- Switzerland

- /

- Construction

- /

- SWX:BRKN

Best Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by accelerating U.S. inflation and stock indexes nearing record highs, investors are increasingly focused on strategies that can offer stability and income in uncertain times. Dividend stocks, known for their potential to provide regular income streams, may be an appealing option for those looking to capitalize on the current market dynamics while potentially benefiting from long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.54% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

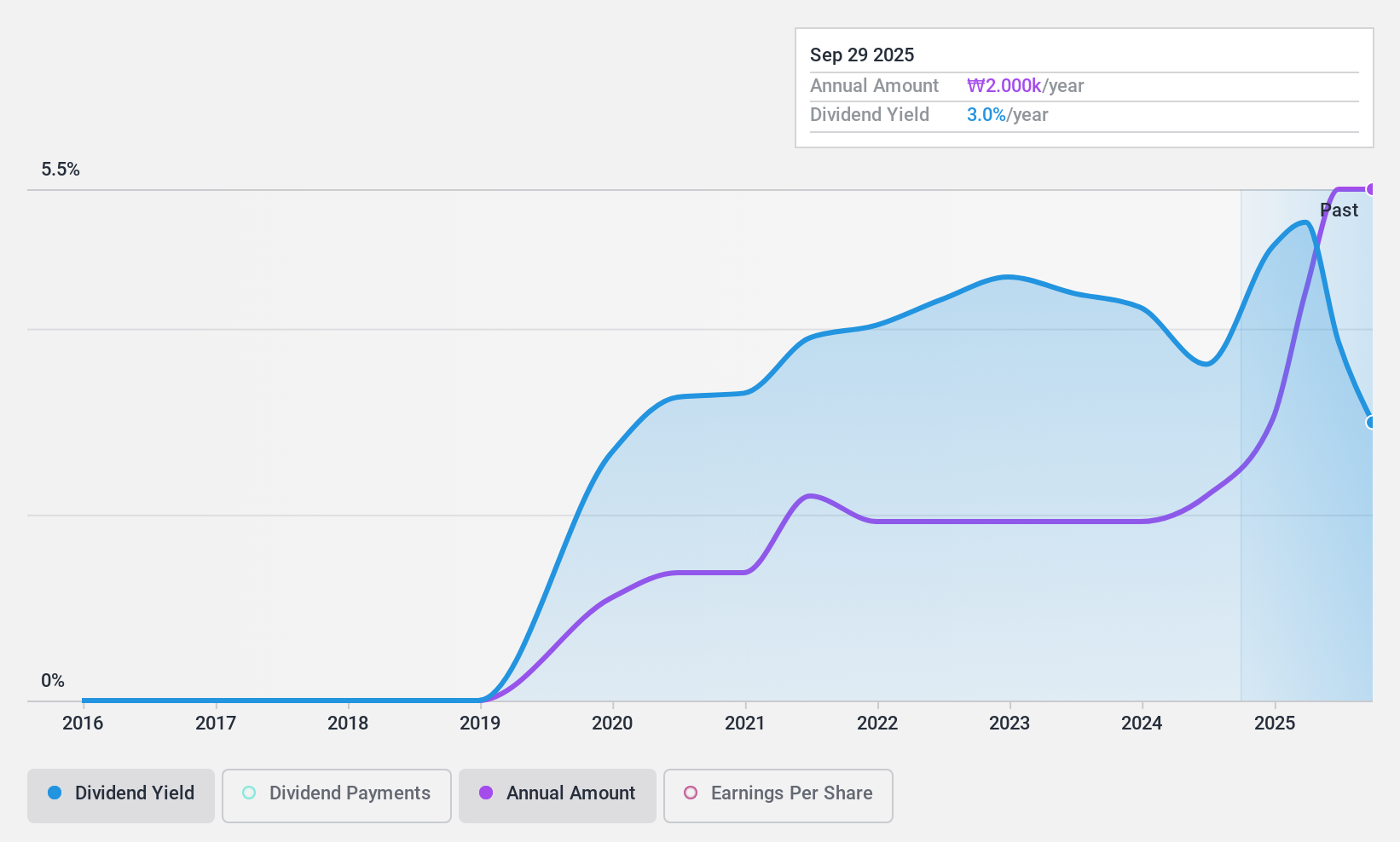

SNT Holdings (KOSE:A036530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩431.62 billion.

Operations: SNT Holdings CO., LTD generates revenue from its Vehicle Parts segment, amounting to ₩1.27 billion, and its Industrial Equipment segment, which contributes ₩286.84 million.

Dividend Yield: 5.4%

SNT Holdings offers a compelling dividend yield of 5.36%, placing it in the top 25% of dividend payers in the KR market. The dividends are well-covered by earnings and cash flows, with payout ratios at 10.1% and 22.3%, respectively, indicating sustainability despite an unstable track record over six years. Although trading below fair value, its dividends have been volatile, reflecting potential risks for investors seeking consistent income streams.

- Unlock comprehensive insights into our analysis of SNT Holdings stock in this dividend report.

- Our expertly prepared valuation report SNT Holdings implies its share price may be lower than expected.

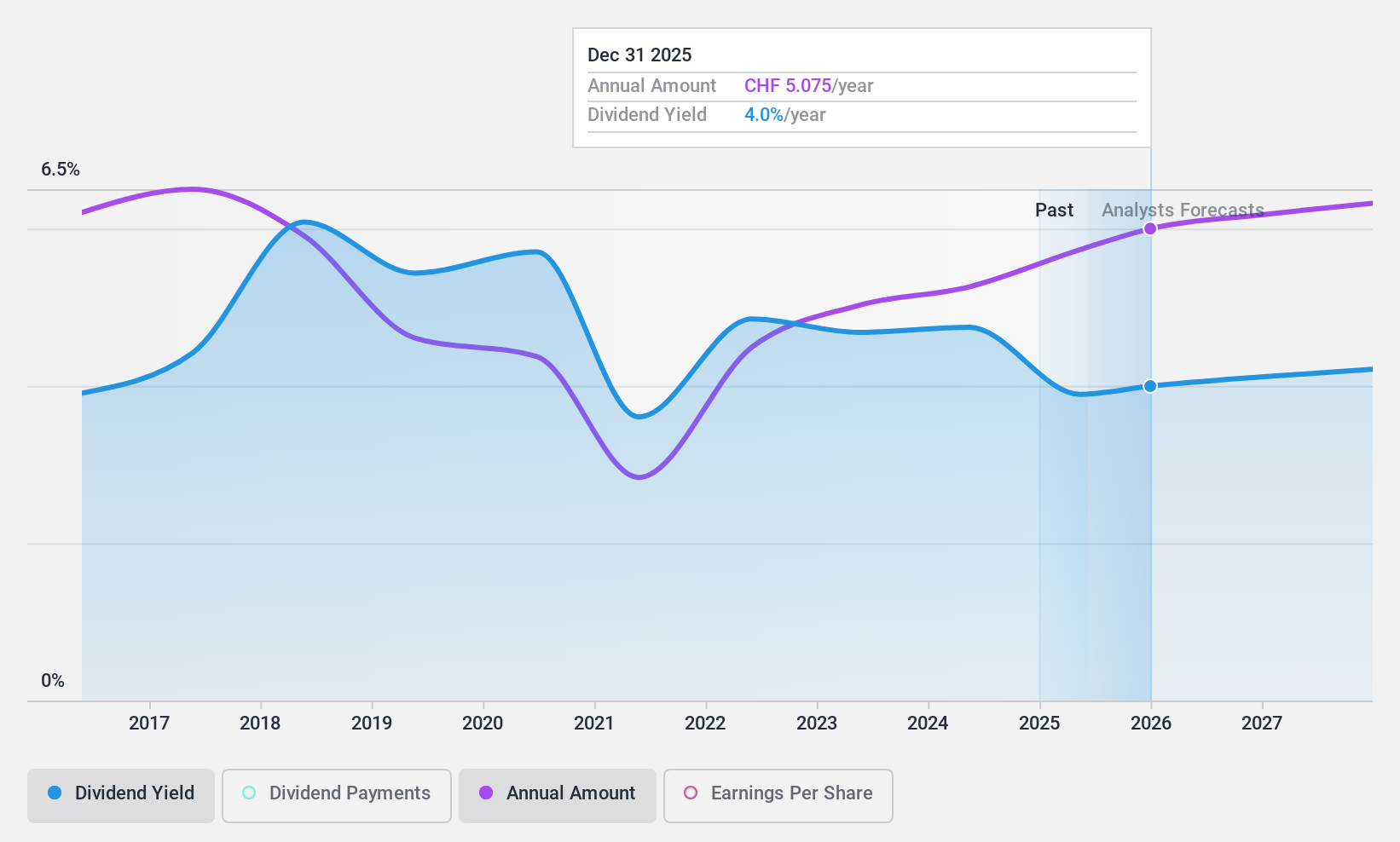

Burkhalter Holding (SWX:BRKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF1.09 billion, provides electrical engineering services to the construction sector primarily in Switzerland through its subsidiaries.

Operations: Burkhalter Holding AG generates CHF1.18 billion in revenue from its electrical engineering services for the construction sector in Switzerland.

Dividend Yield: 4.3%

Burkhalter Holding's dividend yield of 4.32% ranks in the top 25% of Swiss dividend payers. Despite a history of volatility and unreliability over the past decade, dividends are supported by earnings and cash flows, with payout ratios at 87.4% and 59.7%, respectively. The company's earnings have shown growth, but its high debt level may pose challenges to financial stability, affecting long-term dividend sustainability for investors seeking consistent returns.

- Get an in-depth perspective on Burkhalter Holding's performance by reading our dividend report here.

- The analysis detailed in our Burkhalter Holding valuation report hints at an inflated share price compared to its estimated value.

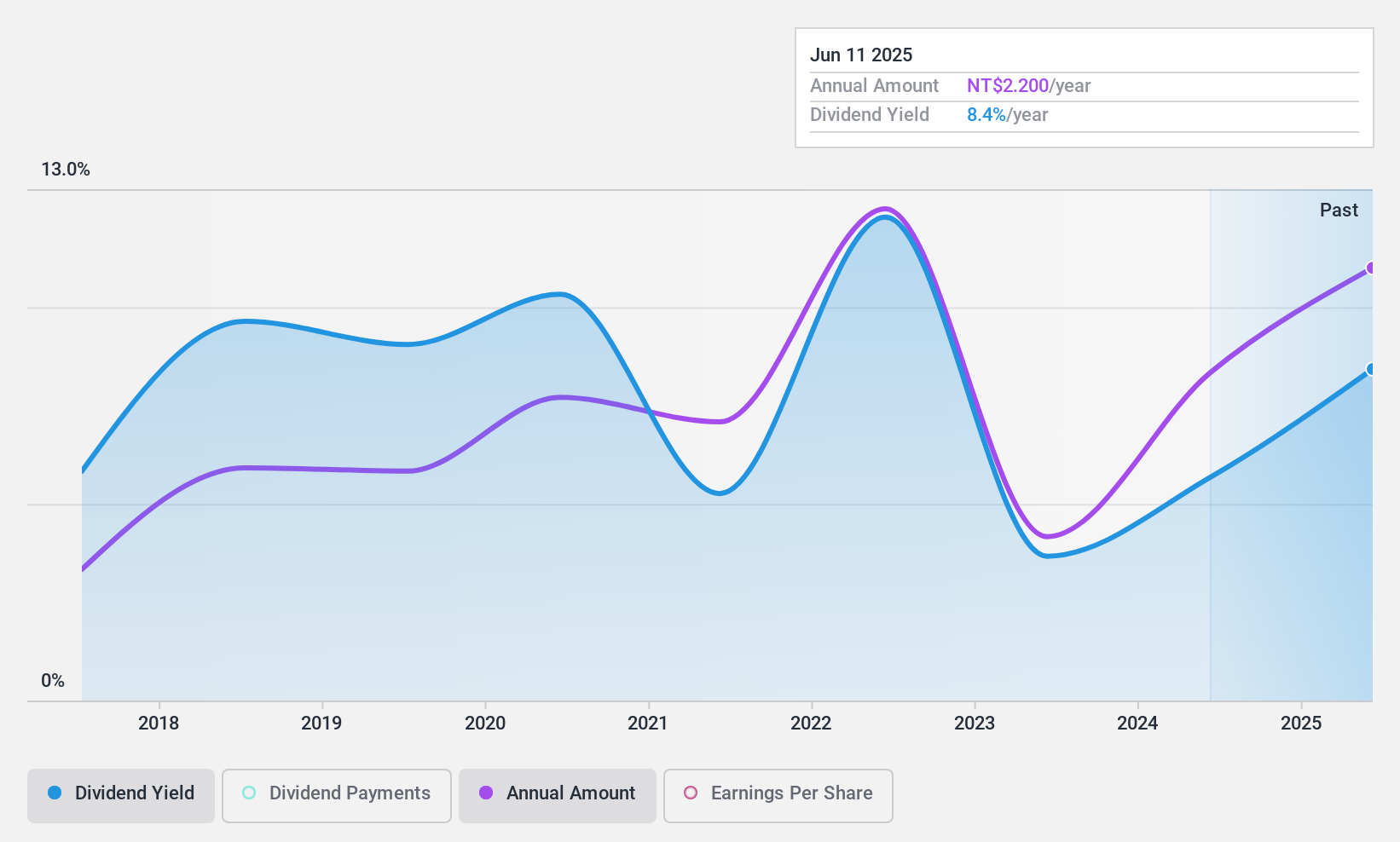

Mayer Steel Pipe (TWSE:2020)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mayer Steel Pipe Corporation processes and sells steel pipes, plates, and other metal products in Taiwan with a market cap of NT$7.90 billion.

Operations: Mayer Steel Pipe Corporation generates its revenue primarily from the Steel Department, which accounts for NT$5.33 billion, supplemented by NT$197.10 million from the Hotel Services Department and a minor contribution from the Property Investment Department.

Dividend Yield: 5.6%

Mayer Steel Pipe's dividend yield of 5.65% is among the top 25% in Taiwan, yet its dividends have been volatile and unreliable over the past decade. Despite a low payout ratio of 37.6%, high cash payout ratio at 173.3% raises concerns about sustainability from cash flows. The company recently entered a joint construction contract worth approximately TWD 870 million, potentially impacting future financials and dividend stability despite recent earnings growth of 66.8%.

- Click here and access our complete dividend analysis report to understand the dynamics of Mayer Steel Pipe.

- The valuation report we've compiled suggests that Mayer Steel Pipe's current price could be inflated.

Make It Happen

- Navigate through the entire inventory of 1983 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BRKN

Burkhalter Holding

Through its subsidiaries, provides electrical engineering services to the construction sector primarily in Switzerland.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives