Nan Ya Plastics Corporation's (TWSE:1303) Shares Not Telling The Full Story

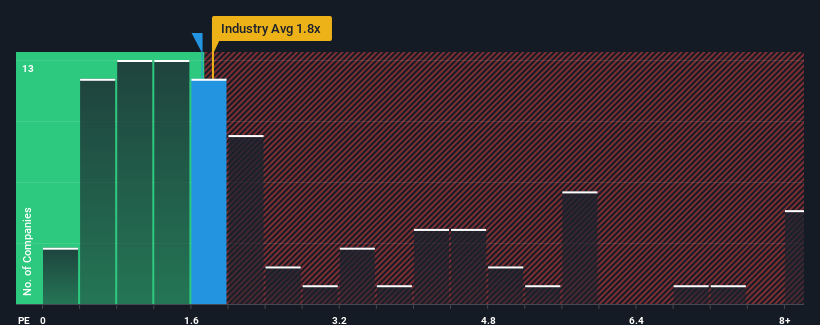

It's not a stretch to say that Nan Ya Plastics Corporation's (TWSE:1303) price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" for companies in the Chemicals industry in Taiwan, where the median P/S ratio is around 1.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Nan Ya Plastics

What Does Nan Ya Plastics' P/S Mean For Shareholders?

Recent times haven't been great for Nan Ya Plastics as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on Nan Ya Plastics will help you uncover what's on the horizon.How Is Nan Ya Plastics' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Nan Ya Plastics' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. As a result, revenue from three years ago have also fallen 5.0% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 26% over the next year. With the industry only predicted to deliver 9.0%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Nan Ya Plastics is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Nan Ya Plastics' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Nan Ya Plastics is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If you're unsure about the strength of Nan Ya Plastics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nan Ya Plastics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1303

Nan Ya Plastics

Engages in the manufacture and sale of plastic products, polyester fibers, petrochemical products, and electronic materials in Taiwan, China and Hong Kong, the United States, and internationally.

Fair value with moderate growth potential.