- Japan

- /

- Transportation

- /

- TSE:9039

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by declining major stock indexes, except for the Nasdaq Composite reaching a record high, global markets are adjusting to interest rate cuts from the ECB and SNB while anticipating another potential cut by the Federal Reserve. Amidst these economic shifts, dividend stocks remain an attractive option for investors seeking steady income streams in uncertain times. A good dividend stock typically offers consistent payouts and demonstrates resilience in various market conditions, making them valuable considerations as global economic landscapes evolve.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.00% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★☆ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

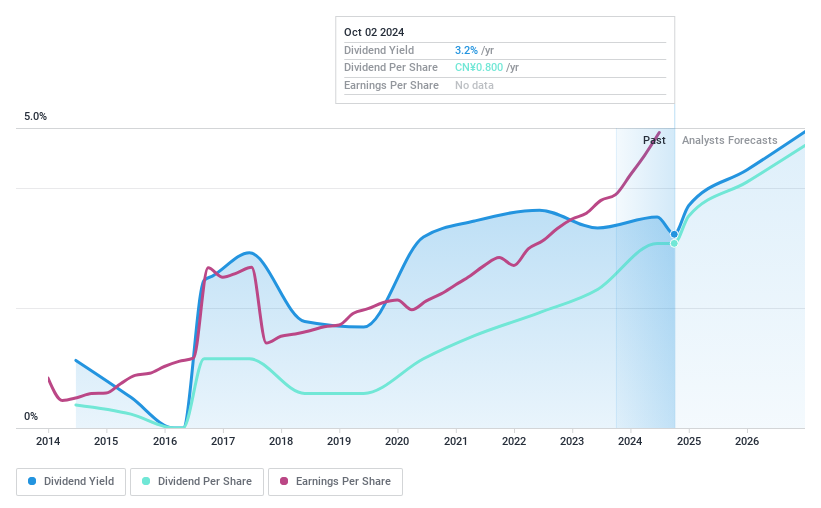

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is a company that produces and sells medicines in China, with a market cap of CN¥12.58 billion.

Operations: Henan Lingrui Pharmaceutical Co., Ltd. generates its revenue through the production and sale of medicines in China.

Dividend Yield: 3.6%

Henan Lingrui Pharmaceutical's dividend is well-covered by earnings and cash flows, with a payout ratio of 66.3% and a cash payout ratio of 73.7%. Its yield of 3.58% ranks in the top 25% within China's market. Despite this, dividends have been volatile over the past decade, showing instability and unreliability. Recent financials indicate strong growth, with net income rising to CNY 573.87 million for the first nine months of 2024 from CNY 466.18 million previously.

- Click here to discover the nuances of Henan Lingrui Pharmaceutical with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Henan Lingrui Pharmaceutical is trading behind its estimated value.

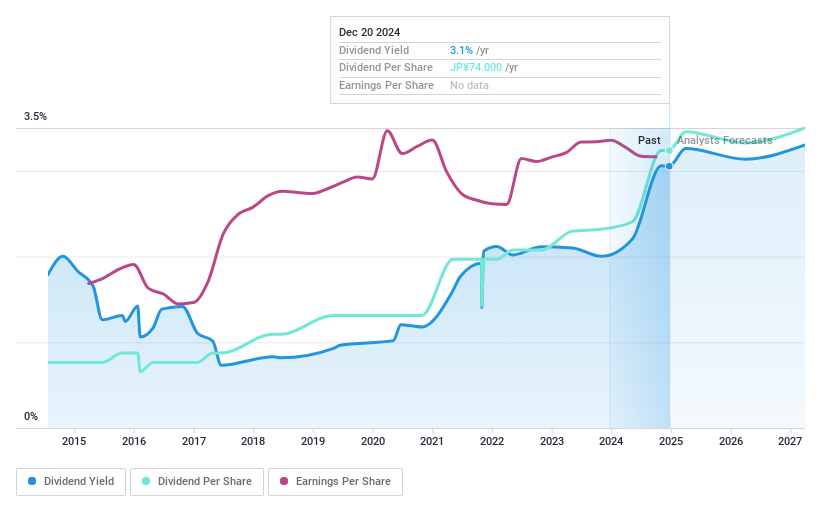

Sakai Moving ServiceLtd (TSE:9039)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakai Moving Service Co., Ltd. offers moving transportation services in Japan and has a market cap of ¥100.10 billion.

Operations: Sakai Moving Service Co., Ltd. generates revenue from several segments, including ¥101.93 billion from the Moving Business, ¥8.23 billion from the Electrical Construction Business, ¥6.62 billion from the Reuse Business, and ¥5.38 billion from the Clean Service Business.

Dividend Yield: 3%

Sakai Moving Service Ltd.'s dividends have shown consistent growth and stability over the past decade, supported by a low payout ratio of 26.6% and a cash payout ratio of 63.9%, indicating robust coverage by earnings and cash flows. Despite offering a dividend yield of 3.01%, which is below the top quartile in Japan, recent announcements highlight an increase in dividends to ¥59 per share for fiscal year-end March 2025, reflecting positive financial momentum.

- Click here and access our complete dividend analysis report to understand the dynamics of Sakai Moving ServiceLtd.

- The valuation report we've compiled suggests that Sakai Moving ServiceLtd's current price could be quite moderate.

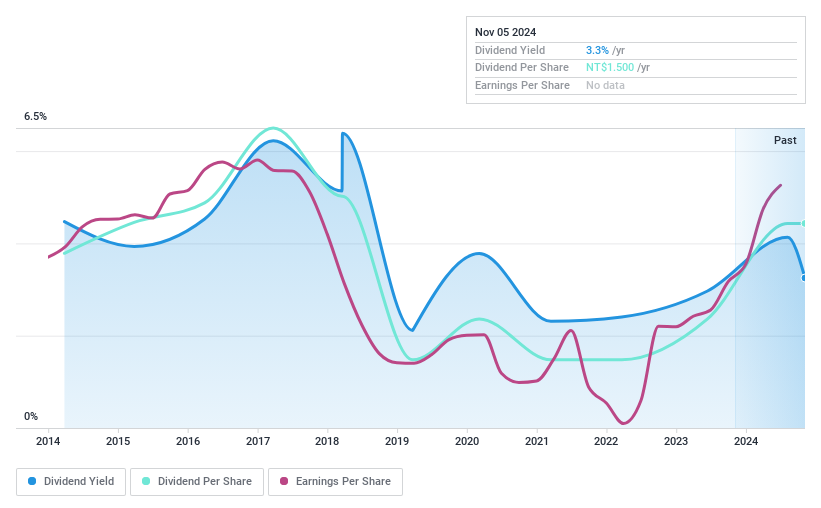

San Fang Chemical Industry (TWSE:1307)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: San Fang Chemical Industry Co., Ltd. produces and markets artificial leather, synthetic resin, and related materials across Taiwan, China, Hong Kong, Southeast Asia, and other international regions with a market cap of NT$15.22 billion.

Operations: San Fang Chemical Industry Co., Ltd.'s revenue segments include NT$1.08 billion from GII, NT$2.55 billion from PTS, NT$1.78 billion from Sanfang Development Co., Ltd., and NT$8.03 billion from SAN Fang Chemical Industry Co., Ltd.

Dividend Yield: 3.9%

San Fang Chemical Industry's dividend yield of 3.92% is below Taiwan's top quartile, reflecting a less competitive position. Despite this, dividends are well-covered by earnings and cash flows with payout ratios under 50%. However, the dividend history has been volatile and unreliable over the past decade. Recent earnings growth, with net income rising to TWD 1.10 billion for nine months ending September 2024, suggests potential for future stability in payouts.

- Click to explore a detailed breakdown of our findings in San Fang Chemical Industry's dividend report.

- According our valuation report, there's an indication that San Fang Chemical Industry's share price might be on the cheaper side.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1967 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sakai Moving ServiceLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9039

Sakai Moving ServiceLtd

Provides moving transportation services in Japan.

Flawless balance sheet established dividend payer.