Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Chlitina Holding Limited (TPE:4137) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Chlitina Holding

What Is Chlitina Holding's Net Debt?

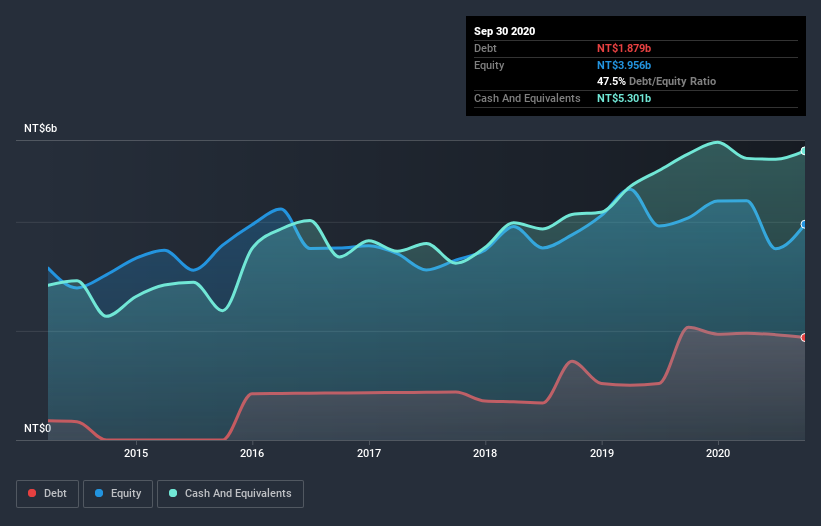

The image below, which you can click on for greater detail, shows that Chlitina Holding had debt of NT$1.88b at the end of September 2020, a reduction from NT$2.06b over a year. However, its balance sheet shows it holds NT$5.30b in cash, so it actually has NT$3.42b net cash.

How Strong Is Chlitina Holding's Balance Sheet?

The latest balance sheet data shows that Chlitina Holding had liabilities of NT$3.07b due within a year, and liabilities of NT$1.72b falling due after that. Offsetting this, it had NT$5.30b in cash and NT$30.9m in receivables that were due within 12 months. So it actually has NT$540.6m more liquid assets than total liabilities.

This short term liquidity is a sign that Chlitina Holding could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Chlitina Holding has more cash than debt is arguably a good indication that it can manage its debt safely.

The modesty of its debt load may become crucial for Chlitina Holding if management cannot prevent a repeat of the 30% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Chlitina Holding can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Chlitina Holding has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Chlitina Holding recorded free cash flow worth 78% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Chlitina Holding has net cash of NT$3.42b, as well as more liquid assets than liabilities. The cherry on top was that in converted 78% of that EBIT to free cash flow, bringing in NT$960m. So we are not troubled with Chlitina Holding's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Chlitina Holding , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Chlitina Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Chlitina Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:4137

Chlitina Holding

An investment holding company, engages in the research, development, manufacture, and sale of beauty and skin care products in Taiwan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives