- Taiwan

- /

- Medical Equipment

- /

- TPEX:3373

Are Radiant Innovation Inc.'s (GTSM:3373) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

With its stock down 14% over the past three months, it is easy to disregard Radiant Innovation (GTSM:3373). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on Radiant Innovation's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Radiant Innovation

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Radiant Innovation is:

51% = NT$642m ÷ NT$1.3b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.51 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Radiant Innovation's Earnings Growth And 51% ROE

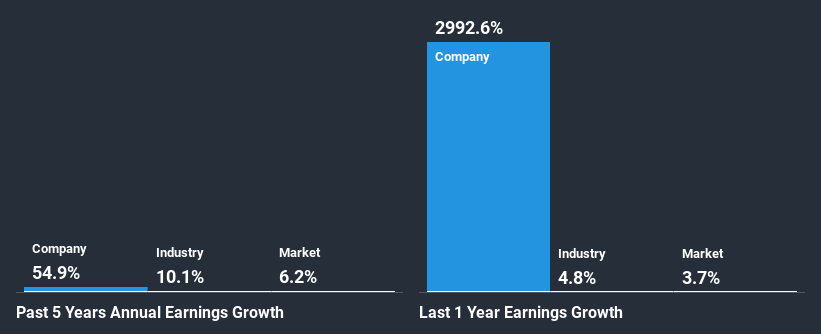

To begin with, Radiant Innovation has a pretty high ROE which is interesting. Secondly, even when compared to the industry average of 11% the company's ROE is quite impressive. As a result, Radiant Innovation's exceptional 55% net income growth seen over the past five years, doesn't come as a surprise.

Next, on comparing with the industry net income growth, we found that Radiant Innovation's growth is quite high when compared to the industry average growth of 10% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Radiant Innovation is trading on a high P/E or a low P/E, relative to its industry.

Is Radiant Innovation Efficiently Re-investing Its Profits?

Radiant Innovation's very high three-year median payout ratio of 120% suggests that the company is paying more to its shareholders than what it is earning. In spite of this, the company was able to grow its earnings significantly, as we saw above. Having said that, the high payout ratio is definitely risky and something to keep an eye on.

Besides, Radiant Innovation has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

In total, it does look like Radiant Innovation has some positive aspects to its business. Specifically, its high ROE which likely led to the growth in earnings. Bear in mind, the company reinvests little to none of its profits, which means that investors aren't necessarily reaping the full benefits of the high rate of return. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Radiant Innovation's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading Radiant Innovation or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3373

Radiant Innovation

Engages in the design and development of infrared technology products in Taiwan.

Flawless balance sheet low.

Market Insights

Community Narratives