Key Things To Consider Before Buying Pancolour Ink Co., Ltd. (GTSM:4765) For Its Dividend

Dividend paying stocks like Pancolour Ink Co., Ltd. (GTSM:4765) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Pancolour Ink is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story. Some simple analysis can reduce the risk of holding Pancolour Ink for its dividend, and we'll focus on the most important aspects below.

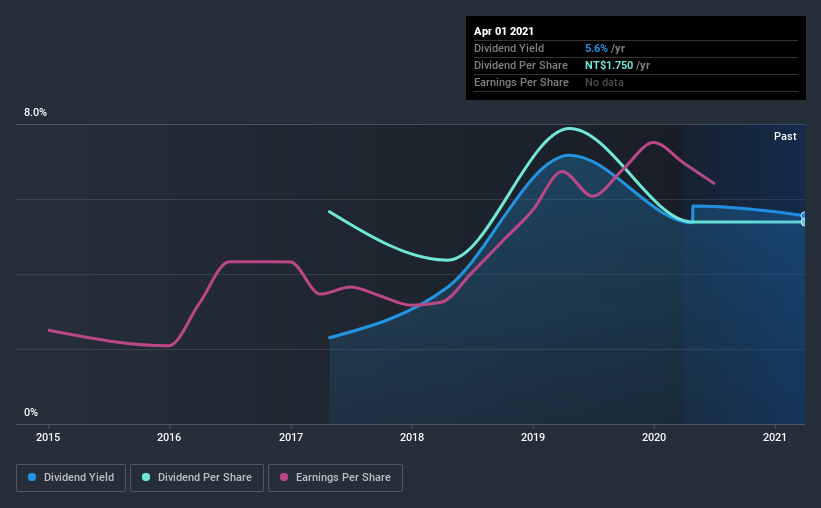

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 55% of Pancolour Ink's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

Consider getting our latest analysis on Pancolour Ink's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Pancolour Ink has been paying a dividend for the past four years. It has only been paying dividends for a few short years, and the dividend has already been cut at least once. This is one income stream we're not ready to live on. During the past four-year period, the first annual payment was NT$1.8 in 2017, compared to NT$1.8 last year. This works out to be a decline of approximately 1.2% per year over that time. Pancolour Ink's dividend has been cut sharply at least once, so it hasn't fallen by 1.2% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's good to see Pancolour Ink has been growing its earnings per share at 25% a year over the past five years. With recent, rapid earnings per share growth and a payout ratio of 55%, this business looks like an interesting prospect if earnings are reinvested effectively.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think Pancolour Ink has an acceptable payout ratio. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. In summary, we're unenthused by Pancolour Ink as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 4 warning signs for Pancolour Ink that you should be aware of before investing.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Pancolour Ink, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4765

Pancolour Ink

Manufactures and sells UV curable inks, coatings, and adhesives in Taiwan.

Slight risk with worrying balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026