Market Participants Recognise Uni-President Enterprises Corp.'s (TWSE:1216) Earnings

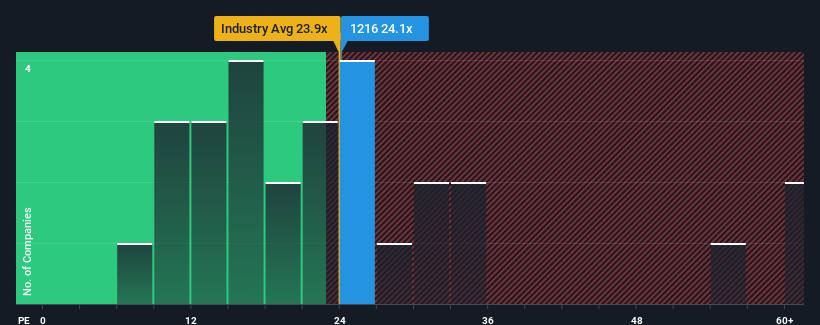

With a median price-to-earnings (or "P/E") ratio of close to 23x in Taiwan, you could be forgiven for feeling indifferent about Uni-President Enterprises Corp.'s (TWSE:1216) P/E ratio of 24.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for Uni-President Enterprises as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Uni-President Enterprises

Is There Some Growth For Uni-President Enterprises?

In order to justify its P/E ratio, Uni-President Enterprises would need to produce growth that's similar to the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.2% last year. Still, lamentably EPS has fallen 16% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 12% each year, which is not materially different.

With this information, we can see why Uni-President Enterprises is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Uni-President Enterprises maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Uni-President Enterprises.

You might be able to find a better investment than Uni-President Enterprises. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1216

Uni-President Enterprises

Manufactures and sells beverage, food, animal feed, and wheat flour in Taiwan and internationally.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives