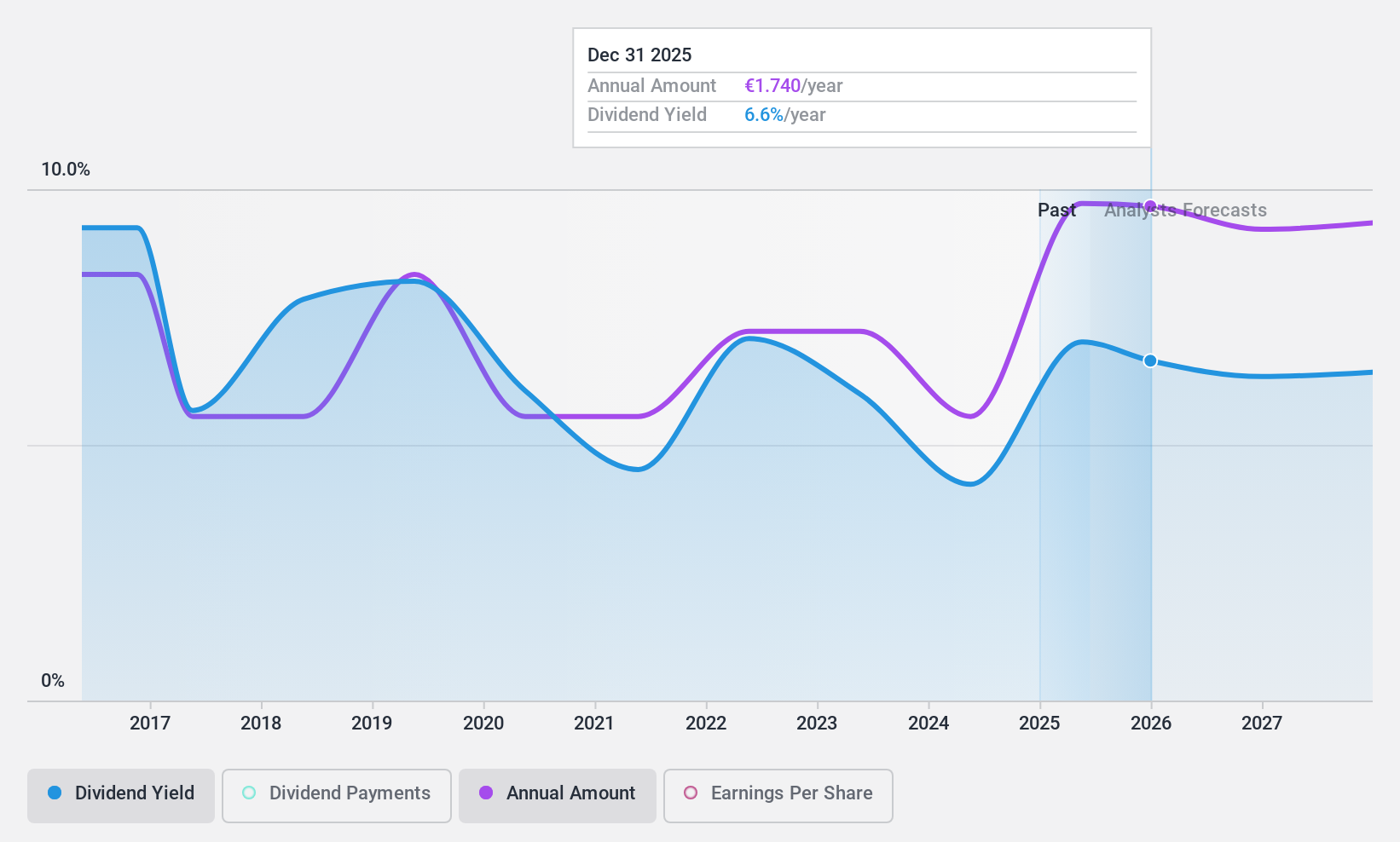

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market cap of €3.74 billion.

Operations: Azimut Holding S.p.A. generates revenue primarily from its asset management segment, totaling €1.44 billion.

Dividend Yield: 3.8%

Azimut Holding's dividends are well-covered by earnings and cash flows, with payout ratios of 26.6% and 29.1%, respectively, though the dividend yield of 3.79% is below the Italian market's top quartile. Despite past volatility in dividend payments, they have increased over the last decade. The company is trading at a significant discount to its estimated fair value and is negotiating to sell an 80% stake in its fintech unit for EUR 1.8 billion to EUR 2.2 billion by March 2025.

- Unlock comprehensive insights into our analysis of Azimut Holding stock in this dividend report.

- Our valuation report unveils the possibility Azimut Holding's shares may be trading at a discount.

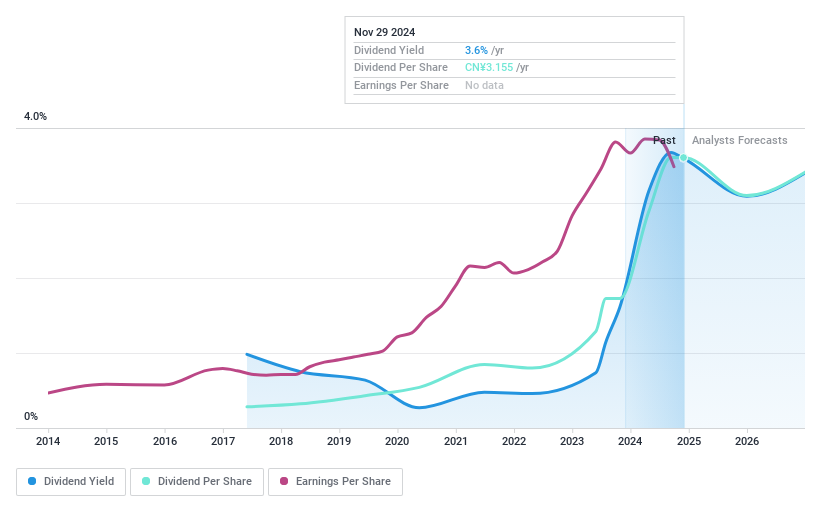

Anjoy Foods Group (SHSE:603345)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anjoy Foods Group Co., Ltd. specializes in the research, development, production, and sale of quick-frozen hot pot, noodle rice, and dish products with a market cap of CN¥22.84 billion.

Operations: Anjoy Foods Group Co., Ltd. generates its revenue primarily from the food processing segment, which accounted for CN¥14.85 billion.

Dividend Yield: 4%

Anjoy Foods Group's dividends, covered by a payout ratio of 65.9% and a cash payout ratio of 83.2%, have been stable over its eight-year history, with recent payments increasing. Despite being removed from key indices in December 2024, the company offers a competitive dividend yield of 4.04%, above the CN market average, and trades at a significant discount to its estimated fair value while maintaining good relative value compared to peers.

- Click here and access our complete dividend analysis report to understand the dynamics of Anjoy Foods Group.

- Our expertly prepared valuation report Anjoy Foods Group implies its share price may be lower than expected.

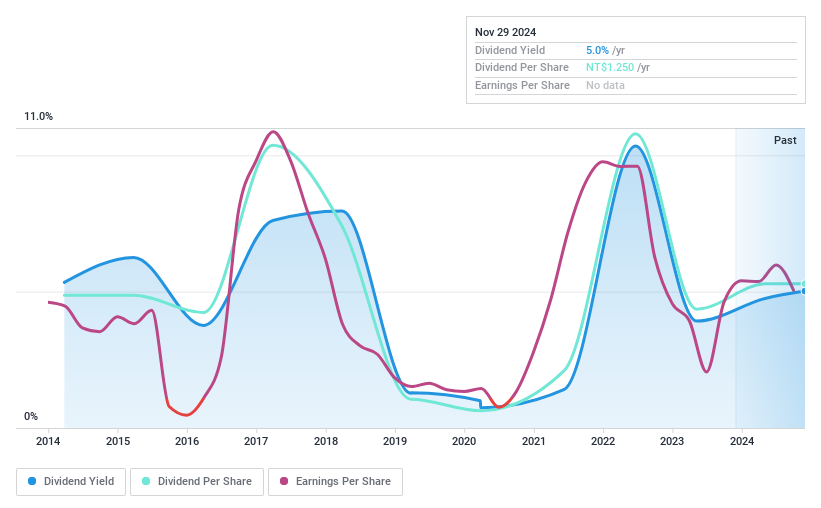

Sheng Yu Steel (TWSE:2029)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sheng Yu Steel Co., Ltd. is involved in the manufacturing, processing, and selling of steel sheets across Taiwan and various international markets, with a market cap of NT$8.29 billion.

Operations: Sheng Yu Steel Co., Ltd. generates revenue of NT$12.86 billion from its core operations in the manufacturing, processing, and sale of steel sheets across multiple regions.

Dividend Yield: 4.8%

Sheng Yu Steel's dividends, supported by a payout ratio of 69.7% and a cash payout ratio of 36%, are well-covered by earnings and cash flows. However, the payments have been volatile over the past decade, impacting reliability despite recent growth. Trading at a significant discount to its estimated fair value, Sheng Yu Steel offers an attractive dividend yield of 4.85%, placing it in the top quartile among TW market dividend payers.

- Take a closer look at Sheng Yu Steel's potential here in our dividend report.

- Upon reviewing our latest valuation report, Sheng Yu Steel's share price might be too pessimistic.

Taking Advantage

- Navigate through the entire inventory of 1977 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2029

Sheng Yu Steel

Manufactures, processes, and sells sheets in Taiwan, rest of Asia, Europe, the United States, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives