- Taiwan

- /

- Healthcare Services

- /

- TPEX:3118

Should Level Biotechnology (GTSM:3118) Be Disappointed With Their 16% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Level Biotechnology Inc. (GTSM:3118) share price is up 16% in the last year, clearly besting the market return of around 9.9% (not including dividends). That's a solid performance by our standards! Unfortunately the longer term returns are not so good, with the stock falling 2.1% in the last three years.

Check out our latest analysis for Level Biotechnology

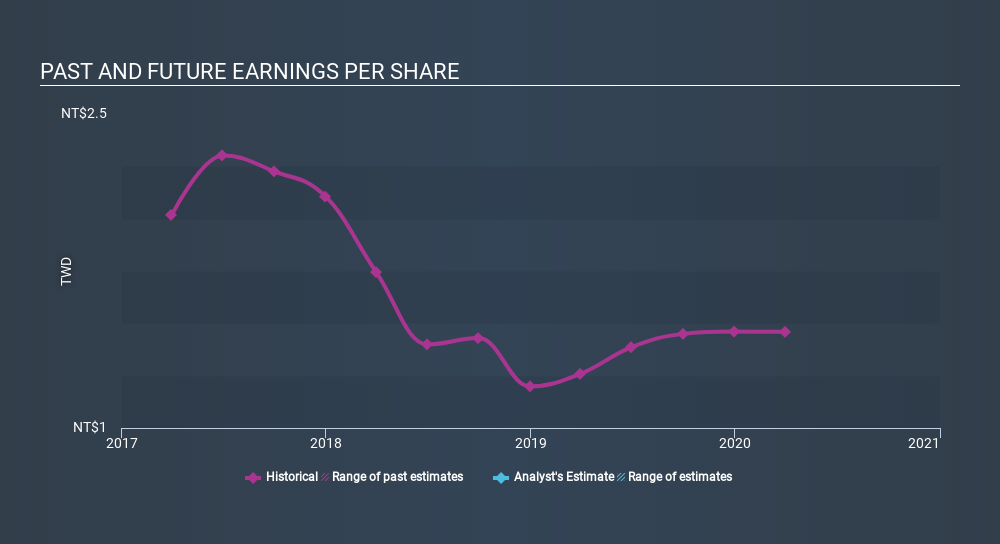

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Level Biotechnology grew its earnings per share (EPS) by 16%. The similarity between the EPS growth and the 16% share price gain really stands out. That suggests that the market sentiment around the company hasn't changed much over that time. It makes intuitive sense that the share price and EPS would grow at similar rates.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Level Biotechnology's TSR for the last year was 20%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Level Biotechnology has rewarded shareholders with a total shareholder return of 20% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5.3% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for Level Biotechnology (1 can't be ignored) that you should be aware of.

We will like Level Biotechnology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TPEX:3118

Level Biotechnology

Engages in marketing and distributing cell culture, immunology, and molecular biology products in Taiwan.

Flawless balance sheet and good value.

Market Insights

Community Narratives