- Taiwan

- /

- Paper and Forestry Products

- /

- TWSE:1905

Did You Miss Chung Hwa Pulp's (TPE:1905) 35% Share Price Gain?

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Chung Hwa Pulp Corporation (TPE:1905) share price is 35% higher than it was a year ago, much better than the market return of around 22% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! However, the stock hasn't done so well in the longer term, with the stock only up 7.0% in three years.

Check out our latest analysis for Chung Hwa Pulp

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months Chung Hwa Pulp went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

Unfortunately Chung Hwa Pulp's fell 14% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

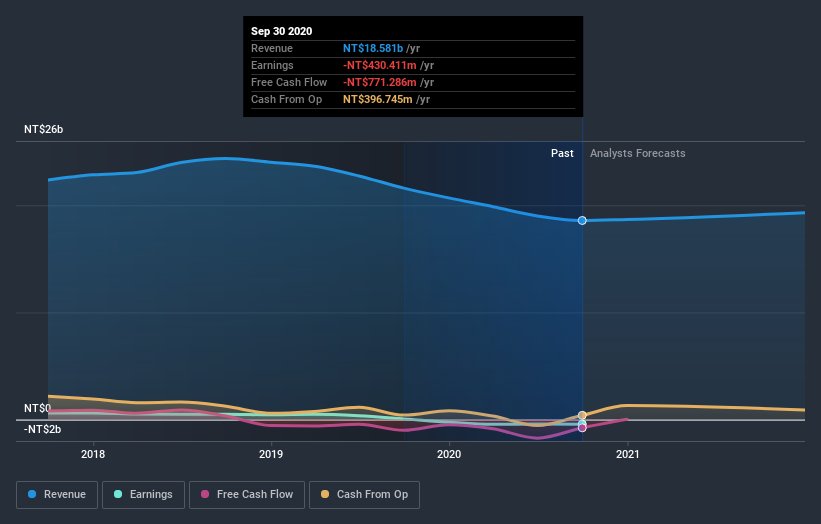

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Chung Hwa Pulp shareholders have received a total shareholder return of 35% over the last year. Of course, that includes the dividend. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Chung Hwa Pulp (including 2 which are significant) .

But note: Chung Hwa Pulp may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Chung Hwa Pulp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1905

Chung Hwa Pulp

Manufactures, sells, and distributes pulp, paper, paperboard, chemical products, and fertilizers in Taiwan and Mainland China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.