- Taiwan

- /

- Oil and Gas

- /

- TWSE:6505

Slammed 25% Formosa Petrochemical Corporation (TWSE:6505) Screens Well Here But There Might Be A Catch

The Formosa Petrochemical Corporation (TWSE:6505) share price has fared very poorly over the last month, falling by a substantial 25%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

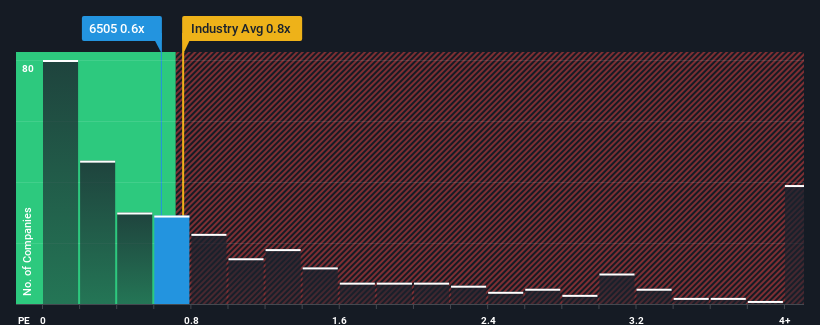

Although its price has dipped substantially, it's still not a stretch to say that Formosa Petrochemical's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in Taiwan, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Formosa Petrochemical

What Does Formosa Petrochemical's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Formosa Petrochemical has been very sluggish. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Formosa Petrochemical.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Formosa Petrochemical's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.4%. Even so, admirably revenue has lifted 50% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 3.1% during the coming year according to the nine analysts following the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 1.5%, that would be a solid result.

Despite the marginal growth, we find it odd that Formosa Petrochemical is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Formosa Petrochemical's P/S

Following Formosa Petrochemical's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We note that even though Formosa Petrochemical trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 1 warning sign for Formosa Petrochemical that you need to take into consideration.

If you're unsure about the strength of Formosa Petrochemical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6505

Formosa Petrochemical

Engages in the petrochemical business in Taiwan, Australia, South Korea, the Philippines, Singapore, Malaysia, Mainland China, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives