- Taiwan

- /

- Metals and Mining

- /

- TWSE:2015

Top Dividend Stocks To Consider For January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, investors are increasingly optimistic about potential rate cuts later in the year. This positive momentum is reflected in major indices such as the S&P 500 and Dow Jones Industrial Average, which have recorded significant gains. In this context of economic recovery and shifting market dynamics, dividend stocks can offer a reliable income stream while providing some stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

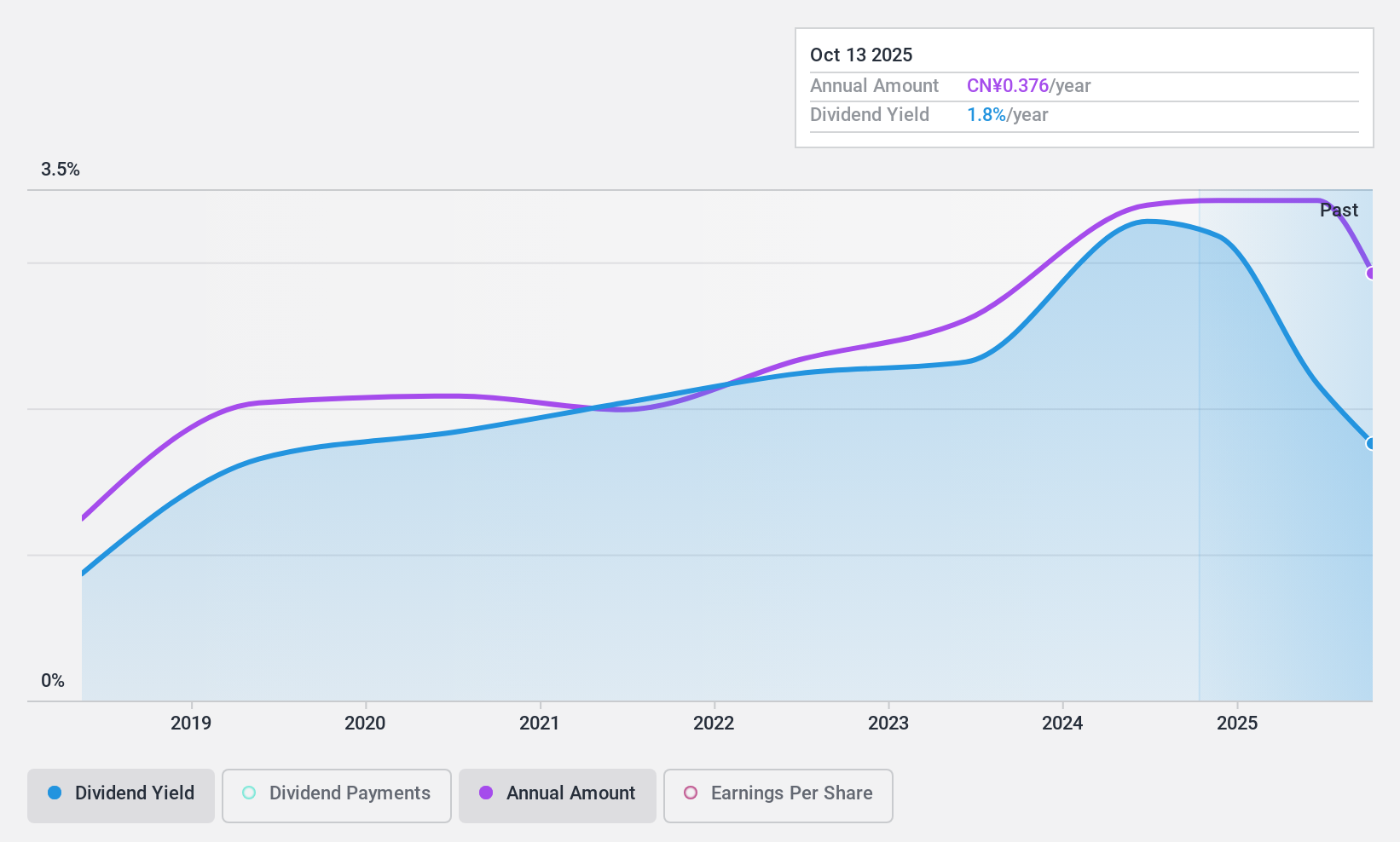

Cisen Pharmaceutical (SHSE:603367)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cisen Pharmaceutical Co., Ltd. and its subsidiaries manufacture and sell chemical drug preparations and health care products both in China and internationally, with a market cap of CN¥6.08 billion.

Operations: Cisen Pharmaceutical Co., Ltd. generates revenue primarily from its Pharmaceutical Manufacturing segment, which accounts for CN¥4.25 billion.

Dividend Yield: 3.3%

Cisen Pharmaceutical's dividend is well-covered, with a payout ratio of 56.1% and a cash payout ratio of 54.4%, indicating sustainability from both earnings and cash flows. Despite revenue declining to CNY 3 billion for the first nine months of 2024, net income rose slightly to CNY 398.12 million, supporting its dividend reliability over seven years. Trading at a significant discount to fair value, it offers an attractive yield in the top quartile for CN market dividends at 3.28%.

- Delve into the full analysis dividend report here for a deeper understanding of Cisen Pharmaceutical.

- Our expertly prepared valuation report Cisen Pharmaceutical implies its share price may be lower than expected.

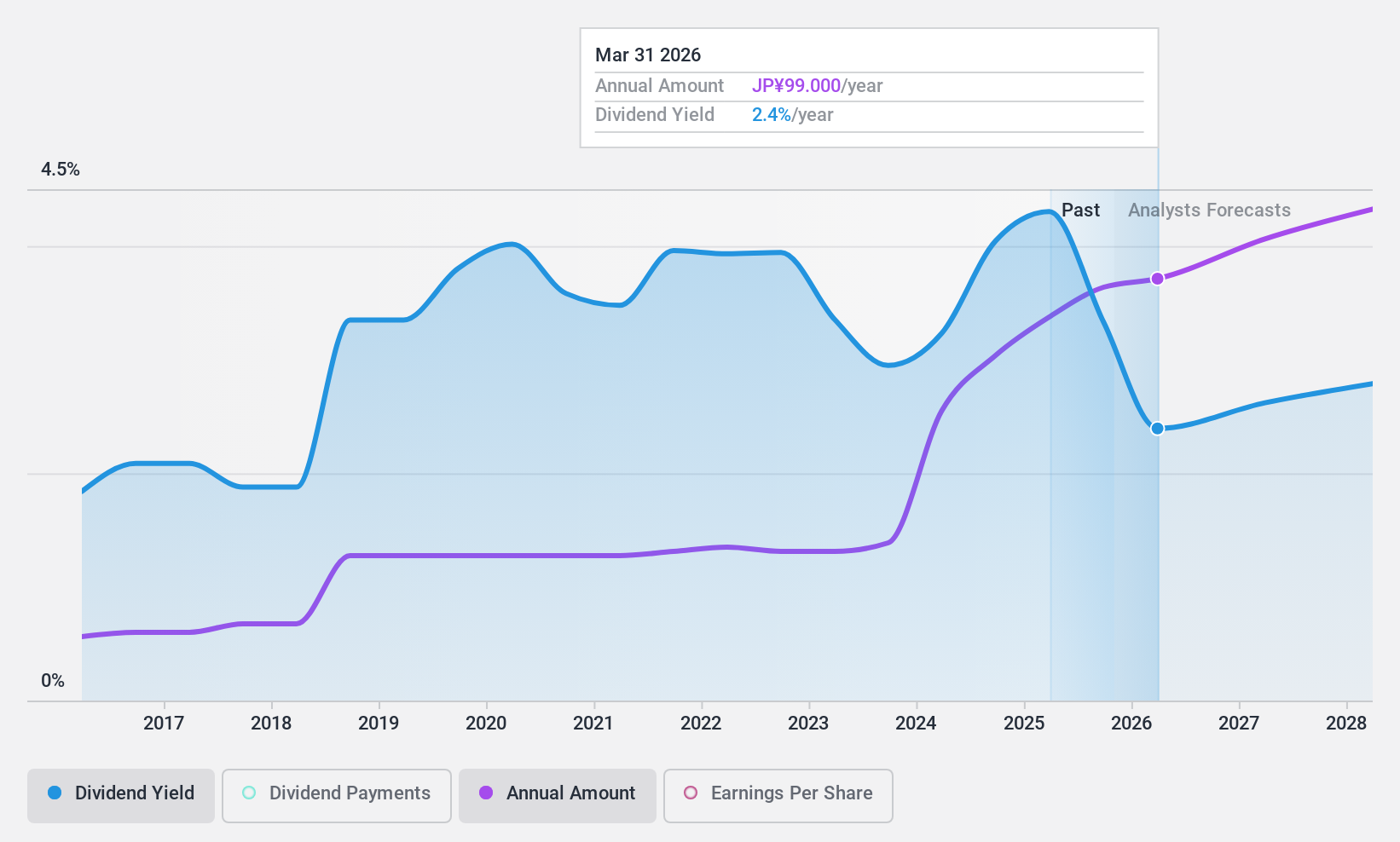

Chugoku Marine Paints (TSE:4617)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chugoku Marine Paints, Ltd. is a company that produces and sells functional coatings globally, with a market cap of ¥114.03 billion.

Operations: Chugoku Marine Paints, Ltd. generates revenue from various regions, including ¥30.66 billion from China, ¥48.33 billion from Japan, ¥18.04 billion from South Korea, ¥23.61 billion from Southeast Asia and ¥29.07 billion from Europe and the United States of America.

Dividend Yield: 3.7%

Chugoku Marine Paints offers a stable dividend profile, with payments reliably growing over the past decade. Its dividends are well-covered by earnings and cash flows, maintaining low payout ratios of 30.9% and 33.6%, respectively. Although its yield of 3.7% is slightly below Japan's top quartile, the stock trades at a significant discount to fair value, enhancing its appeal for value-conscious investors seeking consistent income amidst forecasted earnings declines.

- Navigate through the intricacies of Chugoku Marine Paints with our comprehensive dividend report here.

- Our valuation report unveils the possibility Chugoku Marine Paints' shares may be trading at a discount.

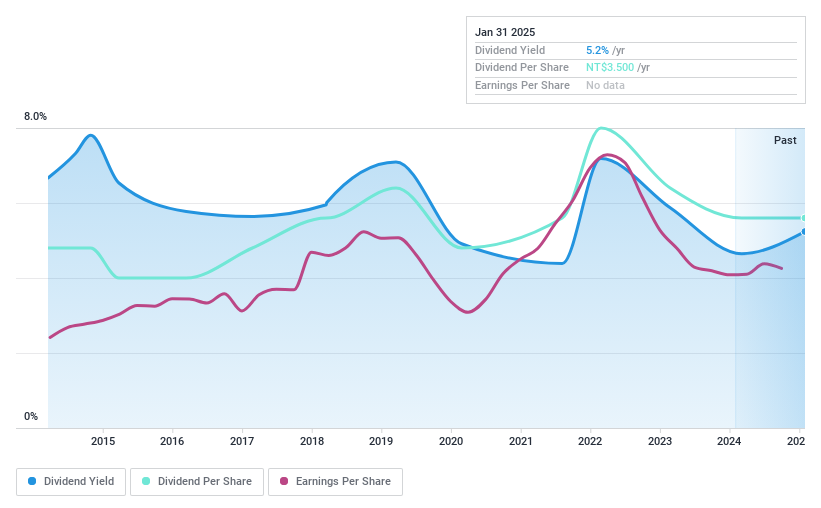

Feng Hsin Steel (TWSE:2015)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Feng Hsin Steel Co., Ltd. is a Taiwanese company that manufactures, processes, and trades steel products, with a market cap of NT$38.73 billion.

Operations: Feng Hsin Steel Co., Ltd. generates revenue of NT$34.77 billion from the manufacture and processing of various steel products, including angle irons, round irons, and flat irons.

Dividend Yield: 5.3%

Feng Hsin Steel's dividend profile is mixed, with a history of volatility over the past decade despite overall growth. The current payout ratios—82.3% from earnings and 87.9% from cash flows—indicate dividends are covered but leave limited room for flexibility. Its yield of 5.26% ranks in Taiwan's top quartile, yet recent earnings showed slight declines in net income, highlighting potential challenges for sustaining dividend stability amidst fluctuating financial performance.

- Dive into the specifics of Feng Hsin Steel here with our thorough dividend report.

- The valuation report we've compiled suggests that Feng Hsin Steel's current price could be quite moderate.

Turning Ideas Into Actions

- Gain an insight into the universe of 1981 Top Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2015

Feng Hsin Steel

Manufactures, processes, and trades various steel products in Taiwan.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives