- Taiwan

- /

- Medical Equipment

- /

- TPEX:6612

Would Shareholders Who Purchased ICARES Medicus' (GTSM:6612) Stock Year Be Happy With The Share price Today?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in ICARES Medicus, Inc. (GTSM:6612) have tasted that bitter downside in the last year, as the share price dropped 25%. That contrasts poorly with the market return of 32%. Longer term investors have fared much better, since the share price is up 19% in three years. Unhappily, the share price slid 1.1% in the last week.

View our latest analysis for ICARES Medicus

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the ICARES Medicus share price fell, it actually saw its earnings per share (EPS) improve by 0.1%. Of course, the situation might betray previous over-optimism about growth.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

Given the yield is quite low, at 0.8%, we doubt the dividend can shed much light on the share price. ICARES Medicus' revenue is actually up 7.8% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

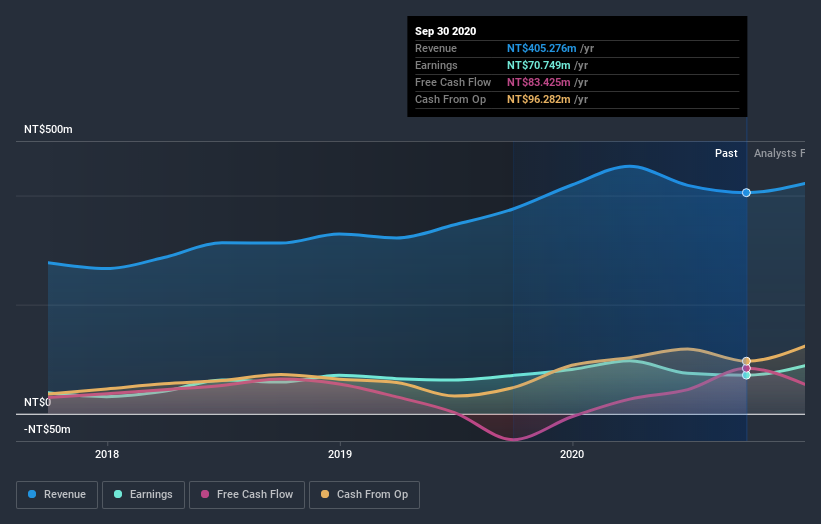

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

ICARES Medicus shareholders are down 24% for the year, (even including dividends), but the broader market is up 32%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 7% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that ICARES Medicus is showing 1 warning sign in our investment analysis , you should know about...

We will like ICARES Medicus better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade ICARES Medicus, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6612

ICARES Medicus

Engages in the design, research, development, manufacture, and sale of intraocular lenses and nanomedical devices in Taiwan, the United States, England, Japan, Spain, China, and internationally.

Adequate balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives