- Taiwan

- /

- Metals and Mining

- /

- TPEX:6755

Shareholders Are Thrilled That The Lian Hong Art (GTSM:6755) Share Price Increased 133%

It might be of some concern to shareholders to see the Lian Hong Art. Co., Ltd. (GTSM:6755) share price down 17% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 133% in that time. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Check out our latest analysis for Lian Hong Art

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

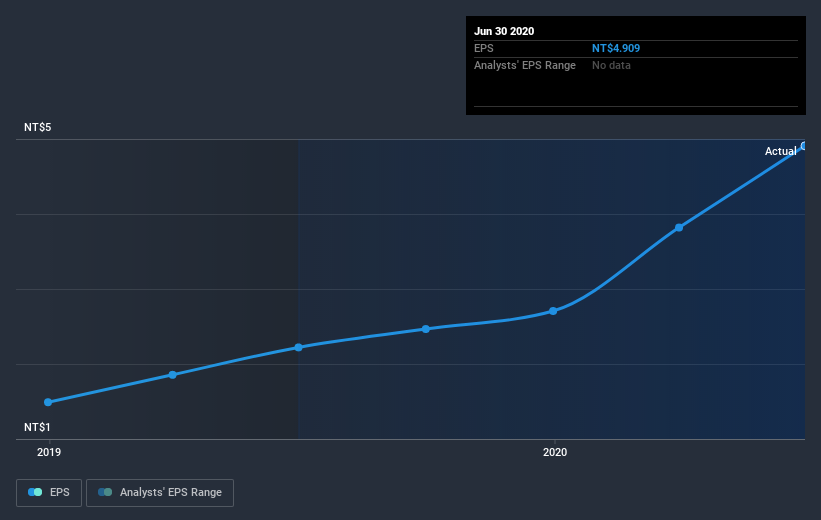

During the last year Lian Hong Art grew its earnings per share (EPS) by 121%. This EPS growth is reasonably close to the 133% increase in the share price. So this implies that investor expectations of the company have remained pretty steady. We don't think its coincidental that the share price is growing at a similar rate to the earnings per share.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

This free interactive report on Lian Hong Art's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Lian Hong Art's TSR for the last year was 137%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Lian Hong Art boasts a total shareholder return of 137% for the last year (that includes the dividends) . The more recent returns haven't been as impressive as the longer term returns, coming in at just 12%. Having said that, we doubt shareholders would be concerned. It seems the market is simply waiting on more information, because if the business delivers so will the share price (eventually). It's always interesting to track share price performance over the longer term. But to understand Lian Hong Art better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Lian Hong Art you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Lian Hong Art or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6755

Lian Hong Art

Manufactures and sells hub components and other structural metal products in Taiwan, Mainland China, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives