Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Yieh Hsing Enterprise Co., Ltd. (TPE:2007) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Yieh Hsing Enterprise

What Is Yieh Hsing Enterprise's Net Debt?

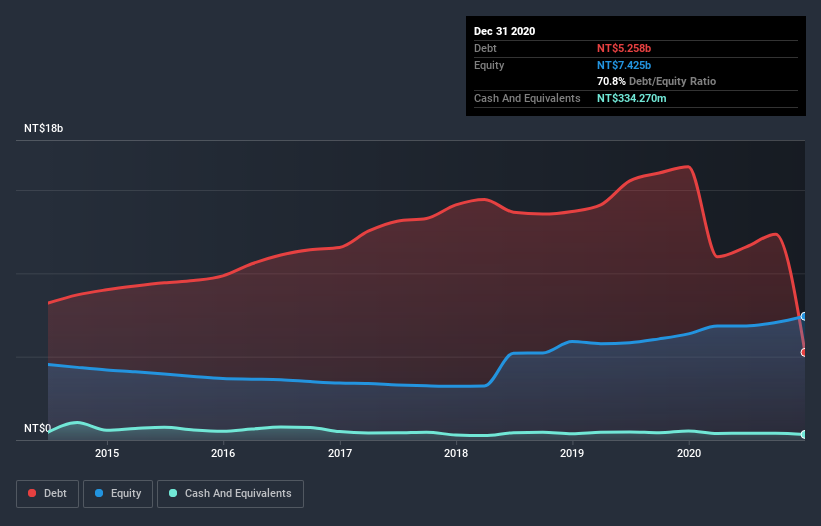

As you can see below, Yieh Hsing Enterprise had NT$5.26b of debt at December 2020, down from NT$16.4b a year prior. However, it does have NT$334.3m in cash offsetting this, leading to net debt of about NT$4.92b.

How Strong Is Yieh Hsing Enterprise's Balance Sheet?

The latest balance sheet data shows that Yieh Hsing Enterprise had liabilities of NT$2.93b due within a year, and liabilities of NT$2.58b falling due after that. Offsetting this, it had NT$334.3m in cash and NT$276.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$4.90b.

This is a mountain of leverage relative to its market capitalization of NT$5.33b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Yieh Hsing Enterprise will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Yieh Hsing Enterprise had a loss before interest and tax, and actually shrunk its revenue by 15%, to NT$5.6b. We would much prefer see growth.

Caveat Emptor

While Yieh Hsing Enterprise's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at NT$354m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through NT$2.6b of cash over the last year. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example Yieh Hsing Enterprise has 3 warning signs (and 2 which are potentially serious) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Yieh Hsing Enterprise or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:2007

Yieh Hsing Enterprise

Produces and sells steel pipes, steel coil processed products, wire rods, whole plant machinery and equipment, and environmental protection equipment systems in Taiwan.

Slightly overvalued with very low risk.

Similar Companies

Market Insights

Community Narratives