These 4 Measures Indicate That Taisun Enterprise (TPE:1218) Is Using Debt Safely

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Taisun Enterprise Co., Ltd. (TPE:1218) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Taisun Enterprise

What Is Taisun Enterprise's Debt?

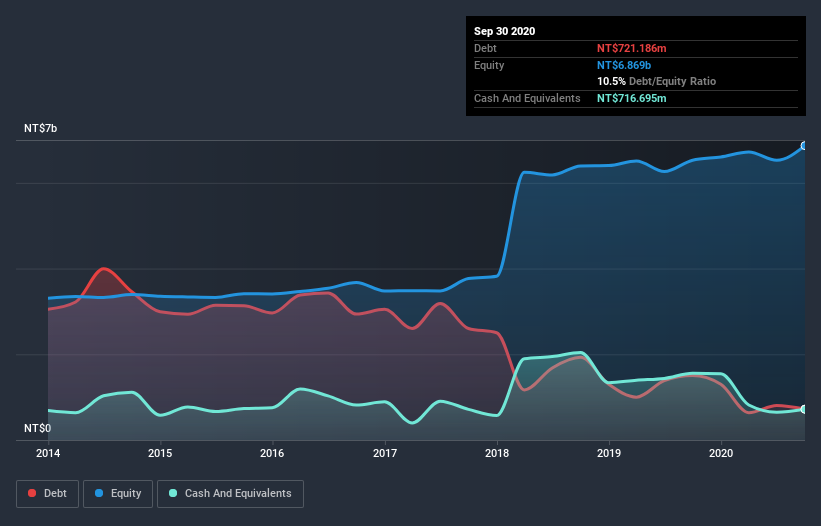

As you can see below, Taisun Enterprise had NT$721.2m of debt at September 2020, down from NT$1.50b a year prior. On the flip side, it has NT$716.7m in cash leading to net debt of about NT$4.49m.

How Strong Is Taisun Enterprise's Balance Sheet?

The latest balance sheet data shows that Taisun Enterprise had liabilities of NT$2.01b due within a year, and liabilities of NT$231.3m falling due after that. On the other hand, it had cash of NT$716.7m and NT$1.44b worth of receivables due within a year. So it has liabilities totalling NT$82.1m more than its cash and near-term receivables, combined.

Having regard to Taisun Enterprise's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the NT$11.5b company is short on cash, but still worth keeping an eye on the balance sheet. But either way, Taisun Enterprise has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Taisun Enterprise has very modest net debt levels, with net debt at just 0.012 times EBITDA. Happily, it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like an Olympic ice-skater handles a pirouette. Better yet, Taisun Enterprise grew its EBIT by 114% last year, which is an impressive improvement. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Taisun Enterprise's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Taisun Enterprise actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Taisun Enterprise's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. We think Taisun Enterprise is no more beholden to its lenders, than the birds are to birdwatchers. For investing nerds like us its balance sheet is almost charming. Over time, share prices tend to follow earnings per share, so if you're interested in Taisun Enterprise, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Taisun Enterprise, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taisun Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:1218

Taisun Enterprise

Engages in the processing, manufacturing, wholesaling, and retailing of oil, food and beverages, fodder, and soybean flour products in Taiwan.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026