- Hong Kong

- /

- Auto Components

- /

- SEHK:1571

Top Dividend Stocks For November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and economic uncertainties, major indices like the Nasdaq Composite and S&P 500 have experienced volatility, with growth stocks underperforming compared to value shares. Amidst these fluctuations, dividend stocks continue to attract investors seeking stability and income in their portfolios. In such an environment, a good dividend stock is often characterized by consistent payouts and strong financial health, providing a buffer against market turbulence while offering potential for long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.12% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

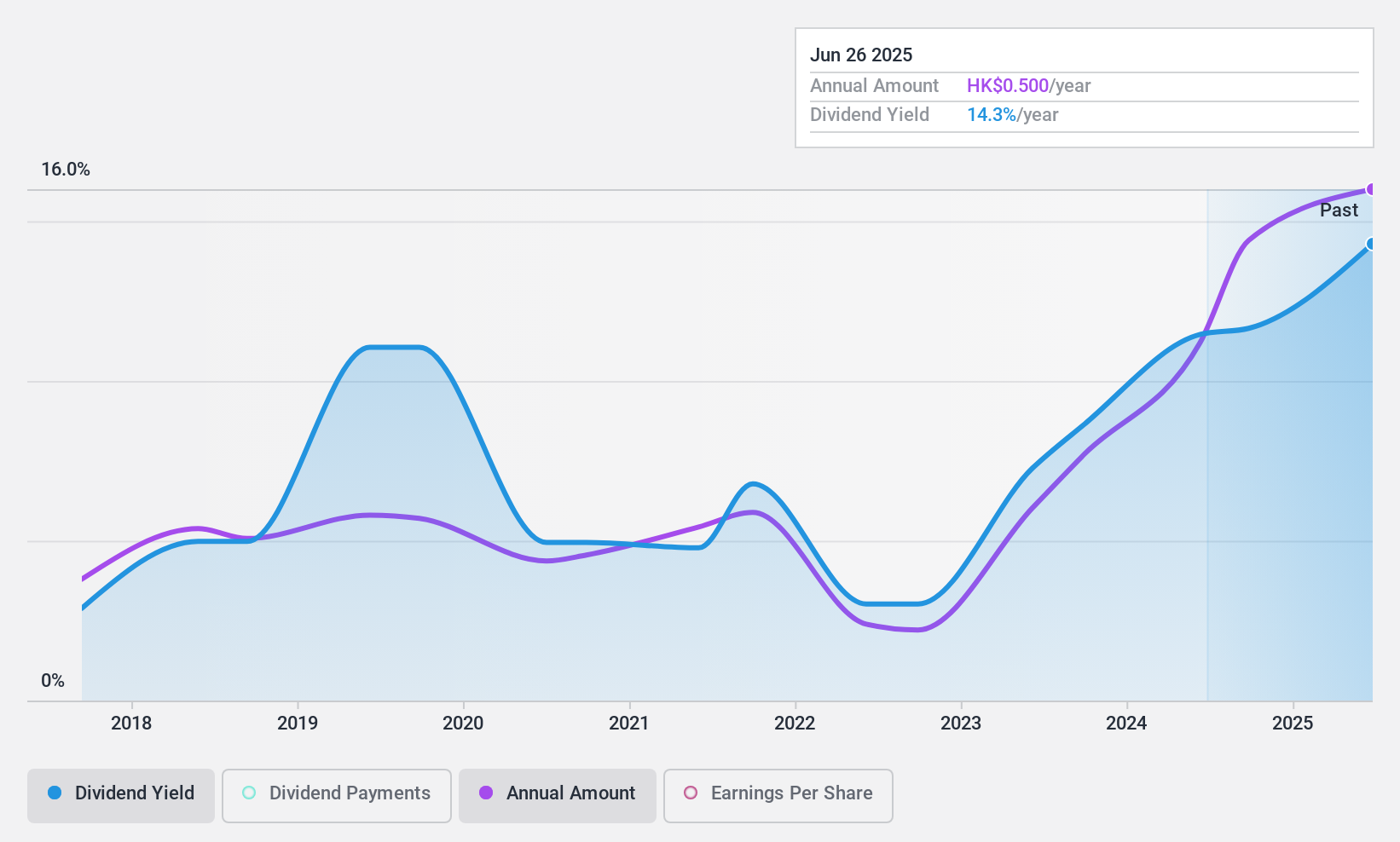

Xin Point Holdings (SEHK:1571)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xin Point Holdings Limited is an investment holding company that manufactures and sells automotive and electronic components across China, North America, Europe, and other international markets, with a market cap of HK$3.65 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of automotive and electronic components, totaling CN¥3.23 billion.

Dividend Yield: 8.6%

Xin Point Holdings offers a compelling dividend profile, with its dividend yield in the top 25% of Hong Kong market payers. Dividends are well-covered by earnings and cash flows, with payout ratios at 61.9% and 49.2%, respectively. However, the company has a volatile dividend history over its seven-year payment period. Recent financials show growth, with half-year sales rising to CNY 1.65 billion and net income increasing to CNY 322.16 million year-on-year.

- Get an in-depth perspective on Xin Point Holdings' performance by reading our dividend report here.

- Our valuation report here indicates Xin Point Holdings may be undervalued.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd. manufactures and sells Chinese medicine products both in Mainland China and internationally, with a market cap of HK$6.90 billion.

Operations: Tong Ren Tang Technologies Co. Ltd.'s revenue is primarily derived from its own operations, contributing CN¥4.29 billion, and from Tong Ren Tang Chinese Medicine, which adds CN¥1.26 billion.

Dividend Yield: 3.5%

Tong Ren Tang Technologies maintains a stable dividend history over the past decade, with dividends growing and remaining reliable. However, its dividend yield of 3.51% is lower than top-tier payers in Hong Kong and not well-covered by free cash flows despite a low payout ratio of 35.4%. Recent financials show improved earnings, with net income rising to CNY 428.75 million for the first half of 2024 from CNY 368.15 million year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Tong Ren Tang Technologies.

- Upon reviewing our latest valuation report, Tong Ren Tang Technologies' share price might be too optimistic.

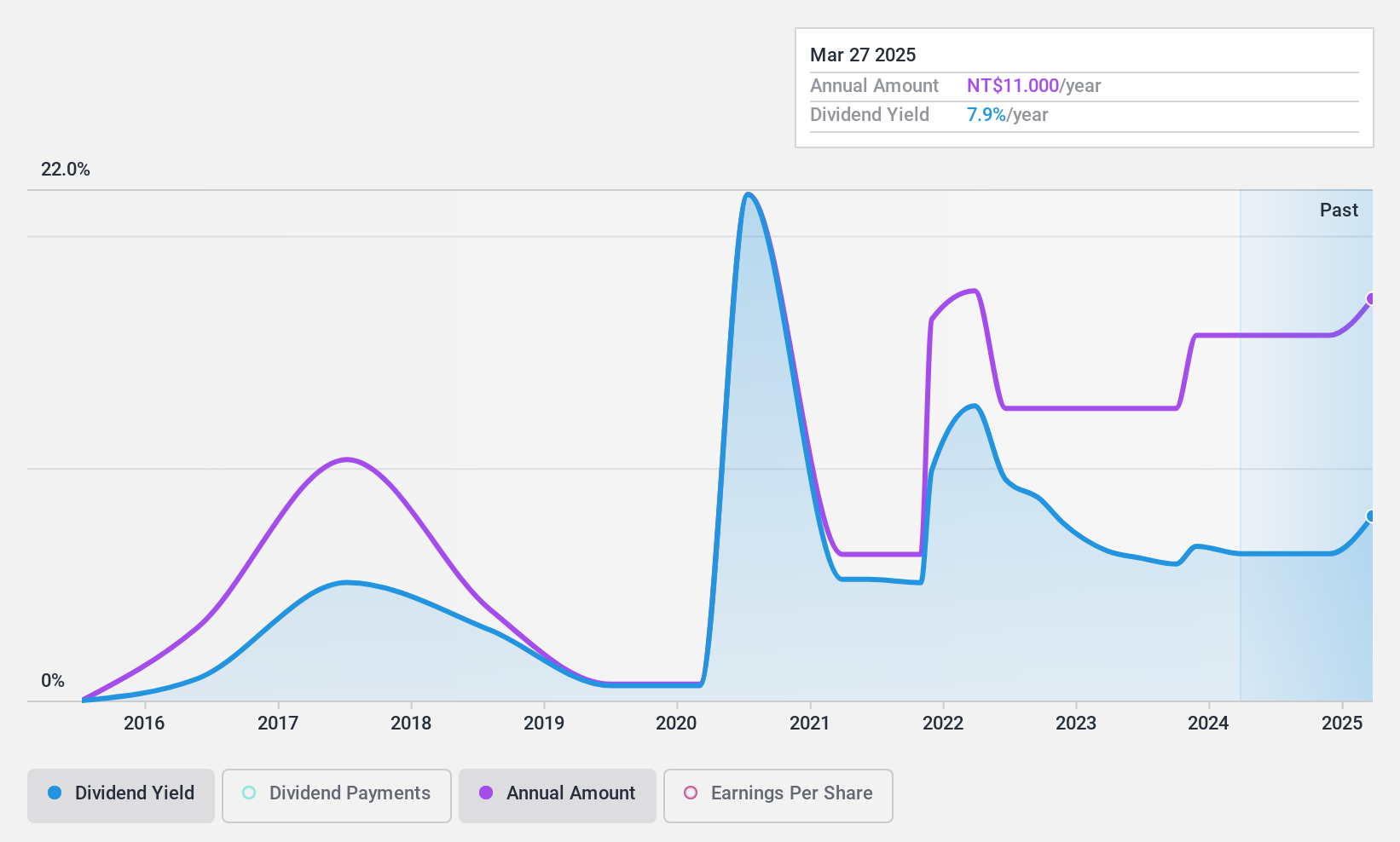

Dr. Wu Skincare (TPEX:6523)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dr. Wu Skincare Co., Ltd. focuses on the research, development, production, wholesale, and retail of cosmetics and skincare products in Taiwan and internationally with a market cap of NT$6.73 billion.

Operations: Dr. Wu Skincare Co., Ltd.'s revenue from Personal Products amounts to NT$1.22 billion.

Dividend Yield: 5%

Dr. Wu Skincare's dividend yield of 4.98% places it among the top 25% in Taiwan, though its track record is less stable, with payouts being volatile over nine years. Despite this, dividends are covered by earnings and cash flows with payout ratios of 75.3% and 65%, respectively. Recent financials show a net income of TWD 238.8 million for the first half of 2024, reflecting growth from TWD 185.24 million year-on-year, supporting dividend sustainability in the near term.

- Click here to discover the nuances of Dr. Wu Skincare with our detailed analytical dividend report.

- Our expertly prepared valuation report Dr. Wu Skincare implies its share price may be lower than expected.

Seize The Opportunity

- Dive into all 1933 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1571

Xin Point Holdings

An investment holding company, manufactures and sells automotive and electronic components in China, North America, Europe, and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives