Investors Aren't Entirely Convinced By Formosa Chemicals & Fibre Corporation's (TWSE:1326) Revenues

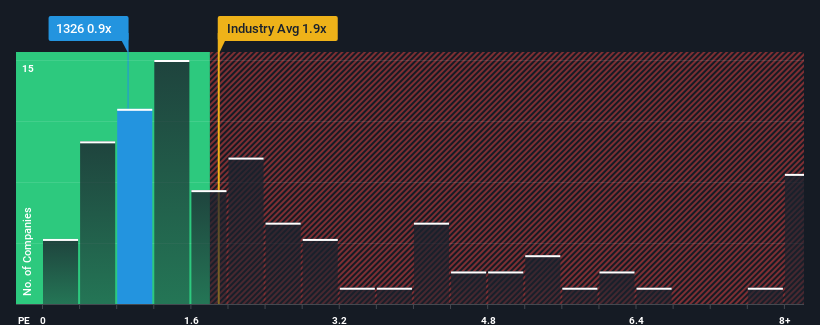

Formosa Chemicals & Fibre Corporation's (TWSE:1326) price-to-sales (or "P/S") ratio of 0.9x might make it look like a buy right now compared to the Chemicals industry in Taiwan, where around half of the companies have P/S ratios above 1.9x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Formosa Chemicals & Fibre

What Does Formosa Chemicals & Fibre's Recent Performance Look Like?

Formosa Chemicals & Fibre has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Formosa Chemicals & Fibre's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Formosa Chemicals & Fibre?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Formosa Chemicals & Fibre's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.0% during the coming year according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.8%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Formosa Chemicals & Fibre's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Formosa Chemicals & Fibre currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Formosa Chemicals & Fibre is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Formosa Chemicals & Fibre, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1326

Formosa Chemicals & Fibre

Produces and sells petrochemical products, nylon fibers, and rayon staple fibers in Taiwan and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives