As global markets navigate a period of volatility, with U.S. stocks facing pressure from AI competition and mixed economic signals across major regions, investors are increasingly seeking stability in their portfolios. In this environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to balance risk amid uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.96% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.96% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Repsol (BME:REP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Repsol, S.A. is a global multi-energy company with a market cap of €13.04 billion, engaged in various energy operations worldwide.

Operations: Repsol, S.A. generates revenue from several segments including Customer (€25.49 billion), Upstream (€4.64 billion), Industrial (€45.83 billion), and Low Carbon Generation (€656 million).

Dividend Yield: 8.6%

Repsol's dividend yield of 8.62% ranks in the top 25% of Spanish market payers, but its stability is questionable due to past volatility and a high cash payout ratio of 333.9%, indicating dividends aren't well-covered by cash flows. Despite trading at a good value, with shares priced 27% below fair value estimates, profit margins have decreased from last year. Recent buybacks totaling €240.47 million may impact future dividend sustainability and financial flexibility.

- Navigate through the intricacies of Repsol with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Repsol shares in the market.

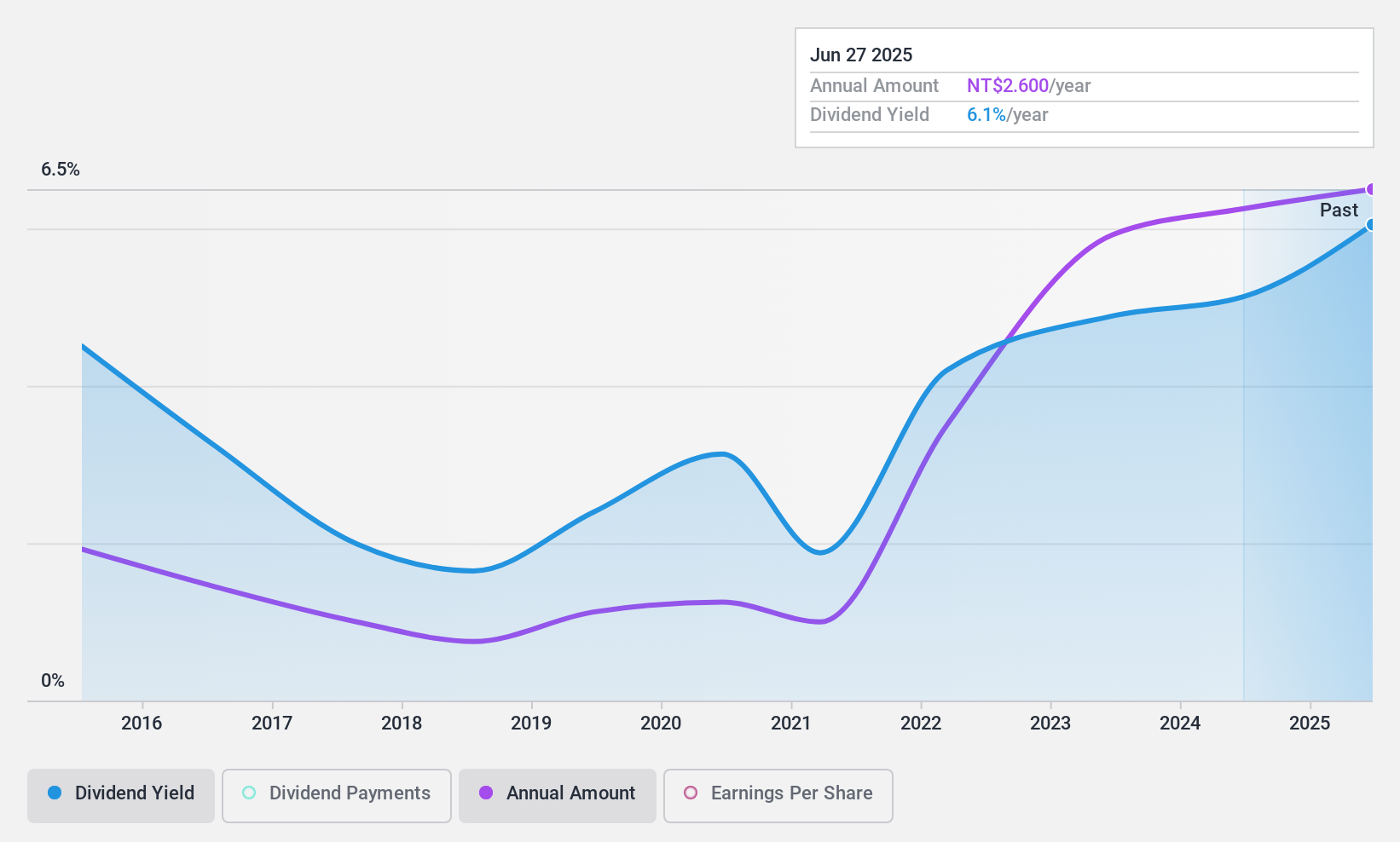

Gloria Material Technology (TPEX:5009)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gloria Material Technology Corp. is a company that produces and sells alloy steel in Taiwan, the United States, China, and internationally with a market cap of NT$28.81 billion.

Operations: Gloria Material Technology Corp.'s revenue segments include NT$12.04 billion from Gloria Material Technology Corp., NT$1.11 billion from Jinyun Iron and Steel Co., LTD, and NT$1.27 billion from Ouying Enterprises Co., Limited.

Dividend Yield: 5.1%

Gloria Material Technology's dividend yield of 5.09% is among the top 25% in Taiwan, yet its sustainability is questionable due to insufficient free cash flows and earnings coverage. Despite a low payout ratio of 48.7%, dividends have been volatile over the past decade, impacting reliability. Recent earnings growth has been strong, with net income significantly up year-over-year; however, revenue forecasts suggest potential challenges ahead for maintaining dividend stability.

- Dive into the specifics of Gloria Material Technology here with our thorough dividend report.

- According our valuation report, there's an indication that Gloria Material Technology's share price might be on the cheaper side.

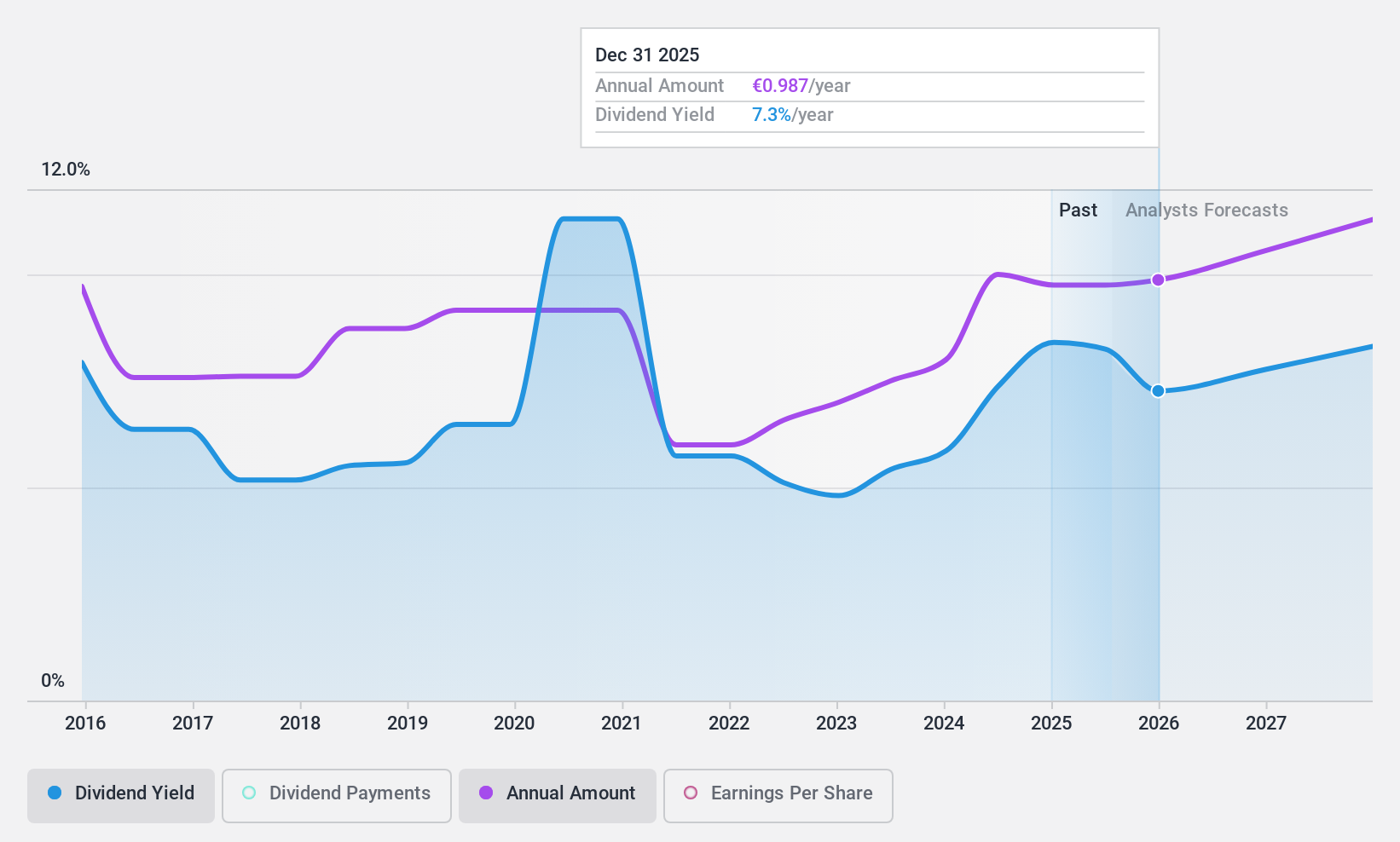

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is a company that produces and distributes sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €112.46 million.

Operations: Schloss Wachenheim AG generates revenue of €441.21 million from its alcoholic beverages segment.

Dividend Yield: 4.1%

Schloss Wachenheim's dividend yield of 4.14% is below the top 25% in Germany, and sustainability is a concern due to a high cash payout ratio of 106.6%. Though dividends have grown reliably over the past decade, recent earnings fell significantly, with net income dropping to EUR 0.634 million from EUR 2.77 million year-over-year. Despite trading below estimated fair value and analyst price targets suggesting potential upside, dividend coverage by free cash flow remains weak.

- Click to explore a detailed breakdown of our findings in Schloss Wachenheim's dividend report.

- In light of our recent valuation report, it seems possible that Schloss Wachenheim is trading behind its estimated value.

Where To Now?

- Access the full spectrum of 1984 Top Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Schloss Wachenheim, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SWA

Schloss Wachenheim

Produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives