Market Still Lacking Some Conviction On China Petrochemical Development Corporation (TWSE:1314)

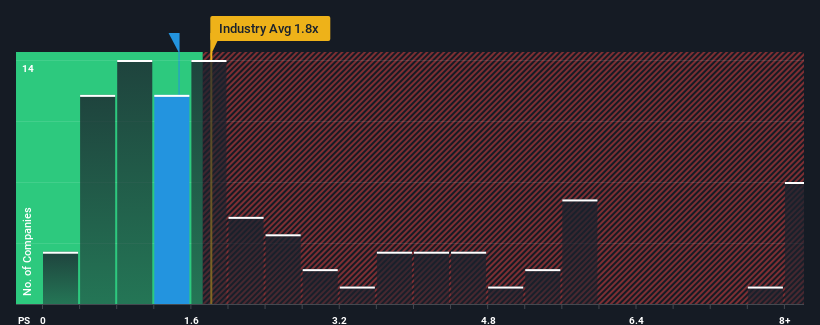

It's not a stretch to say that China Petrochemical Development Corporation's (TWSE:1314) price-to-sales (or "P/S") ratio of 1.5x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Taiwan, where the median P/S ratio is around 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for China Petrochemical Development

What Does China Petrochemical Development's P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for China Petrochemical Development, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Petrochemical Development will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For China Petrochemical Development?

The only time you'd be comfortable seeing a P/S like China Petrochemical Development's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.5% last year. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 5.1% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that China Petrochemical Development is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Petrochemical Development currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with China Petrochemical Development, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on China Petrochemical Development, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1314

China Petrochemical Development

Produces and sells petrochemical intermediates and related engineering plastics, synthetic resins, chemical fiber, and other derivative products in Taiwan, rest of Asia, and internationally.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives